What Is Bull Trap in Crypto Trading and How to Identify It?

crypto basics

One of the key characteristics of the thriving world of cryptocurrency is its volatility. It represents an opportunity for savvy investors and traders to see high returns on their holdings. And while trading comes with many signals, indicators, and other various buzzwords, one of the key terms that you should be aware of is the bull trap in crypto.

But what exactly is a bull trap in the context of crypto trading? How dangerous is it, and how can you recognize it before it happens or adapt if you get caught in the trap?

Join us as we explore the intricacies of crypto bull traps to help both entry-level enthusiasts and seasoned traders get the most out of their assets. Let’s get started!

What Is a Bull Trap in Crypto Trading?

A bull trap in crypto trading refers to a false signal that indicates a market in a temporary uptrend is going to continue upward. However, the trend quickly reverses and leads to a decline, oftentimes to lower prices than before the bull trap started.

Before we explain a bull trap in greater detail, let’s first define what a bull market is. A bull run represents the rise of the market, which encourages investors to keep buying. It stands in contrast to the bear market, which is in a continuous downtrend, discouraging investors from entering it.

The meaning of the bull trap in crypto is the same as in any other financial market that involves trading. The term stems from the fact that investors end up “trapped,” holding their assets that have dropped in value.

At that point, they can either sell them at a loss or keep holding them in hopes the price comes back around. However, in that case, there's the risk of the cryptocurrency's price dropping even lower, resulting in even greater losses.

In the end, inexperienced traders and investors who bought cryptocurrency during peaks of bull traps usually end up with losses, which is why it’s crucial to familiarize yourself with the concept.

The Psychology Behind the Bull Trap

The psychology behind crypto bull traps involves various cognitive biases and the herd mentality that affect the majority of investors, especially those with less experience.

Here are some of the key concepts that affect the decision-making processes of investors who fall for bull traps:

- Fear of missing out (FOMO). FOMO is one of the key psychological phenomena that influences investors to make less-than-optimal decisions. When they see the price of a cryptocurrency rise, they may buy in the fear of missing out on great gains, only to fall for a bull trap.

- Optimism bias. A sense of false optimism may arise when seeing a mild upturn after witnessing a decline in the price of cryptocurrency. Investors may end up believing that the downturn is over and purchasing the asset optimistically, thinking that it’s only going to keep rising.

- Confirmation bias. Bullish investors with confirmation bias may only factor in the good news and uptrend indicators during their trading. They often ignore any negative signals that show the market might experience a downturn.

- Overconfidence. Increased optimism coupled with confirmation bias often results in overconfidence in investors. In these cases, they might invest more than initially planned, which can result in greater losses in the case of crypto bull traps.

- Herd mentality. As the price of a coin or token starts to increase and investors see others buying in, they might enter the market merely because they think not everyone can be wrong.

How Do Bull Traps Happen?

There are many factors that influence how bull traps happen in the crypto market. A combination of internal dynamics, external factors, and investor psychology is what affects the overall market movement.

Some of the technical factors that can prompt investors to fall for bull traps are:

- Support levels. These represent prices where a market is supposed to bounce back into an uptrend. However, these bounces can be short-lived and may quickly turn into another downtrend.

- Moving averages. Many traders rely mostly on moving averages to determine future market movements. If they don’t pay attention to other signals, they might fall into the crypto bull trap.

On the topic of external influence, some that can result in bull traps include:

- News and events. Positive news can result in price spikes. However, if there are no fundamental reasons for these uptrends, the price can quickly return to previous levels, trapping unsuspecting investors.

- Regulatory changes. Announcements of regulatory changes that are beneficial to the crypto market can also result in short-term upward trends that can lead to bull traps.

Investor psychology is another major factor that can influence the cryptocurrency market. Previously discussed phenomena such as FOMO and herd mentality can push investors to act based on subjective feelings rather than on objective facts and indicators.

Lastly, since the cryptocurrency market is rather small compared to traditional financial markets, it can be susceptible to pump-and-dump schemes. Institutional investors and large groups can influence the market movement to create artificial bull price inflation before selling their positions and plummeting prices.

How to Identify a Bull Trap

There are many ways to identify a bull trap and avoid potential losses during a trade. While there’s no single foolproof signal, a combination of several is usually a strong indicator of a crypto bull trap in the making.

Here are some of the signals and strategies you can use to recognize it:

- Low trading volume during periods of upward turns or after bounces off of support levels is usually a strong indicator of a potential bull trap. Real upward trends are usually followed by high trading volume that supports them. You can use volume oscillator tools (e.g., the VROC indicator) to identify volume spikes or sustained efforts.

- Resistance levels need to be closely monitored during an upward turn. If a cryptocurrency fails to break a resistance level or quickly retreats below it, that can indicate a reversal.

- The moving average is another good indicator for bull traps. A movement above the line followed by a quick drop below can signal a continuous downtrend and a bull trap.

- False breakouts happen when the price moves out of the established trading range only to quickly return, indicating the potential for a bull trap.

