What is a Crypto Exit Scam?

ethereum

Cryptocurrency is a decentralized and relatively unregulated area of finance that has both pros and cons. Decentralization tends to be a uniformly positive thing, but a lack of regulation does mean that you’ll often see scams like the infamous crypto exit scam.

To protect your wealth and safely navigate the shark-infested waters of crypto, educate yourself about what can go wrong. That way, you’ll find it easy to avoid scams and enjoy a far more rewarding experience in crypto.

So, for all about crypto exit scams and things to be careful of during your crypto journey, keep reading!

What is a Crypto Exit Scam?

There are a lot of crypto scams out there, but the crypto exit scam is especially nefarious because it’s the developers of a project who are responsible for orchestrating the fraud.

There are hundreds, if not thousands, of crypto projects out there, and more are being created each and every day. Marketing is one of the key considerations for many of these projects since however good the tech they’re developing is, they won’t get anywhere without a community willing to back them.

A crypto exit scam is all about this sort of marketing. You’ll hear terms like “shill” being bandied around a lot—shills, put simply, are people being paid to spread the word about or support a project.

It’s not just the developers who may be involved in a crypto exit scam, however. They might be using individuals with a lot of clout to shill their project—just like FTX employed a legion of celebrities for the job, an exit scam can definitely involve influencers.

In fact, a lot of “crypto YouTubers” are suspected of participating in exit scams. One of them, Ben Armstrong, a.k.a. “Bitboy,” was even publicly accused of such by the CTO of Ripple, David Schwartz.

Why do Crypto Exit Scams Work?

One of cryptocurrency’s inescapable truths is the fact that the extreme volatility experienced by the various cryptos can make them extremely profitable.

Everyone knows someone who got into Bitcoin early and made a pile (or sold too early). It’s often said that hindsight is 20-20, and it’s far too easy to imagine buying BTC all the way back in 2013 and being another Winklevoss.

This is true for almost every asset class.Ever heard of Ronald Wayne? You probably haven’t. Well, Wayne was a co-founder of Apple alongside Steve Jobs and Steve Wozniak. He was something of a minority shareholder even at the beginning, owning 10% of the fledgling company.

10% of Apple, however, is a fortune of Biblical proportions. At today’s market capitalization of $2.76 trillion, owning 10% of that would make you the richest person in the world today. According to the BBC, you’d make the historical top 10 with that sum, too, sitting somewhere between William the Conqueror and Nikolai Alexandrovich Romanov, the Tsar of Russia.

Needless to say, Ronald Wayne isn’t on that list.He “paperhanded” his Apple stock after just 12 days, selling it back to Jobs and Wozniak for just $800.

The point here is that astronomical fortunes are made by those who can enter a position early in an asset’s life. That’s the dream being offered by the folks setting you up for a crypto exit scam, the fear of missing out (FOMO) on the next coin that goes to the moon.

How Does a Crypto Exit Scam Work?

Many crypto exit scams leveraged initial coin offerings, which were popular during 2017 and 2018. Again, there’s precedent for fortunes being made here—Ethereum ran an ICO in 2015, and anyone who’d participated and held onto their ETH a couple of years down the line was very well off.

Creators of the project would set up an exciting project and hype it up. Major, multi-channel marketing campaigns would be carried out, complete with shills, all intended to drive up interest in the project prior to the ICO.

Then, the ICO would be announced and carried out, and lo and behold, the developers would vanish with participants’ funds at the end of the ICO.

You could argue that the age of the ICO is over, but it really isn’t. Token Generation Events (TGEs) and the like are just ICOs that use a different name, and you should take care when investing in any sort of coin. Even if it isn’t an exit scam, the project could fail.

Things to Look Out For

Here are some of the main red flags to keep an eye out for if you want to avoid a crypto exit scam:

- Undoxxed developers. Doxxing, or revealing the real identity of someone, is generally considered a bad thing online, where we all enjoy our veneer of pseudonymity. However, it’s far easier for an exit scam to be successfully carried out when a developer stays anonymous. It’s not unheard of for project devs to do so, but having the developers’ real identities attached to the project makes an exit scam a little less likely.

- Poor token distribution. Truly fair or equitable launches are quite rare in crypto these days, so it’s useful to look at the planned token distribution. If the team behind the project holds an outsized portion of the supply, you might begin to smell a rat.

- No code audits. There are a lot of third-party firms that projects use to audit code. These firms will stake their reputation on the audits that they do, so not engaging one to go over a project’s code is somewhat suspicious.

- Aggressive marketing. As mentioned, marketing is important and helps secure the required funding for the project. But does the amount of marketing feel excessive? If it’s being shilled far too much, or the marketing efforts seem disingenuous and out of proportion, you can take this as a red flag.

