Everything You Need to Know About Mining Rigs

nfts

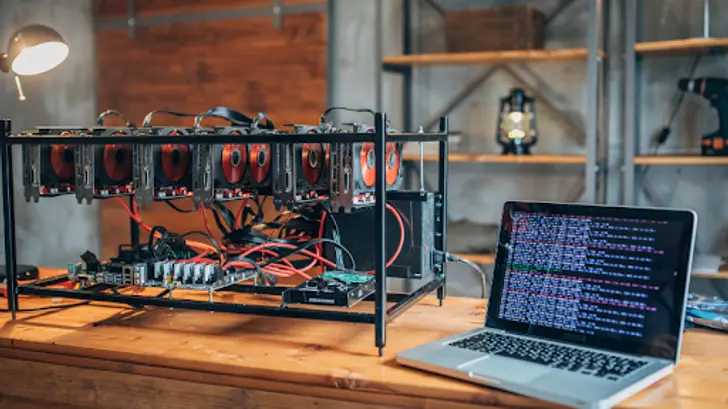

When you hear the words “mining rig,” you don’t usually think of a laptop connected to a handful of GPUs. However, when it comes to crypto, a rig like this could make you a lot of money every day.

What is cryptocurrency mining, though, and how does it work? Is it worth your while to consider setting up a mining rig, and how best can you optimize your income from it? Which coins can you even mine with a setup like this?

In this article, we’ll go over the mining rig meaning, explain how it works, and more!

What is Cryptocurrency Mining?

While mining is nothing more than the first step of the production process when it comes to traditional metals, it’s a lot more important for cryptocurrencies that use a consensus mechanism called proof of work.

Cryptocurrencies are the payment units of distributed networks called blockchains. Put simply: blockchains record the transactions that take place on the network in a ledger. These transactions are grouped into blocks, which are then chained together, with each block pointing to its predecessor.

Under the hood, this is accomplished by network nodes called “miners” who contribute the computing power required to process these transactions. Miners also race to solve cryptographic puzzles that essentially link one block to the next via a hash of the block’s contents.

Mining a block like this is a race. All of the network’s miners devote their hash power to the solution of the cryptographic puzzle, with the winner being allowed to produce the block. They’re also rewarded for doing so with the coins that make up the block reward.

By being paid to the winning miner, these coins enter the circulating supply. This incentivizes miners to put their computing power toward the network, thereby enhancing the decentralization and security of the blockchain in question.

All of the computing power, or hashing power, that miners devote to the blockchain is produced by their mining rigs.

What is a Mining Rig?

A “mining rig” is the term given to the machines (often specialized computers) used by a crypto miner to generate hash power. It can be anything from your PC, as in the early days of Bitcoin, to an entire warehouse or complex with hundreds of thousands of dollars’ worth of GPUs or ASIC mining computers.

A mining rig can be as large or small as you can afford, although the type of computers you use will differ based on the coins you’re mining. For example, Bitcoin is mined by ASICs, while Ethereum was a big reason for the GPU craze of 2020 and 2021 since it was ASIC-resistant while still proof of work.

There are a lot of other proof-of-work cryptocurrencies that can be mined with GPUs, just as there are coins that you’re better off using an ASIC rig to mine. Coins like Monero can’t be mined with either, instead requiring a CPU to mine. For this reason, a mining rig can come in all shapes, sizes, and configurations.

What is the Significance of Proof-of-Work Mining?

We’ve already established that crypto mining is more important than simply creating coins—it’s far more than that. In fact, proof-of-work mining is a truly revolutionary concept.

As mentioned, one miner wins the race to produce a blockchain’s next block. The rest of the miners then get together and validate it quickly, with the difficulty of validation being far, far less than the difficulty of solving the hash.

What’s actually happening here is the distributed network coming to an agreement on the truth of what happened on the blockchain in the last few seconds or minutes (different blockchains have different block times).

Proof of work mining is often thrown under the bus for its energy consumption, but there is the fact that significant and tangible work is being done to generate coins. Proof of work consensus sees energy being converted into coins.

