How to Stake Fantom: Beginner’s Guide to Staking

crypto staking

Walking around the exciting world of blockchain, we find ourselves at the doorstep of Fantom, a network that has carved its niche in the realm of staking. If you've ever wondered "how to stake Fantom," you're in the right place.

Staking is the lifeblood of the Fantom network, a crucial element in fortifying its proof-of-stake security.

Fantom is a direct competitor to Ethereum. Much like Ethereum, It's also a layer-1 blockchain with staking capabilities. In essence, you can earn passive income by staking its token, FTM.

Imagine Fantom as a high-speed train known for its swift and cost-effective transactions, racing alongside other fast trains like Solana (SOL) and Avalanche. It's earned its stripes as an "Ethereum killer," scaling better than its counterparts.

Fantom's high-throughput blockchain is an open-source smart contract platform that is scalable and EVM-compatible. Think of it as a playground where you can deploy and run your Ethereum decentralized applications (DApps) on Fantom. Its structure is like a supportive scaffold for its decentralized finance (DeFi), managing digital assets, and DApps.

Below, we’ll dive into details on how to stake this promising crypto!

What is Fantom Staking?

Fantom staking refers to the process of participating in the Fantom blockchain network's consensus mechanism to validate transactions, enhance network security, and earn rewards.

This is a proof-of-stake (PoS) model, where investors lock up their FTM tokens for a certain period of time.

By doing this, they contribute to the security and stability of the network. Simultaneously, they are earning passive income in the form of FTM rewards.

The fascinating aspect of staking FTM is that the tokens remain in the owner's wallet during the staking period, accessible only to them. It's similar to a security guard locking up a vault of precious tokens, safeguarding the Fantom blockchain.

The process heavily relies on validators, who play a critical role in transaction validation. These validators stake their FTM tokens, incentivizing them to adhere to the protocol's rules and ensuring the network's integrity. As a security measure, validator nodes must lock up at least half a million FTM tokens, creating a figurative protective moat around the consensus mechanism.

The yield for staked tokens is determined by the current inflation rate, the total number of FTM staked on the network, and the uptime and commission (fee) of individual validators.

So, in a nutshell, Fantom staking is a passive, secure, and potentially lucrative way to contribute to the Fantom network while earning rewards. It's as simple as locking your FTM coins in a wallet and collecting rewards as you sleep.

How to Get Fantom

Now, you might be wondering, "Where can I buy FTM?" You can get these tokens at a cryptocurrency exchange, a DEX, or within select wallets. It's like shopping for a rare item; you should always do your own research when selecting a reputable cryptocurrency exchange.

For the best security, it's not recommended to leave your tokens on an exchange, much like you wouldn't leave your valuables in a public place. Instead, transfer them to your non-custodial or cold/hardware wallet after procuring them.

Some of the places where you can buy FTM tokens are Binance, OKX, Kraken, and Kucoin.

Where to Stake Fantom?

When your FTMs are already in place, it’s time to find them a decent staking hub. There are several platforms that offer this service. Here are some of the most popular ones:

