What is Price Impact in Crypto?

crypto basics

Trading can be a tough game, and there are an uncountable number of variables at play that can make it so. This can be even more true if you’re trading in significant quantities, especially because factors like price impact can become crucial to whether or not you pull the trigger on those orders.

You may have heard the word “liquidity” in both the corporate media and cryptocurrency circles—but what is it exactly?

Liquidity is tied very closely to price impact when trading, so that, along with what price impact is and how to minimize it, are some of the topics this article covers.

So, let’s get to it!

What Causes Prices to Change?

Prior to the creation of cryptocurrency exchanges, Bitcoin was used as peer-to-peer currency. It was mined by users in the know, and less technically savvy enthusiasts could only get their hands on it by convincing these early miners to sell BTC to them directly.

Sophistication comes to a fledgling asset as the number of interested buyers and sellers grows. This allows the establishment of a market. It could be a forum-based market with listings or an exchange complete with a trading book, but what matters is the number of buyers and sellers.

If you were going to buy a fungible asset off a marketplace like this, you’d naturally gravitate toward the cheapest seller. You’ve probably done this for any number of other things, checking a few different websites before completing a purchase.

When you do decide to take the cheapest seller’s offer, though, you’re taking that offer off the wider market. The person who wants to buy the same thing after you has to pick the next best offer, which may be a little bit more expensive.

With your purchase, therefore, you’ve “moved the market” and caused a price impact. This analogy can be taken to even the most sophisticated markets, although how much of a price impact you can make depends very much on liquidity.

Why is Liquidity Important?

Liquidity is an oft-used and perhaps even more oft-misunderstood word when it comes to capital markets and trading. It’s actually a very simple concept, however—if you want to buy something and there’s nobody willing to sell it at all, the market has no liquidity.

For this reason, it’s logical to say that liquidity is the cornerstone of any market. The problem here is that liquidity may not affect you one bit, and yet corporate media attempts to portray liquidity as being the one key feature of capitalism that we’d be back to the stone age without.

The types you find shouting off mountaintops about liquidity have, unfortunately, forgotten about the even more basic economic principle of supply and demand. A fungible asset, by nature, is subject to the laws of supply and demand, which means that if you offer the right price, sellers will pop out of the woodwork.

That works the other way as well. If you have an asset and wish to sell it, you need to offer a price that’s attractive to buyers. Set your price too high, and you may have to wait a while.

All of this is something you can watch play out in real-time on many an exchange’s order book. For the given cryptocurrency, you’ll see a list of bids posted by buyers (offers to buy the asset) and asks posted by sellers (prices at which they’ll sell).

If this order book has a lot of units of the asset on both the bid and ask sides, it has deep liquidity.

Imagine a BTC order book with tens or even hundreds of Bitcoin being offered and requested within a tight price range. If you buy 0.01 BTC from this order book, you’re hardly making a splash—or your order will have minimal price impact. On the other hand, if you buy a few thousand BTC and complete several of the tasks in one order, your order has a large price impact.

So, a market with deep liquidity often sees minimal price impact, and vice versa. This is why everyone seems to harp on about it—crypto whales and institutions hate it when their orders have a large price impact.

Who Provides Liquidity in Crypto?

Cryptocurrencies are offered up for trading by different trading venues, which can be both centralized and decentralized. Decentralized exchanges are extremely innovative and possible thanks to blockchain technology, but centralized exchanges function in a very similar manner to TradFi markets.

You can look at the biggest cryptocurrency exchanges in the same way as you might a hybrid between stock exchanges and market makers. The latter, a type of company that household investors don’t often hear about, are charged with providing liquidity by both buying and selling shares on the exchange.

The stated purpose of these organizations is to provide investors with the best possible price for their assets, but what they often end up doing is minimizing the price impact of normal trades.

Part of the reason for this is that they’re allowed, via a regulatory exemption often referred to as the “Madoff Exemption,” to create shares out of thin air simply to serve liquidity. This then leads to the issue of naked short selling and failure to deliver (FTD) that plagues many of the world’s major stock markets.

TradFi Market Makers Bernie Madoff and Ken Griffin

The vulnerability to manipulation and past instances of outright fraud by exchanges such as Sam Bankman-Fried’s FTX mean that decentralized exchanges are a great option when and where available.