Bitcoin was actually mined with the CPUs of enthusiasts’ computers in the early days. The first Bitcoin miners had a decent chance to win a block reward operating solo, but these days it’s practically impossible without anything short of a massive mining rig or even a mining farm.

All proof-of-work blockchains incentivize miners with the tantalizing prospect of winning the network’s often lucrative block reward. The miner who wins the race to produce a Bitcoin block, for instance, wins a block reward of 6.25 BTC.

Is Running a Mining Rig Profitable?

If you’re running a single computer or just a few machines in your mining rig, you can compare cryptocurrency mining to a lottery. Your total hashing power serves as the ticket guaranteeing entry to the lottery.

That said, the odds of winning a block aren’t quite as bad as with a lottery, and there are no intermediaries who take their cut before finally paying out. But, who knows, you might get lucky like the miner who beat the odds and won 6.25 BTC.

The problem with running a mining rig is that there are a lot of miners vying for that vaunted BTC block reward. Even if you look at proof of work cryptocurrencies with far smaller market capitalizations, the block reward can be extremely valuable.

As the value of the coins that are paid out in the block reward increases, so does the competition to win them. That’s how a market works, although a market will also insist on profitability. Meaning you can expect to make a profit if you can generate a decent amount of hash power while also keeping costs, such as electricity, low.

What Does a Mining Rig Cost?

The cost of your mining rig will depend purely on what coin you want to mine and the equipment required to do so.

Many proof-of-work cryptocurrencies, including Bitcoin, are mined using specialized computers called ASICs. These machines can put out a huge amount of hash power and provide plenty of bang, but they aren’t shy in the buck department either.

ASICs can cost from $500 all the way up to $20,000, but even the most expensive models can be worth it since they provide a fantastic amount of hash power across multiple coins. That said, they also tend to be quite noisy and are very expensive to power.

Besides, that’s only one machine. If you want a rig with multiple ASICs, you may even be looking at a six-figure outlay or more. Meanwhile, ASIC-resistant cryptos can be mined with GPUs, but these aren’t cheap either.

Given the vagaries of the price-inelastic enthusiast PC-building market and the major manufacturers’ knowledge of just how highly crypto miners value high-end GPUs, these aren’t cheap either. For instance, a rig of up to 18 GPUs could easily match or even surpass the price of a top-tier ASIC miner.

How to Set Up a Mining Rig

There are a lot of things to consider when setting up a mining rig.Primary among these is the cost of electricity because operating a rig in an area with high power costs may not be profitable, at least in the short term.

When deciding on the starting capital you’ll need for your rig, you’re mostly looking at the cost of purchasing the computer hardware you need for mining. As mentioned, this depends on the coin(s) you want to mine and might be one or more ASICs or multiple GPUs, along with the cooling gear and other peripherals to go with them.

Once you’ve factored in rent for a location to house your rig and maintenance costs on top of electricity, you’re all set. Now you need to figure out how much you'll make and if it makes sense to go ahead with the plan.

If you’re spending a lot of money on your rig and are considering it an ongoing business with the aim of making a profit, you’ll need to be very sure of your business plan.

On the other hand, if you’re just running a small rig with the aim of collecting and holding coins for the long term, the cost of power isn’t that big of a deal. This is especially true if you’re working from home and making use of a PC that’s in operation anyway!

Last but not least, you need to decide whether you want to operate your mining rig as a solo miner or join a mining pool.

What is a Mining Pool?

Mining pools give crypto miners the option of earning regular rewards by combining the hash power of all participants. This allows the hash function to be processed much faster by the pool as a whole, letting participants earn a regular, reliable income rather than hoping to win the block reward jackpot by themselves.

Advantages of Joining a Mining Pool

If you have a mining rig, especially one on the smaller side, you may want to consider joining a mining pool because of:

- Guaranteed payout. It’s difficult to make it as a solo miner, and the odds of winning a block reward on a blockchain like Bitcoin are extremely remote. There’s actually no guarantee of ever winning a block reward, so all of your mining may be in vain unless you’re running a massive farm or mining a very low-difficulty or brand-new coin. A mining pool, especially one with a decent amount of the blockchain’s total hash power, can guarantee a regular income even if your rig consists of just your home PC.

