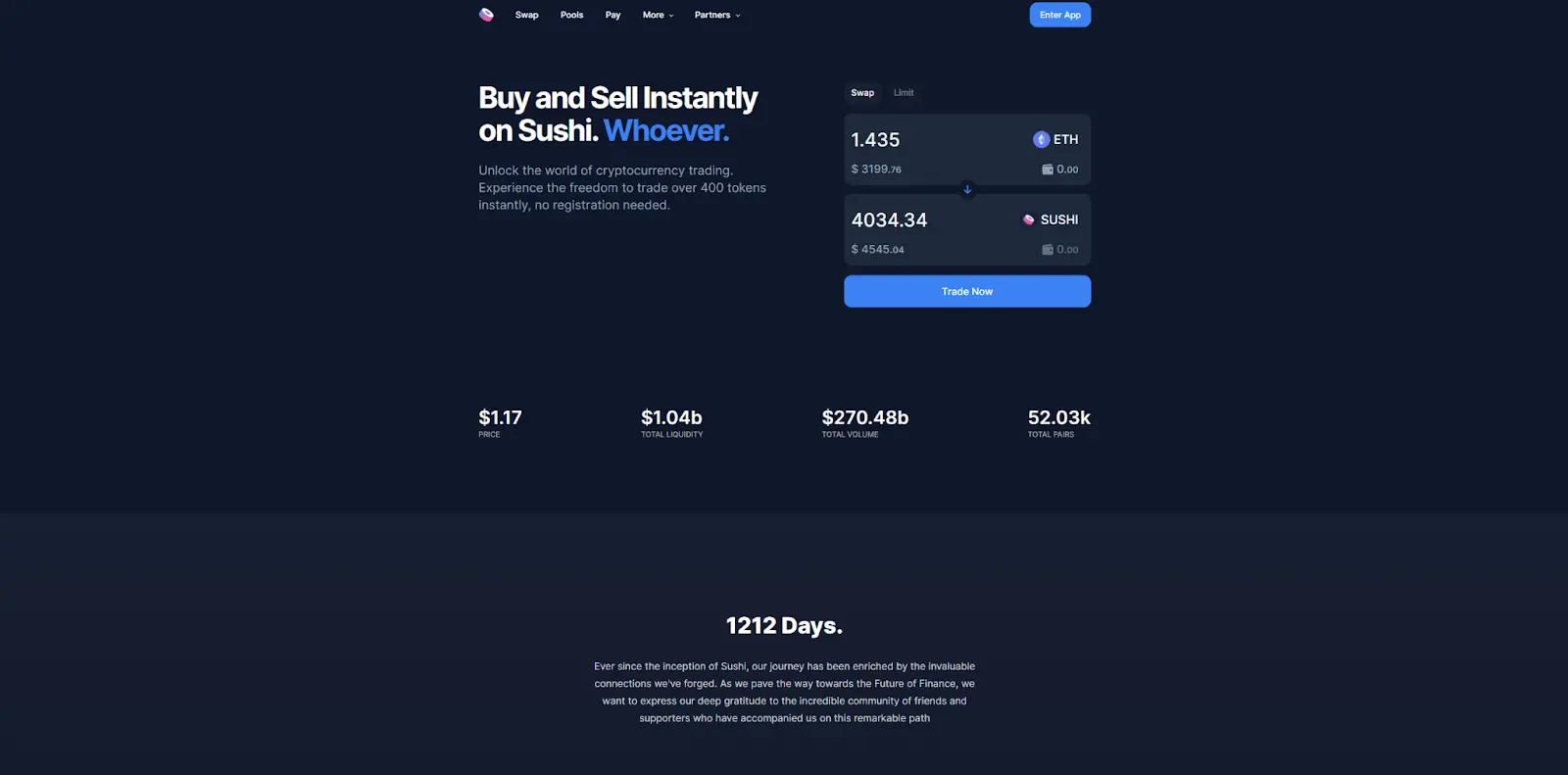

What Is SushiSwap? Should You Use the Platform or Invest in It?

crypto exchanges

Decentralized exchanges (DEXs) embody the core ideology of the cryptocurrency space. They allow for the exchange of value and information with unprecedented levels of independence, unlike anything TradFi has to offer. Among many of these platforms available to crypto enthusiasts, SushiSwap stands out as one of the most popular.

But what exactly is SushiSwap, and how does it work? Who or what enables trading when there’s no central governing authority to ensure both sides meet their end of the bargain?