- Inadequate whitepaper. A project’s whitepaper is important, and if you take a look at some of the best blockchains’ whitepapers, you can see the level of diligence and detail put into them. An inadequate or inconclusive whitepaper, therefore, is a bad sign.

- Unrealistic promises. If the project’s shills claim that you’re going to become a billionaire by buying a few tokens, watch out. Remember that basic rule of investing—if something offers high returns, that means it also involves proportionally high risk. Failing that, some things are just too good to be true.

Famous Crypto Exit Scams

If you think crypto exit scams aren’t worth worrying about, think again! Here are some exit scams that hoodwinked plenty of investors worldwide.

#1. Squid Game (SQUID)

This one was always going to be a trap, but people bought in nonetheless. Based on the hit Netflix show, the SQUID token set the world alight by capitalizing on a fad, and then the developers dumped their tokens, netting a cool $12 million.

If the name wasn’t enough, the project’s whitepaper also contained this promise: “The more people join, the larger (sic) reward pool will be.”

Dodgy grammar, itself a red flag, aside, that claim underlines a classic feature of what we know today as a Ponzi scheme. Despite this and plenty more red flags, the Squid Game managed to snare plenty of victims.

Out of over 43,000 wallets tied to the SQUID token, eight held more than 1 percent of the token’s entire supply. One account, the same acknowledged to have pulled the rug out from under investors, held 5 percent of the token supply.

#2. BitConnect

It might have been relegated to a series of memes, but BitConnect was once a top 10 cryptocurrency. According to the US Department of Justice, BitConnect operated by paying early investors using money from later investors in a classic Ponzi scheme.

The fraudulent platform’s founder, Satish Kumbhani, is accused of misleading investors, wire fraud, and conspiracy to commit commodity price manipulation and could face 70 years in jail. According to the DOJ, his promoters propped up the price of the platform’s digital currency to create false market demand.

#3. OneCoin

A true exit scam, OneCoin was all about marketing. Its founder, Ruja Ignatova, went by the sobriquet “Cryptoqueen” and made appearances in front of cheering crowds at venues such as London’s Wembley Arena.

In October 2017, less than two years after the height of her popularity, Ignatova hopped onto a plane in Sofia and vanished, never to be seen again. According to the FBI, she had scammed investors out of $4 billion.