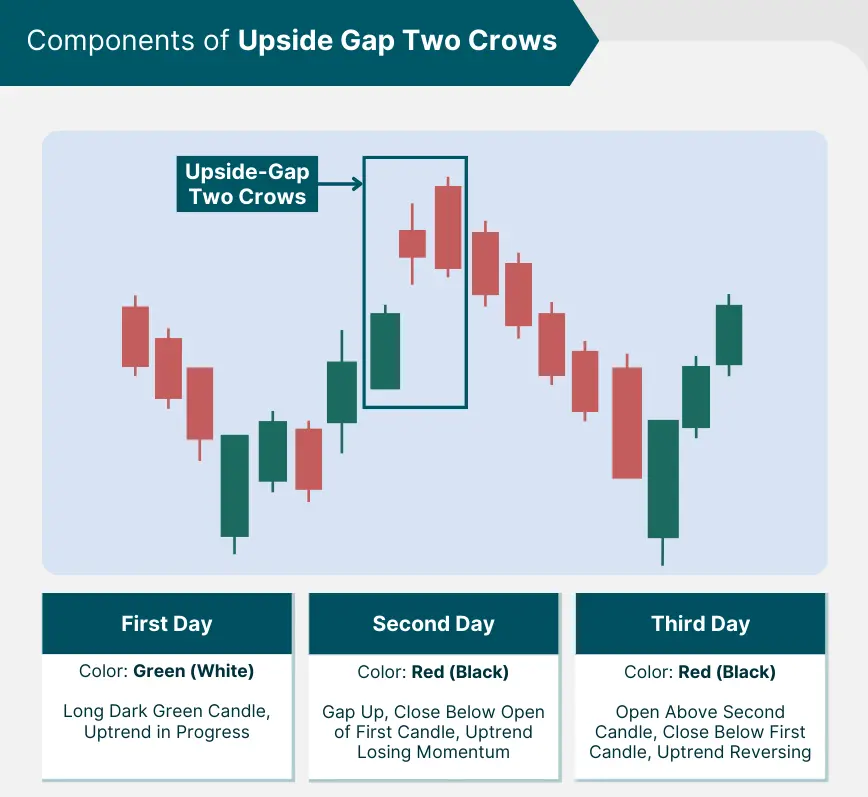

- Reversal patterns such as shooting stars (check the image below) or bearish engulfing patterns can indicate a bull trap in combination with other signals.

- Unjustified price rises from a fundamental standpoint can also lead to a bull trap. If a coin or token sees a surge in price without positive news, regulations, or other factors, the price might come back down quickly.

- Stop-loss hunting is often utilized by large-scale market makers who briefly and artificially pump the price up to trigger stop-losses from smaller traders.

Bull Trap in Crypto Trading Example

Let’s go through a step-by-step example of Bitcoin in a bull trap:

- Imagine if BTC was trading around $10,000 for a while.

- A minor piece of good news regarding crypto regulation comes out, and BTC quickly rises to $15,000, resulting in a 50% gain.

- Investors see that sudden surge and rush in to buy BTC, thinking its price is going to go much higher.

- Soon after, another, greater piece of bad news breaks out, and the price quickly drops back to $10,000.

- Investors are now left holding BTC, which has lost 33% of its value.

At this point, BTC holders can either sell it at a loss or hold it, hoping its price will come back in the future. However, the coin can always drop further, incurring even bigger losses for investors caught in a bull trap.

Here’s another example in the form of a candlestick pattern, which shows an uptrend reversal and indicates a potential bull trap:

How to Prevent a Bull Trap

There is no way for a trader to singlehandedly prevent a bull trap in the crypto market. The market dynamics are determined by many different factors as well as countless investors, both retail and institutional. However, a trader can take precautionary steps to avoid being caught in a bull trap.

One of the most important things you can do to avoid bull traps in crypto markets is to practice continuous learning. Educate yourself on different charts, trading techniques, and market analyses that can help you spot both bull traps and bear traps.

Furthermore, you should stay in the loop by following the news. That’s one of the best ways to avoid FOMO or herd mentality influencing your decisions. It can help you with a fundamental analysis, allowing you to tell minor news from big ones.

If you’re a frequent trader who uses technical analysis, try not to rely on a single indicator. While many professional traders do not advise using countless indicators either, try to use a combination of a few and only enter a trade when they align.

Lastly, it’s important to practice risk management. When trading, always use stop-loss functionalities and size your positions accordingly. On a larger scale, try to diversify your portfolio and don’t put everything into one asset so that you don’t lose as much even if you buy into a bull trap.

Key Takeaways

As you can see, bull traps in the crypto market represent a potentially dangerous series of events that can result in losses for average investors. That’s why it’s vital to familiarize yourself with the concept and figure out different ways to avoid these traps.

With this article, we’ve given you everything from definitions of these traps to examples, key identifiers, and the psychology behind them. You now have the necessary knowledge to avoid not only Bitcoin but also Ethereum bull traps, as well as bull traps involving every altcoin in the crypto market.

Stay safe, stay informed, and may no trap cause you harm!

Bull Trap in Crypto FAQ

What is the difference between a bull trap and a bear trap?

The difference between a bull trap and a bear trap is in the way the market moves. A bull trap ends with an unsuspected downturn that harms investors who tried to long the market. A bear trap happens when the market moves upward, liquidating all short positions.

How do you spot a bull trap?

You can spot a bull trap by paying attention to charts and noticing some of the recognizable candlestick patterns, like shooting stars or bearish engulfing. Other ways include paying attention to the trading volume or resistance levels, practicing fundamental analysis, and more.

How do you predict a bull trap?

You can predict a bull trap by using technical analysis tools that indicate a temporary reversal in the market. While there’s no foolproof way to predict a bull trap, noticing that several signals show its potential formation can be strong evidence.

Is Bitcoin in a bull trap right now?

Bitcoin is not in a bull trap right now. Bitcoin has a somewhat consistent four-year cycle that repeats itself, and it is currently trading in a stable range. However, it can enter a bull trap at any moment, especially before the bull market starts.

Can you profit from bull traps?

You can profit from bull traps if you spot them on time. That allows you to short the cryptocurrency that’s about to experience a downturn and profit from its decrease in price.