In this article, we’ll delve into the intricacies of this prominent DEX and its native token, SUSHI. You’ll find out if this is a good place for you to perform trades and whether SUSHI is worth buying. Let’s jump right in!

What Is SushiSwap (SUSHI)?

SushiSwap is an Ethereum-based decentralized exchange that operates using an automated market maker (AMM) model. The DEX was created as a fork of Uniswap, which is why the two platforms share many similarities.

Similar to Bitcoin, SushiSwap was also founded by a pseudonymous developer or entity by the name of Chef Nomi. They partnered up with two additional developers known as 0xMaki and sushiswap. The three have been in charge of everything—from code development to project management—since the launch in September 2020.

The DEX's popularity quickly rose as developers came up with what is now dubbed the “Vampire attack” in the SushiSwap vs. Uniswap history. Essentially, before the DEX was launched, they saw that Uniswap was giving its liquidity providers a portion of fees as rewards and nothing more.

Chef Nomi and his partners upped the stakes. They offered significantly more rewards in the form of the platform’s native SUSHI tokens to liquidity providers in addition to fee compensation. Within the first week of SushiSwap’s launch, the platform has accrued more than $1 billion in its liquidity pools, most of which was siphoned from Uniswap.

After that move, Chef Nomi exchanged his SUSHI holdings for Ethereum using the now-defunct Sam Bankman-Fried’s FTX exchange. The trade was worth around 14 million dollars and caused an uproar in the community. That prompted Chef Nomi to revert the transaction, apologize, call it a mistake, and leave the project.

How Does SushiSwap Work?

SushiSwap works using liquidity pools as cryptocurrency funds for trading with an AMM algorithmically adjusting prices. This is a revolutionary cryptocurrency concept specific to decentralized exchanges, which removes the need for order books present in traditional financial markets and centralized exchanges.

Liquidity pools are funds made up of different cryptocurrency coins and tokens that facilitate trading and are governed by smart contracts. In regular markets, when someone creates a trade order, they need a counterparty that matches their requirements for the order to execute. This creates an order book with buying and selling requests, which also forms the price of the asset.

When a DEX user initiates a trade, they'll gain assets from one pool while submitting theirs to another. That removes the need for a trading counterparty to match the initial offer. It also allows for quick and efficient trading in periods of low market activity.

Since SushiSwap doesn’t have an order book to determine the price of the assets, an automated market maker is employed to do so. Essentially, it’s an algorithm that automatically adjusts the price based on the ratio of assets in the pool.

To incentivize users to submit their funds to liquidity pools, SushiSwap grants them LP (liquidity provider) tokens. They are digital IOUs representing ownership of the submitted cryptocurrency and can be exchanged for the original assets plus any fees and rewards earned.

LP tokens can further be used for staking and providing liquidity to earn even more rewards, usually in the form of the platform’s native SUSHI token.

How & Where to Buy SUSHI?

There are two main ways to buy SUSHI, which are:

- Using a centralized exchange (CEX)

- Using a decentralized exchange (DEX)

The more straightforward way to obtain SUSHI for most users, especially entry-level cryptocurrency investors and traders, is by using a centralized exchange such as Binance, Kraken, or Coinbase. Here are the typical steps:

- Create an account with the exchange. Unlike DEXs, CEXs are privately owned platforms. They require users to create accounts using their email or phone number.

- Perform KYC verification. KYC stands for Know-Your-Customer and is used to verify a customer's identity. You’ll need a government-issued ID, like a driver’s license or passport, for this step.

- Fund your account. Most CEXs allow users to purchase crypto with fiat. You can use credit or debit cards, bank account transfers, or third-party payment processors to buy the most common cryptocurrencies like BTC, ETH, USDT, and more.

- Buy SUSHI. You can then use assets in your CEX account to purchase SUSHI. The most common method is to find a trading pair and exchange cryptocurrencies. Notable pairs include SUSHI/USDT, SUSHI/BTC, and SUSHI/ETH.

- Secure your SUSHI. You can leave your crypto in your CEX account, but then you give it control over your private keys. The most secure option is to transfer them to a personal crypto wallet.

Buying SUSHI on a DEX is a more complex way of doing it, but it is entirely private with no KYC verification. Here are the steps:

- Fund your wallet. A popular choice for an easy-to-use hot wallet is MetaMask, and you can fund it by sending assets from a centralized exchange or receiving a transfer from someone else.

- Connect your wallet to an exchange, such as SushiSwap or Uniswap.

- Use the Swap function to exchange another currency for SUSHI.