- Regular payouts. Mining pools make it so that you can’t win and claim a block reward outright, but they do convert mining time into cryptocurrency. You can earn a regular income from your mining rig this way, especially if you use a pool with a good payout scheme.

Disadvantages of Joining a Mining Pool

Here’s why you may want to avoid mining pools:

- Centralization. Cryptocurrencies are supposed to be decentralized, but mining pools centralize hash power. New models like peer-to-peer mining pools do, however, help combat this sort of problem.

- Single point of failure. Attacking or compromising a big mining pool could adversely affect the network, and mining pool operators have occasionally been known to cheat.

How to Join a Mining Pool with Your Mining Rig

Here’s a brief guide on how to get started with a mining pool.

#1. Pick a Cryptocurrency

First of all, pick your poison. You may decide to accumulate a certain coin that provides better mining income than others. Either way, picking the coin or coins you want to mine is crucial because it’ll dictate what gear comprises your mining rig.

#2. Buy Mining Equipment

Once you’ve decided what you want to mine, you can invest in the equipment required to make up your rig. Be it ASICs, GPUs, or even CPUs for coins like Monero, remember not to forget things like mounting racks, power supplies, and cooling.

#3. Review Available Mining Pools

After a quick search for the top mining pools for your selected coin, check their stats and what sort of hash power they have. Ensure that the pool is transparent and that the payout schemes don’t raise any red flags.

If you’re connecting with a comparatively low-end mining farm or just your home PC, check the minimum payment threshold—you should be able to find a pool that’ll pay you every few days.

#4. Choose and Join a Mining Pool

Once you’ve found a mining pool that suits you, join up. Some pools require registration, but generally, it’s just a matter of downloading the mining pool software.

If you don’t have a crypto wallet at this point, don’t go any further without getting one. You’ll have to configure the mining pool software with your wallet address to receive any payouts, so having your own wallet is crucial.

Key Takeaways

A mining rig is a setup of computers, whether specialized ASICs or consumer-grade GPUs, that you can use to mine proof-of-work cryptocurrencies. A rig can encompass as much size and space as it needs in order to generate hash power, but even your home PC, with its CPU and GPU, can be a pretty effective mining rig.

Crypto miners and their rigs are crucial to the operation of proof-of-work blockchains because their computational power secures and decentralizes these networks. A proof-of-work blockchain that’s being worked on by a very small amount of hash power can be attacked or taken over far too easily.

Setting up and running a mining rig is compensated via the blockchain’s block reward, which all the miners working the chain compete for. The block reward is something of a lottery, with your hash power equivalent to how many entries you purchase.

Therefore, small-scale rigs aren’t likely to win any block rewards by themselves, and operators of small mining rigs tend to join mining pools. While not very conducive toward centralization, mining pools can guarantee you a small but regular crypto income from your mining rig.

Mining Rig FAQ

What does mining rig mean?

A mining rig refers to the machines you use to mine cryptocurrency. Your rig could just be your home PC, but it could also be a bunch of GPUs hooked up to a specialized motherboard or even a row of ASIC machines to mine Bitcoin.

What is proof of work?

Proof of work is a consensus mechanism for blockchains that requires miners to devote a considerable amount of hash power to the network. PoW networks are often criticized for their energy requirements since the more rigs there are mining them, the better.

How much does a mining rig cost?

A mining rig can cost anywhere from $500 to upwards of five figures, depending on what coins you’re looking to mine and how powerful of a rig you want to build. That doesn’t include the peripherals and cooling that you’re likely to need.

How to set up a mining rig?

First, decide on what coin you want to buy, then buy the correct mining equipment for it. Hook them up, download the required mining software, configure your wallet, and you’re good to go!

What coins can you mine?

You can use a mining rig to mine any proof of work cryptocurrency. However, Ethereum, formerly one of the most popular proof-of-work coins, can no longer be mined.