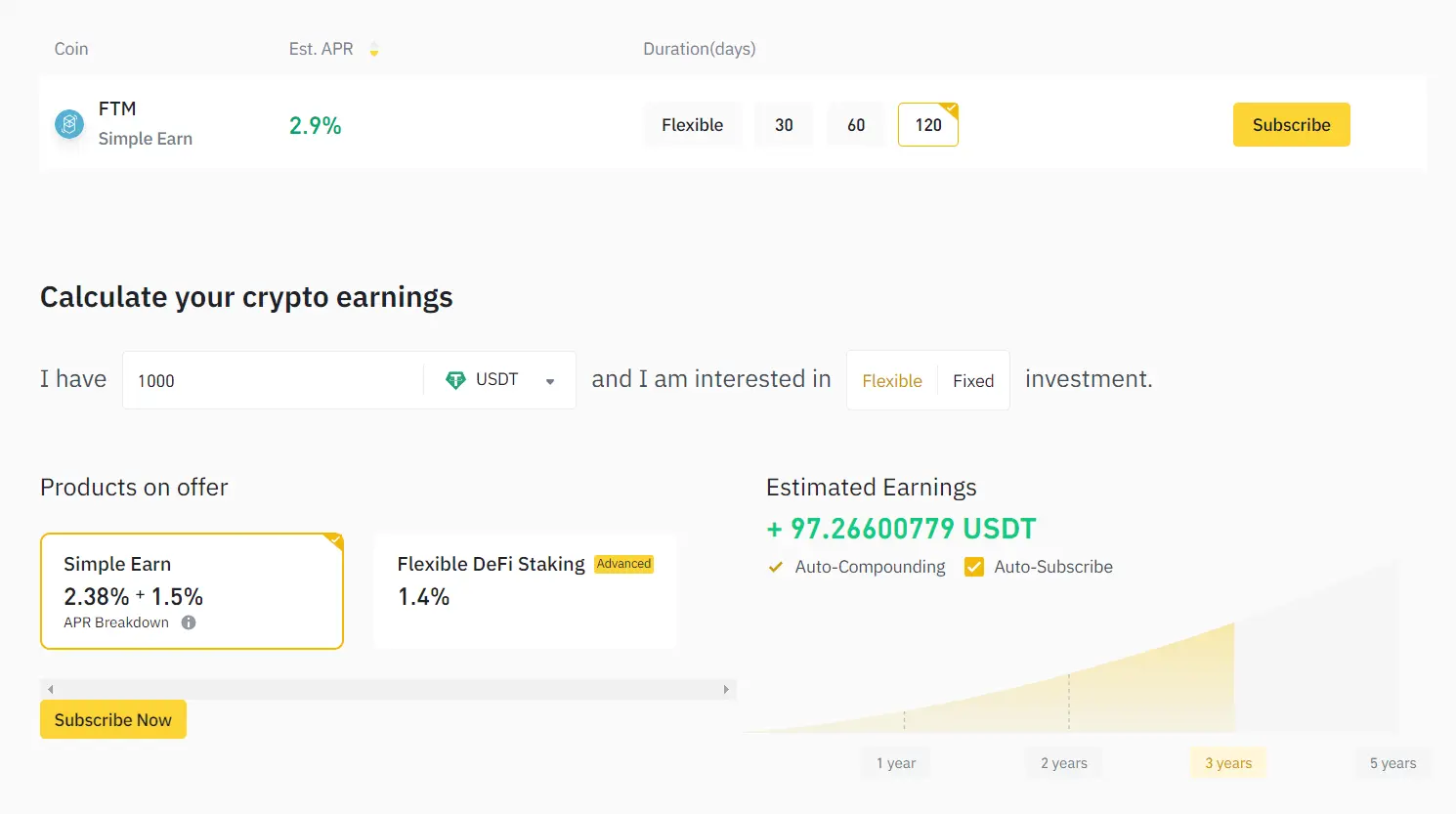

- Binance: Known as the world's largest crypto exchange, Binance offers both flexible and locked staking for FTM. With locked staking, you can choose to lock up your assets for 30, 60, or 120 days, while flexible staking allows you to unstake your assets at any time. Binance offers competitive staking rewards, with rates ranging from 1.9% to 2.9%, depending on the lock-up period. Plus, there are no staking fees or commissions, making it a cost-effective choice.

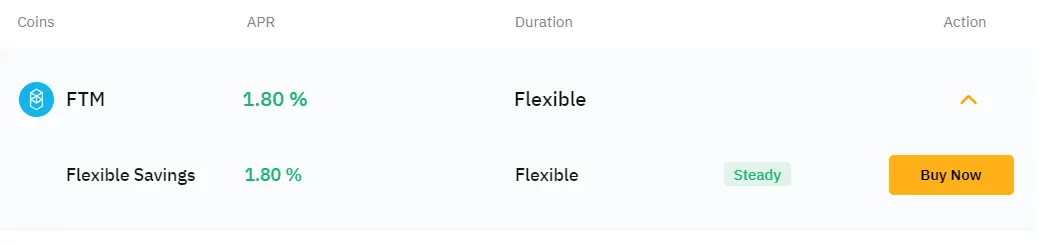

- Bybit: Those who want flexibility when staking FTM should look into this Singapore-based exchange. A 1.80% annual yield becomes even more appealing when you have the option to un-stake your crypto at any moment. The un-staking has no fees associated with it, and any management fees are already calculated in the APY.