Rather than needing to trust centralized market makers for liquidity, decentralized exchanges use blockchain-based automated market makers (AMM) to facilitate trading.

What are AMMs and Liquidity Pools?

Decentralized exchanges like Uniswap, Sushi, and Pancakeswap use automated market makers to allow traders to buy and sell cryptocurrencies transparently, right on the blockchain.

Holders of cryptocurrencies can deposit their crypto to liquidity pools, which usually contain a pair of crypto assets. These pools can receive contributions from a lot of users, which then translates to deep liquidity.

Traders can buy and sell paired assets from the pool. Pricing is governed by a mathematical formula along with arbitrage—there are individuals and institutions waiting to pounce when the price of an asset in the liquidity pool deviates slightly from the price on an exchange or another pool.

There’s a lot of money to be made in those differences if you can deploy enough capital fast. It’s also possible to see a price impact by trading in these pools, which again depends on liquidity.

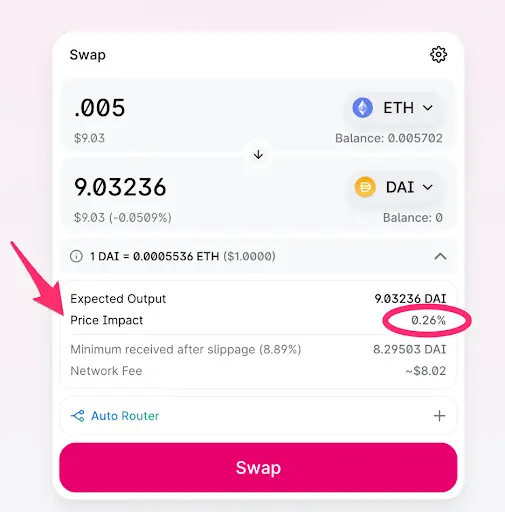

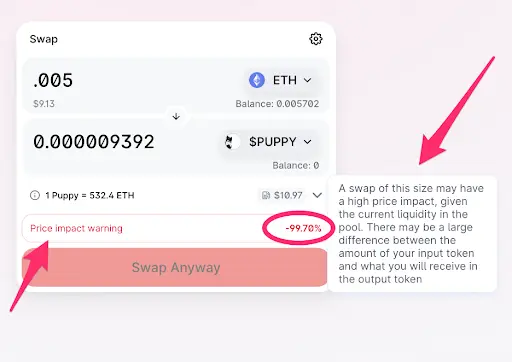

If you trade between ETH and DAI on a popular platform like Uniswap, as in the above picture, you won’t experience much in the way of price impact since there’s plenty of liquidity. If you’re buying a much more obscure token, however, you might see a significant price impact.

This decentralized manner of providing liquidity eliminates the need for an intermediary like a centralized market maker. Better yet, it incentivizes users to provide liquidity by paying them the trading fees that an exchange would otherwise happily pocket.

Price Impact vs. Price Slippage

When you swap cryptocurrency using a decentralized exchange that utilizes automated market makers, you’ll run into the term “price slippage.” It’s often confused with price impact, but the two terms actually mean different things.

Price impact refers to the change in token price caused by your trade. Slippage, on the other hand, is the change in token price caused by the total movement of the market.

Price impact looks at the way your trade impacts the total liquidity in the liquidity pool. Price slippage is reflected as the difference between the price you expect to receive after swapping tokens and what you actually receive after the swap is complete.

What are OTC Trades?

This is how you can avoid a major price impact when purchasing a relatively large amount (relative to liquidity) of a cryptocurrency. Imagine if you were to buy a few thousand BTC off an order book. The price impact would be massive since you’d wipe out entire pages’ worth of ask orders, with the price climbing with each one.

OTC trading is the way to get around that, whether you’re trading traditional equities or crypto. Many crypto exchanges have an OTC desk, where the exchange plays the role of a dealer. Once you tell them how much crypto you want to buy, they’ll make you an offer.

You then simply have to accept the offer and make your payment, while the dealer takes on the risk of acquiring the crypto for you. You’re probably seeing why exchanges offer this service now since they have all the tools required to minimize any risk to themselves and avoid price impact in acquiring the crypto for you.

What’s the catch, you ask? Not everyone can get access to OTC trading desks since they only really come into play for truly massive transactions. When you see firms like MicroStrategy loading up on BTC, you can bet it’s being done via OTC trading.