How to Provide Liquidity on SushiSwap

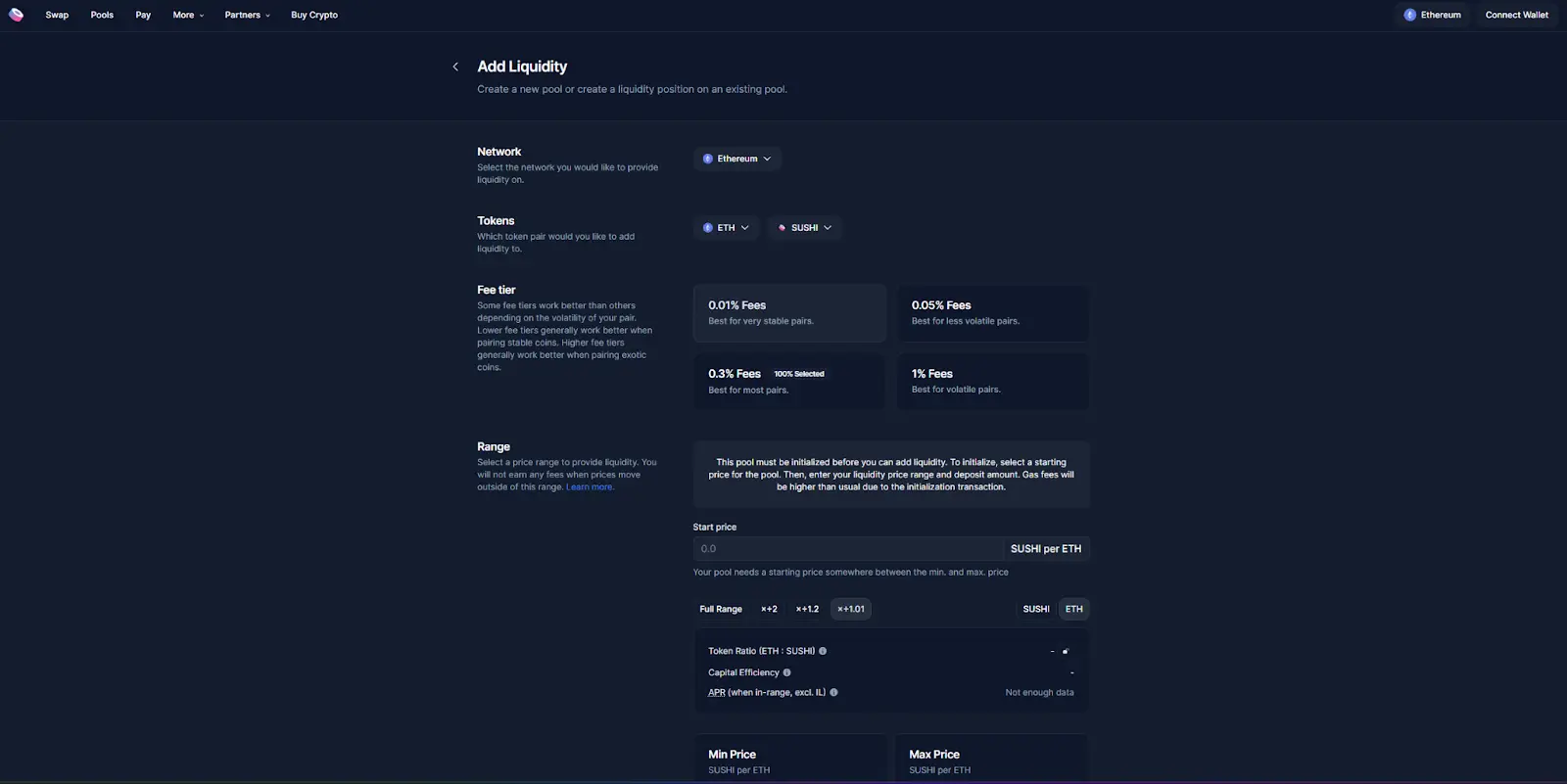

Providing liquidity on SushiSwap is a straightforward process that you can start by selecting the Pools section on the platform’s website. Here’s a step-by-step guide on how to begin providing liquidity in minutes:

- Go to the Pools section in the navigation bar on the official Sushi website.

- Tap on the “Connect Wallet” button. SushiSwap currently supports five wallets, which are Injected, MetaMask, WalletConnect, Coinbase Wallet, and Gnosis Safe.

- Select “I want to create a position” and choose between a V2 or V3 position.