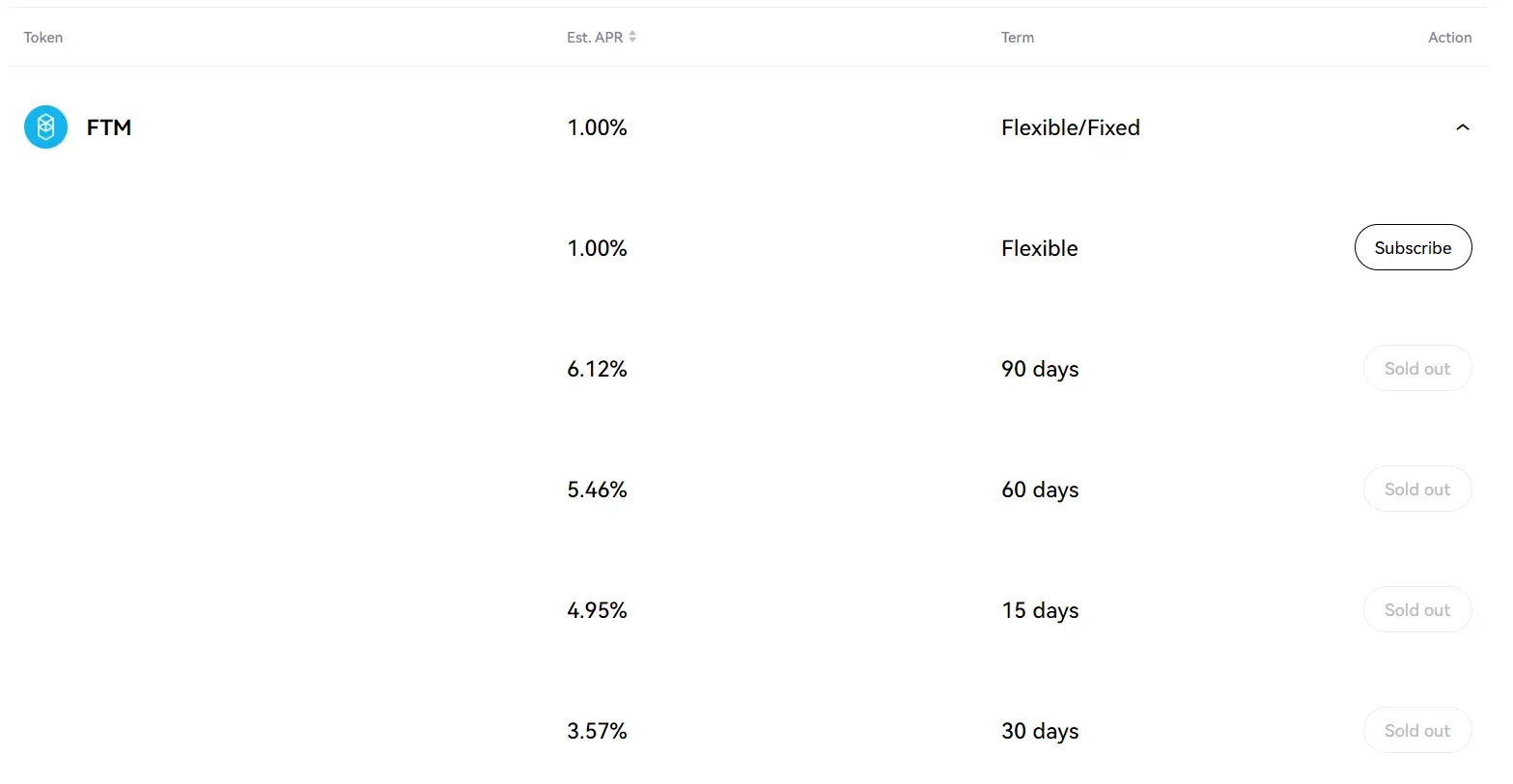

- OKX: If you're fine with locking up your FTM for a specific period of time in exchange for a higher yield, then check out OKX. Their fixed staking plans include 15, 30, 60, and 90-day lock-up periods, where you can earn between 4% and 7% APY. Naturally, the longer the lock-up period, the higher the yield. Lastly, OKX also offers flexible staking.