How to Minimize Price Impact

Since price impact is a function of the depth of liquidity at your chosen trading venue and the quantity of coins or tokens you’re trading, the easiest way to minimize price impact is to choose a venue with deep liquidity.

It’s also possible to spread your trades out, splitting them up into smaller amounts and across a wider range of time rather than entering one big block order. This allows you to take advantage of liquidity that may enter the market gradually.

Arbitrage traders are also very quick to jump on any swings in price within a pool, so splitting orders into smaller chunks also allows you to wait for them to restore the price before going in again.

It’s also wise to look into DEX aggregators like 1inch. They’re designed to find you the best prices across multiple exchanges, so they might be your best bet.

Price Impact in Stocks vs. Crypto

As mentioned previously, traditional equities are subject to the manipulation of even basic economic principles, such as supply and demand, in the name of liquidity. The famous GameStop stock surge in January 2021 is a great example of this, with the report on events by the US Securities and Exchange Commission noting that $GME short interest was 122.97%.

Put simply, that means short sellers sold more GameStop shares than actually existed, vastly (and artificially) diluting its supply. The saga remains unresolved, but it remains an excellent case in point for the price impact on stocks.

Since those events, household investors have directly registered (DRS) a significant proportion of the company’s shares, leading to decreased liquidity on the open market. DRS for stocks is almost exactly the same as withdrawing your crypto into your own wallet.

Traders, therefore, experience a far greater price impact when buying $GME than most other stocks, assuming their orders aren’t routed to a dark pool.

Dark pools are meant to be something like crypto OTC trades for institutions and big investors to efficiently exchange large blocks of shares without a price impact. However, a lot of market makers route small orders to dark pools as well or even internalize them.

What are the Risks of Using Crypto Exchanges?

Blockchain is all about openness and transparency, and one of the best things about crypto is that you can verify that your trades are being settled in real-time. The traditional financial system, meanwhile, is like a black hole, with entire networks of centralized entities working hand in hand with each other.

If you buy some stock using a broker, for example, you’re a beneficial shareholder. You don’t actually own the shares; you own entitlement to the shares. Even the broker doesn’t own the shares—they’re held by a custodian called the DTCC (if they're in a US company).

Your broker can earn money by lending those shares to short sellers, forcing you to liquidate them, and doing many other things with the stock you paid for. The only way to alleviate all this risk and take your shares into your own custody is by engaging the DRS system mentioned previously.

The same sort of caveats apply to crypto exchanges. If you have crypto on an exchange, all you actually hold is an entitlement. You don’t really have on-chain proof that the exchange bought those coins for you, and as Sam Bankman-Fried showed, exchanges can even make bad bets with your money in contravention of their own terms and guarantees.

Ultimately, a crypto exchange is a great way to buy crypto with minimal price impact, but it’s a liability after that until the point when you pull your coins off the exchange and into the safety of your own wallet.

Key Takeaways

Price impact is what you’ll experience if you try to trade tokens that aren’t liquid or attempt to purchase crypto in extremely large blocks. Your trade will capture the sell orders placed by multiple sellers, ticking the market upward each time and raising the price of the crypto asset, at least in that trading venue.

This mainly affects institutions and whales, which is one explanation for why corporate media seems to excuse any sin in favor of liquidity. It’s undeniably important if you want to trade an asset of any kind, though, and it’s possible for you to experience a big price impact even with a small trade if you’re buying an obscure altcoin.

To minimize price impact, you can either chase liquidity by going to bigger venues and centralized exchanges or spread your orders out. Smaller orders over a longer period of time will generally get you the best possible prices if you’re willing to endure the time and effort.

Price Impact FAQ

#1. What is price impact?

Price impact is the effect on the price of an asset when you buy it. It’s natural that buying pushes the price up and selling depresses the price, and it’s easy to observe this by watching an exchange’s order book.

#2. Why is liquidity important?

The amount of liquidity in the market determines how much of a price impact your trades will have. In a highly liquid market, you’re unlikely to have a price impact on your trades, but illiquid cryptos are almost impossible to buy quickly without some price impact.

#3. How to minimize price impact?

The easy way to minimize price impact is to find the deepest source of liquidity. Alternatively, you can spread orders across a period of time or even different venues. DEX aggregators can be a good way to do this.