- Choose the network to provide liquidity on. The biggest and most popular network is Ethereum, but there are many others, like Arbitrum One, Polygon, and BNB Smart Chain.

- Select a token pair. Liquidity pools are formed from pairs of cryptocurrencies to enable trading between them, so make sure you have both in your wallet.

- Choose a fee tier. The options range from 0.01% to 1% fees. Lower tiers are less risky and best for stable pairs, while higher fee tiers are for highly volatile altcoins.

- Select a price range in which you’ll earn rewards. Once the price of assets moves out of that range, you’ll stop earning crypto from fees. Narrower price ranges offer higher APR than wider ranges.

- Input how much of both assets you want to add to the pool and submit to start providing liquidity.

Advantages of SushiSwap

Let’s check out some of the key advantages of using a SushiSwap crypto exchange:

- Complete anonymity. Being a DEX, SushiSwap doesn’t require users to create accounts with their phone numbers and emails or perform KYC verifications using personal IDs. That allows cryptocurrency enthusiasts to transfer assets among themselves the way Satoshi Nakamoto intended.

- Full decentralization. Another DEX-related perk of SushiSwap is the absence of a singular governing authority. No one person or entity manages everyone’s assets or decides how the platform is going to operate or develop further. Instead, that power is given to all token holders in a Sushi DAO.

- User-friendly interface. SushiSwap’s website features a simple and intuitive web design. The platform’s main features are readily available from the get-go. Users can start swapping on the main page and access liquidity pools from the top bar.

- Cross-chain support. The exchange supports more than 400 tokens, and not just on the Ethereum network. The cross-chain support feature means participants can natively swap tokens between 7 chains: Ethereum, Arbitrum One, Base, Polygon, OP, BNB Smart Chain, and Avalanche C-Chain.

- Built-in analytics. SushiSwap offers in-depth information about its liquidity pools to help users find the best place to put their funds. They list thousands of pools along with useful metrics like total value locked (TVL), trading volume, fees, APR, and more.

Cons of SushiSwap

Like every other exchange and crypto platform, SushiSwap is not without cons. Let’s examine some of the key drawbacks of this exchange:

- Smart contract risks. SushiSwap is a DeFi platform, which means that most of its operations are governed by programmable smart contracts. They are like any other code, and while widely used within the crypto sphere, smart contracts can sometimes be hacked and exploited.

- Complexity. Trading crypto on a centralized exchange is generally a much easier way to do it, especially for beginners. SushiSwap trading requires a certain level of knowledge about peer-to-peer trading, crypto wallets, gas fees, slippage, different chains, etc. All of that can be intimidating to entry-level traders.

- Impermanent loss. Whenever you submit your assets to a liquidity pool, you’re exposed to the risk of impermanent loss. While the math behind impermanent loss can get complex, the bottom line is that due to a price shift of the deposited tokens, the value of withdrawn funds can be lower than the value of the submitted.

Is SushiSwap a Good Investment?

SushiSwap can be a good investment for DeFi-oriented cryptocurrency enthusiasts who want todiversify their portfolio. At the moment of writing this article, the price of the SushiSwap token is around 95% lower than its all-time high (ATH) price of $23.38 in March 2021.

If the token were to return to its previous ATH value, current buyers would experience thousands of percent of ROI. Moreover, the exchange is still relatively new, having been established in 2020. That gives both the platform and its token room to grow.

On the other hand, the crypto space is notoriously famous for many popular projects and notable altcoins disappearing overnight. As a result, the general rule is to have altcoins such as SUSHI be just a fraction of your portfolio.

The Future of SushiSwap

The future of SushiSwap depends on the development of the crypto space and the mainstream adoption of DeFi. The exchange has an active blog where participants and token holders keep the discussion going about potential improvements.

There are numerous proposals that could enhance the AMM model, create new streams of revenue generation, improve the overall infrastructure, and more.

On the one hand, SushiSwap might see broader acceptance and more value locked in as other users join and contribute to its liquidity pools. On the other hand, regulation could get in the way of the progress of decentralized exchanges as a whole, SushiSwap included.

Key Takeaways

SushiSwap stands out as one of the biggest names in the DeFi space. It’s an innovative and user-friendly platform that facilitates peer-to-peer trading and rewards participants who make it possible.

That’s why we learned what SushiSwap is used for and how to get the most out of its features. Ultimately, the crypto space is highly volatile and unpredictable, so you should always exercise caution and never rely entirely on one platform or invest all your funds in one token!