What is Know Your Customer (KYC) in Crypto?

crypto basics

If you try to sign up to use a top-tier cryptocurrency exchange, the odds are that you’ll be asked to complete a series of steps to fulfill the exchange’s Know Your Customer in crypto. Often, this involves submitting official documents that prove your identity and could even require you to take a picture!

Many people think this process is invasive, and they’re probably right. Consumers are forced to compromise their privacy to access just about any service in today’s day and age, and KYC feels like an extension of that.

So, let’s explore why Know Your Customer protocols are part and parcel of most crypto exchanges and centralized services, who requires them, and how they came about!

What are the Origins of Know Your Customer?

Know Your Customer protocols are part of compliance with anti-bribery and anti-money laundering (AML) standards enacted at both the national and global levels.

In 1989, an intergovernmental organization called the Financial Action Task Force (FATF) was established by the G7 group of countries to examine and develop measures to combat money laundering.

The G7, which includes France, Canada, Germany, Japan, Italy, the United Kingdom, and the United States, issued an economic declaration creating the FATF and outlining its purpose. In 2001, the FATF expanded its mandate to combat terrorist financing, and in 2019, its mandate was changed to be open-ended.

Along with the opening up of its mandate, the FATF revised its standards in 2019 toinclude binding measures for the regulation and supervision of the activities and service providers related to virtual or crypto assets.

This revision provided guidance and recommendations on how member jurisdictions should regulate cryptocurrency businesses. It placed anti-money laundering measures and countered the financing of terrorism (CFT) obligations on several virtual assets and virtual asset service providers.

This guidance was updated in 2021, with certain provisions spelling out different ways that virtual asset service providers should gather data on transactions and verify the accuracy of depositor information.

How Powerful is the FATF?

The FATF isn’t exactly small fry. In fact, whatever crypto services you use or think of using may be within the organization’s reach unless they’ve gone out of their way to set up in an obscure location.

By the end of 2022, the FATF would comprise 37 full member nations and two regional organizations, the European Commission and the Gulf Cooperation Council. It also maintains the FATF blacklist, which currently features Iran, Myanmar, and North Korea.

Given that the entire FATF network covers 187 countries, it can be considered a global policymaker that generates the necessary political will to bring about national regulatory reforms pertaining to money laundering and bribery.

Why does Crypto Need KYC?

Put simply,the main objective of KYC is to prevent businesses in the cryptocurrency industry (virtual asset service providers, or VASPs, according to the FATF) from being used, whether intentionally or not, by money launderers or terror financiers.

With proper KYC processes in place, businesses can vet their customers to ensure that they’re not providing services to hardcore criminal elements or terror networks. The point isn’t really to collect all of your data but to monitor client activity and avoid the risk of being used for serious crimes.

Cryptocurrency tends to be given a bad rap and associated with crime by individuals who either don’t understand the technology or have an ulterior motive.

For instance, Charlie Munger, a 98-year-old billionaire mainly famous for being Warren Buffet’s sidekick, decried crypto investors and compared Bitcoin to child prostitution. Quite the quote, given that one of the most infamous purveyors of child sex trafficking in history is a fellow Wall Street hedge fund manager, Jeffrey Epstein.

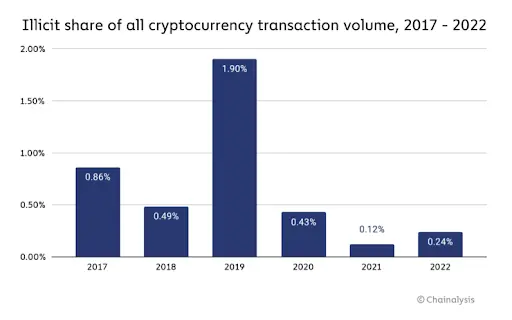

On the other hand, analytics firm Chainalysis’ 2023 Crypto Crime Report found that the illicit share of all cryptocurrency transaction volume in 2022 was just 0.24%, up from 0.12% the previous year but far lower than previous years.

Meanwhile, the National Money Laundering Risk Assessment of 2021, released by none other than the US Treasury Department, had this to say: “The use of virtual assets for money laundering remains far below that of fiat currency and more traditional methods.”

The report goes on to point out deficiencies on the part of banks, accusing them of inadequate CDD and enhanced due diligence, insufficient customer risk identification, and ineffective processes related to suspicious activity monitoring and reporting.