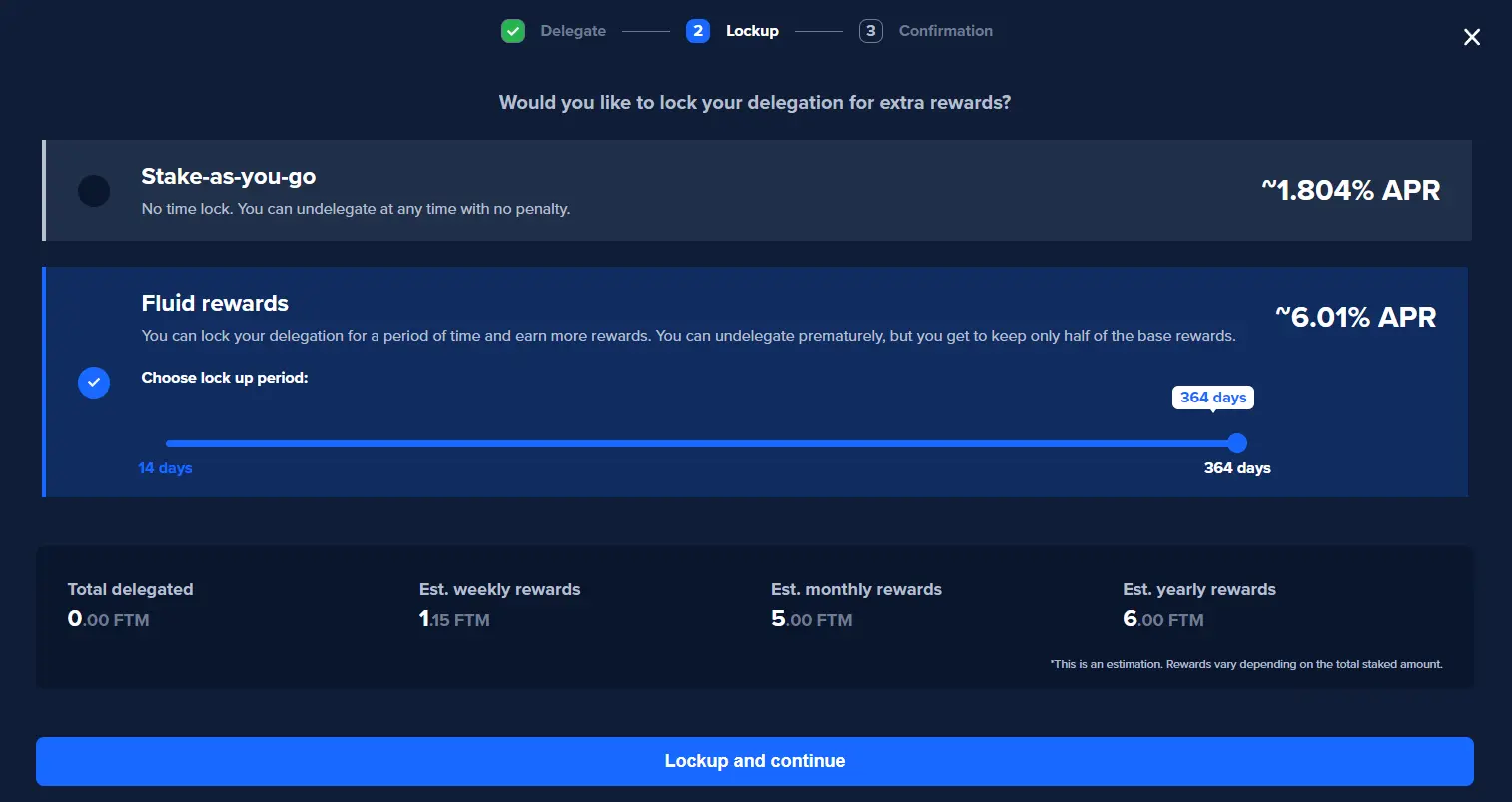

- Fantom Wallet: If you prefer security over convenience and don't want to keep your crypto on an exchange, you can stake FTM directly from a Fantom Wallet. You can join a staking pool and lock up your crypto for anywhere between 14 and 365 days, earning between 1.80% and 6% APY. Fantom Wallet also has the option of liquid staking (using your funds to facilitate DeFi lending and borrowing on Fantom Finance). Many consider this to be the best and safest form of staking.