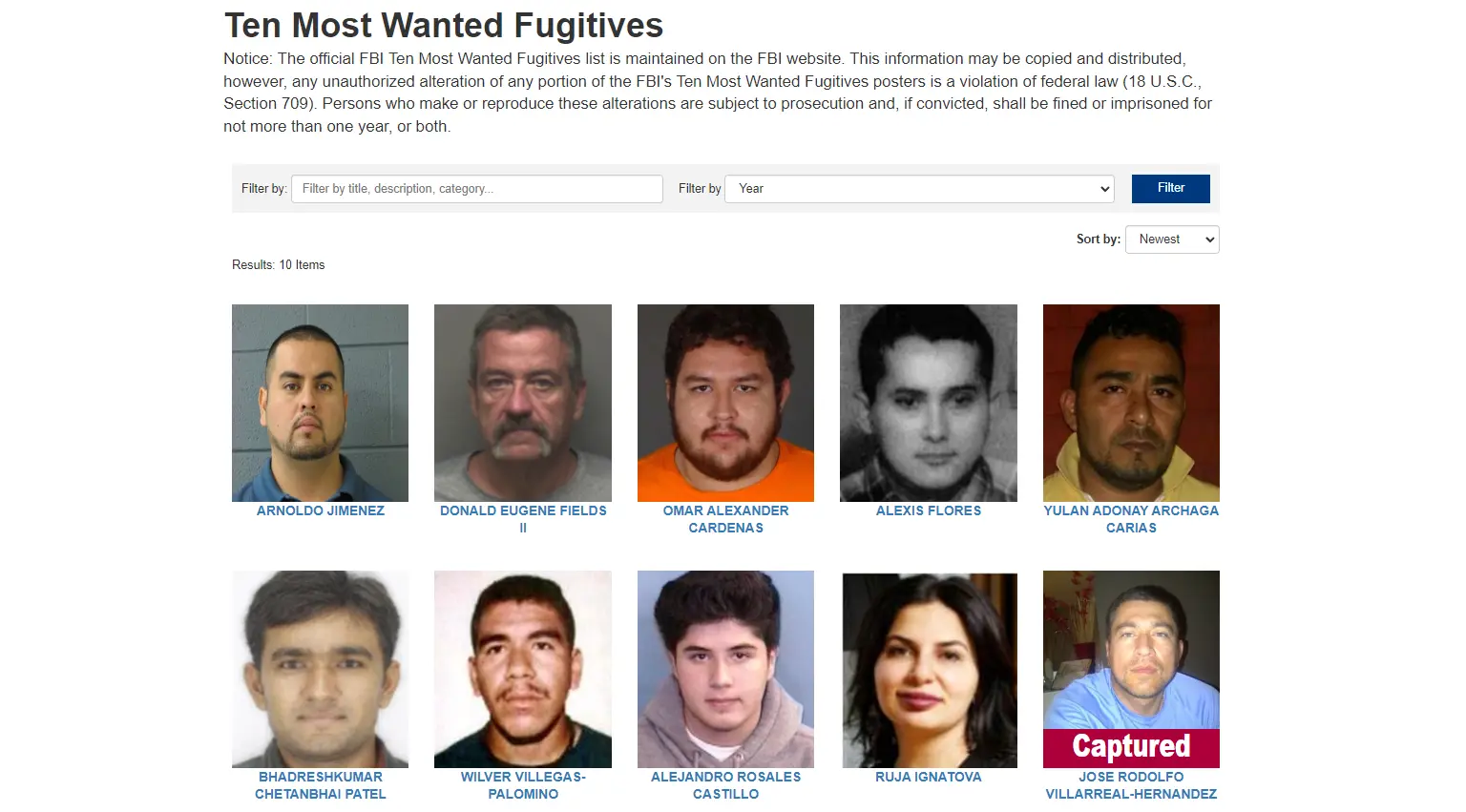

Ignatova, as it happens, is still on the FBI’s Most Wanted Fugitives list and is the only woman among that group of luminaries. There’s a reward of $250,000 for information leading to her arrest, and she is believed to travel with armed guards and/or associates.

While Ignatova remains at large, her associates haven’t been as lucky. Her business partner, Karl Sebastian Greenwood, was arrested in Koh Samui, Thailand, and extradited to the US before pleading guilty to three charges. Ignatova’s brother, Konstantin Ignatov, was arrested in Los Angeles and pleaded guilty to wire fraud conspiracy, money laundering, and fraud charges.

#4. Confido (CFD)

During the crypto bull run of 2017/18, an escrow-related crypto startup called Confido was doing the rounds. The CFD token rallied to a market capitalization of $6 million, at which point the Confido team disappeared overnight after acquiring some $175,000 from their backers.

Other Crypto Scams

Now that you know all about crypto exit scams, here are a few other crypto scams you need to look out for to stay safe.

#1. Rug Pulls

There isn’t too much to differentiate between rug pulls and exit scams except that if there is a difference, rug pulls tend to be applied to token offerings like Initial DEX Offerings, while crypto exit scams can be carried out in different ways.

Just like in an exit scam, the perpetrator of a rug pull will try to hype up a project by pumping its value, often through paid YouTube influencers and shills, before dumping the token and disappearing with their profits.

#2. Phishing

These types of scams have been around forever, but that’s because people continue to fall prey to them. If your email address is acquired through a hack (or simply sold by a firm you’ve provided your data to), you’ll often see emails from a “bank” or some sort of “support” asking you for personal or wallet details.

You’ll be fine as long as you don’t navigate to a site and provide personal or wallet info via an email link.

#3. Romance Scams

Worryingly, also referred to as “pig butchering scams,” these won’t get you unless you use dating apps or sites. Scammers will try to strike up a relationship over the long term, eventually getting you to send them crypto before disappearing.

#4. Investment Advisors

Just like with a real investment advisor, these scammers will promise you the world but require you to pay an upfront fee. That said, real investment advisors are probably worse—they’ll get you through the terms and conditions, often via the inclusion of annual fees that are only mentioned in the small print of your contract.

#5. Ponzi Schemes

Just like with BitConnect, Ponzis use the money gained from early investors to pay out later investors. Therefore, early investors vouch for and champion the platform, not knowing that the company or individuals behind it are biding their time, waiting for the number of new investors to hit a critical mass before disappearing into the sunset with their funds.

#6. Hedge Funds

They’ve got a bad rep already, but watch out if they’re closely tied to a crypto exchange or market maker.Bernie Madoff is a noted exponent, but Sam Bankman-Fried is the best-known modern perpetrator. Namely, he took customer deposits to his FTX crypto exchange and funneled them off into his hedge fund, Alameda Research.

Key Takeaways

The crypto exit scam is a noted way to scam investors out of a project, and the developers are usually at fault. They’ll hype up a project via extensive marketing before disappearing with the money accrued from project backers.

Aside from excessive marketing, one of the major warning signs of a possible crypto exit scam is a developer team that is anonymous. Devs who are willing to reveal their real names and identities are not only taking a risk but also putting their personal credibility on the line and making it harder for themselves to get away with it if an exit scam is the end goal.

Another thing to look out for is what the project is offering. Projects that focus on technology rather than extreme investment gains are much more likely to be legit. Taking Bitcoin and Ethereum, for example, neither of them offered any sort of promise when it came to investment, but the tech in question changed the world.