Each of these platforms has its own advantages, so it's worth considering your individual needs and circumstances when deciding where to stake your FTM. Whether you're looking for flexibility, high returns, or direct staking, there's a platform out there that's right for you.

How to Stake Fantom

There are various strategies and options for staking, each with its own benefits and considerations. Here's a step-by-step guide on how to stake FTM in the simplest possible way.

Step 1 - Have 1 FTM

To begin staking, you need to have at least 1 FTM. You can purchase FTM on various exchanges like Binance. If you're using Binance, you'll first need to buy Tether (USDT) and then swap it for FTM.

Step 2 - Get a Wallet

One of the best wallets to hold and stake your FTM is the Fantom fWallet. On top of staking, this wallet allows you to access blockchain apps and manage multiple tokens.

The simplest way to use fWallet is to use the Fantom browser extension and use it to deposit funds. If you're more concerned about privacy, you can also connect your hardware wallet, such as Ledger, to fWallet.

Step 3 - Go to a Fantom Staking Portal

With your wallet set up and funded, head to the Fantom Staking Dashboard, where you can start staking. Keep in mind that there are many different validators, and some of them are riskier than others.

Fortunately, there's a handy Verified Staking Provider (VSP) Program where you can find a respectable validator.

Step 4 - Deposit FTM

Click the 'Add Delegation' button and select a validator. Decide on the number of tokens you'd like to stake (recall: 1+ FTM), then click 'Continue' and sign the transaction.

Step 5 - Choose a Validator

Choosing a validator is a crucial step. Each validator offers different maximum lock periods and APR amounts.

If you're unsure about how to choose a validator, refer to the FAQ for guidance on selecting a validator.

Step 6 - Finalize The Transaction

Enter the amount of FTM you want to stake, press 'Continue,' enter your password, and click 'Delegate.' You'll start earning rewards in the form of FTM tokens the moment you sign the transaction.

Keep in mind that you can always increase the amount of crypto you stake by repeating the process. Moreover, you can create several instances of staking with different amounts and lock-up periods.

On the flip side, there's a 7-day unbound period when unstaking FTM. Should you decide to pull your assets before a lock-up period, you'll have to pay a penalty (more about it below).

How to Run a Fantom Validator Node

Running a Fantom validator node is a crucial task that contributes to the security and efficiency of the Fantom network.

Validators operate full nodes, take part in consensus mechanisms, and generate new blocks. This process requires certain technical skills and resources, making it more suitable for tech-savvy individuals.

Validators are required to stake a minimum of 500,000 FTM and can have a maximum validator size of 15 times the self-stake amount.

The hardware requirements include an AWS EC2 m5.xlarge with four vCPUs (3.1 GHz) and at least 4.5 TB of Amazon EBS General Purpose SSD (gp2) storage or equivalent.

The rewards for running a validator node are approximately 13% APY, which includes the normal APY on self-stake and 15% of delegators' rewards. However, the APY can vary based on the staked percentage.

Here's a step-by-step guide on how to run a Fantom validator node, based on the official Fantom documentation:

- Launch a Cloud Instance. You can run a node on your own hardware or use a cloud provider like Amazon AWS.

- Set Up a Non-Root User. This technical step involves adjusting a few settings.

- Install the Required Tools. This includes installing Go and Opera.

- Register a Validator. Create a validator wallet, which will serve as your identity in the network and will be used to authenticate and sign messages.

- Run the Validator Node. Restart your node in validator mode using the appropriate command.

Remember, running a validator node is a technical process, and it's recommended to refer to Fantom’s instructions for full specifications and details.

What Are Good Options for Fantom Wallets?

Navigating the world of Fantom (FTM) tokens, you'll encounter a diverse array of wallets, each offering its own unique blend of features and advantages.

These are:

- Fantom Wallet: The official custodian of Fantom's blockchain, the Fantom Wallet is a versatile tool for managing your digital assets. It empowers users to establish a wallet, transact in FTM tokens, stake their holdings, and participate in governance votes. Crafted as a Progressive Web App (PWA), it ensures seamless updates across all platforms with a unified codebase.

- MetaMask: A crowd-favorite in the crypto sphere, MetaMask is a digital vault that facilitates the sending, receiving, and storing of FTM. It can be tethered to DApps operating on the Fantom blockchain and other EVM-compatible networks. MetaMask provides a fortified gateway for users to interact with decentralized applications, guaranteeing they retain control over their accounts and data.

- Coinbase Wallet: As the proprietary wallet of one of the globe's most prominent cryptocurrency exchanges, the Coinbase Wallet provides a straightforward method to safeguard FTM and connect to the Fantom network. It's available for iOS and Android and as a Google Chrome extension. With the Coinbase Wallet, users can seamlessly integrate with the Fantom Foundation DeFi ecosystem.

- Ledger Nano X: This esteemed hardware wallet is renowned for its security features and compatibility with various operating systems and devices. For those wondering how to stake Fantom on Ledger, it can be utilized to directly access the network’s DeFi platform and stake the tokens. The Ledger Nano X can also be synchronized with MetaMask to explore various DApps on the Fantom network.

Each of these wallets presents a unique set of attributes, making it essential to select one that aligns with your individual needs and preferences.

Is it Safe to Stake Fantom?

Staking FTM is generally considered safe due to the inherent security measures in place. Importantly, the validator node, which plays a crucial role in the staking process, cannot access your staked tokens. This means that your investment is secure as long as you keep your mnemonic phrase or private key confidential and secure.

Moreover, it's important to understand that when you stake FTM, you're not actually sending your tokens to the validator. Instead, you're delegating your voting rights to them. This means that while the validator can represent your stake in the network's consensus mechanism, they don't have the ability to move or spend your tokens.

However, it's essential to note that staking isn't without risks. Your stake can be slashed, which means you could lose a portion of your staked tokens if the validator behaves irresponsibly or maliciously. To mitigate this risk, it's advisable to choose reputable Fantom validators. These validators typically have active communities, official websites, and Twitter accounts, indicating their credibility and transparency.

While you have the option to withdraw your stake before the lock-up period ends, doing so will incur a penalty. Therefore, it's crucial to consider your financial strategy and commitment before staking. As with any investment, understanding the potential risks and rewards is key to making informed decisions.

How Much Can You Earn From Staking Fantom

The two main parameters that influence the profitability of staking Fantom are:

- Lock-up period

- The amount of FTM staked

For instance, a 14-day lock-up period with a minimum amount of crypto staked results in a 5.01% annual percentage yield. Comparatively, if we increase the lock-up period to 365 days, the APY more than triples to 15.31%.

To put those numbers into practice, let's say you staked 100,000 FTM for a period of one year. You'd get 6% APY, which results in 6,000 FTM in rewards at the end of the year. However, should you decide to unstake early, your APY would drop to 0.9%. That significantly lowers the reward amount.

Using our example, unstaking at day 300, after earning 5,000 FTM, would only give you 95,900 from the original FTM staked. That's to account for a reward penalty for unstaking early. Ultimately, you'll end up with a total of 100,900 FTM.

As a final piece of advice, make sure to use the Fantom staking rewards calculator. It can help you determine potential earnings in advance and figure out the best lock-up-to-reward period ratio.

How to Unstake Fantom

Unstaking your FTM is straightforward but involves a 7-day waiting period. Here's a brief rundown:

- Navigate to "Staking" in your wallet's sidebar.

- In the "Unstake" tab, specify the FTM amount to unstake. If you have locked delegations, click "Unlock more?" to include them, but remember, early unlocking incurs a penalty.

- Click "Unstake" and confirm the transaction.

After a week, your unstaked FTM will be accessible in your wallet.

How to Stake Other Tokens on Fantom

Staking tokens on Fantom extends beyond FTM, with a variety of DeFi tokens available for yield generation.

Here are a few:

- SpookySwap: This decentralized exchange offers the option to use FTM for yield farming. Pair FTM with SpookySwap's native token, BOO, to provide liquidity. You can also stake BOO.

- Beethoven X: This automated portfolio manager and liquidity provider in the Fantom ecosystem allows users to stake BEETS (Beethoven X native token) for 31% APR.

- QiDao: Qi Dao is a zero-interest crypto lending protocol that allows you to stake its native token, QI. APR depends on the length of the lock-up period.

- Scream: A decentralized lending protocol on the Fantom network that gives users access to deep liquidity. You can stake its native token, SCREAM, for ~58% APR.

- Geist Finance: A decentralized lending and borrowing market built on Fantom. In addition to many other features, you can stake GEISTFTM for 14,26% APR.

Remember, to stake these tokens, you'll need a wallet connected to the Fantom Opera network.

Key Takeaways

Staking presents an attractive opportunity to generate returns on your FTM tokens.

With an APY that often surpasses its Layer-1 counterparts, Fantom offers a compelling proposition for those who believe in its potential. However, it's crucial to remember that with high rewards come inherent risks.

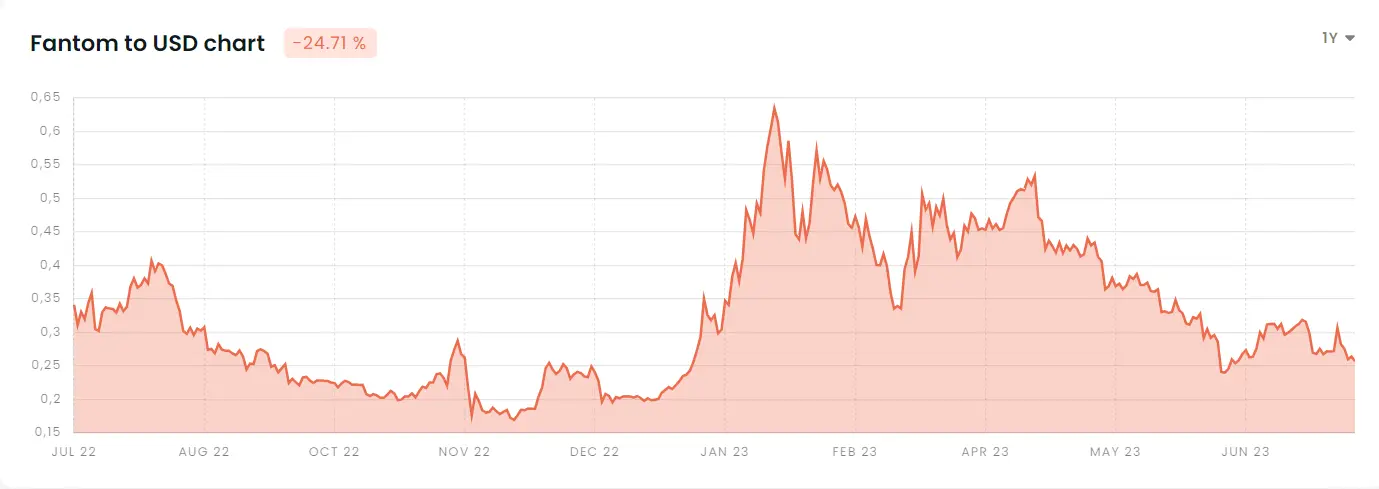

The bear market of 2022 saw FTM and many other crypto tokens experience significant drawdowns, exceeding 90% in some cases.

While staking can increase your token holdings, it doesn't necessarily guarantee an increase in overall value. Additionally, staking and locking up your tokens can limit liquidity, making it challenging to exit a position when needed.

As with all investment strategies, it's essential to thoroughly understand the risks involved and make informed decisions.

How to Stake Fantom FAQ

#1. What is the minimum stake for Fantom?

The minimum stake required to become a validator on the Fantom network is 500,000 FTM tokens.

#2. How much can I earn from staking?

The estimated reward rate for staking Fantom is approximately 5.01%. This means that if you hold and stake your FTM tokens for a year, you can expect to earn about 5.01% on your investment.

#3. Can I lose my tokens while staking?

Yes, there is a risk of losing your staked tokens if the validator node you stake to behaves maliciously. It's crucial to choose a reputable validator node to mitigate this risk.