So, it’s not actually unfair to suggest that crypto is a lot cleaner than banking, and KYC can help it stay that way!

What is Money Laundering?

You now know what Know Your Customer is and why it’s needed, but what exactly is the whole “money laundering” problem that it’s attempting to prevent?

Money laundering is a process that criminals employ to hide the illegal source of their income. As the word “laundering” suggests, the money trail is cleaned up through a series of often creative transactions and made to resemble legitimate earnings.

Stories of old Colombian drug cartels go into great detail about truly obscene amounts of cold, hard cash lying around, hidden behind walls, and even being used to pad couches and mattresses at cartel hideouts. The problem with this much physical cash is that it’s difficult to use.

The term “money laundering” actually originates from no less an infamous figure than Al Capone. The Chicago-based gangster used a chain of laundromats to launder his illegal gains.

How? Simple, actually. A business like a laundromat is often paid cash to perform a service on a daily basis. All it needs to do as part of a money laundering operation is inflate the number of daily sales that it reports when making cash deposits to the bank. Some of the money deposited would be legit, but the rest is illicit cash.

Incidentally, that’s part of where KYC comes in. Replace crypto exchange and yourself for bank and laundromat in this example, and you see the need for KYC.

Then, to avoid the tax bill that the higher income would result in, the business can invest the money in other legitimate businesses or even assets. The liberal use of shell companies or holdings helps to further obscure the money’s trail. This sort of thing is called layering, following which the money can be considered clean and further invested or used.

How Do You Satisfy KYC Requirements?

So, what exactly do you need to do to assure both your exchange and the FATF that you’re on the up and up? The Know Your Customer crypto requirements tend to vary from service to service and provider to provider, and one exchange may have drastically different requirements from another.

By and large, this is because they answer to different jurisdictions. The FATF provides guidelines and recommendations, so different countries and even states can interpret those guidelines differently.

In general, though, there are certain things that exchanges tend to ask you for. Here’s a common know your customer checklist if you’re thinking of using a Know Your Customer crypto exchange:

- Your full name

- Date of birth

- Phone number

- Email address

- Physical address

- Photo or scan of official, government-issued identification (driving license/passport)

- Copy of utility bill or bank statement (you can usually redact the amounts)

- Photo of yourself holding your identification

Is KYC a Legal Necessity?

As detailed above, measures like KYC are guided by policies created by global bodies such as the FATF. The guidelines and recommendations made by these bodies are acted upon by national legislators and regulators, and businesses operating within those jurisdictions and answering to those regulators need to toe the line.

Cryptocurrency is a relatively new asset class in terms of global popularity, though, and if you keep up with the news, you’ll know that the policy and regulatory framework around crypto are far from set. New directions seem to emerge frequently, and what’s true today might not be so tomorrow.

Generally, KYC is something that crypto exchanges need to implement if they want to operate with the blessing of their home jurisdiction and those in which they offer services.

Jurisdiction is important, as you see with the Binance group—the Binance crypto exchange that you can use in the US is Binance.us, which is an entirely different entity from Binance.com, used by everyone else.

As a rule of thumb, you can expect exchanges that deal in fiat currency to require far more KYC than exchanges that operate on a crypto-to-crypto basis.

Does Know Your Customer Put You At Risk?

As long as the exchange you’re signing up for is reputable and has good controls and security in place to protect your information, KYC shouldn’t be a big risk. Still, it does pose something of a risk since the storage of your personal information on a third party’s servers opens up the possibility of those servers being hacked.

Additionally, Know Your Customer scams are also a thing. This happens when you’re sent a message, an email, or even called to supposedly provide or update your Know Your Customer crypto information.

The scammer will try to ask you questions, get you to reveal your information over the phone, or ask you to download an app that allows them to hijack your phone. As long as you remember that KYC is a process that is done online and not over the phone, you shouldn’t fall victim to this sort of scam.

Can You Buy Crypto Without KYC?

Yes, you can, although you do need to ask questions about the reputability of the service provider and whether there’s any custody of funds involved.

Generally, there are two types of cryptocurrency exchange, centralized and decentralized. Decentralized exchanges don’t require you to sign up or register yourself. Instead, they allow you to connect purely with your crypto wallet, not requiring anything else.

These decentralized exchanges, or DEXs, don’t normally require any KYC. That said, they also work purely on the blockchain, which means that there’s no fiat currency involved. So, to carry out a fiat-to-crypto or crypto-to-fiat transaction, you may have to find a more conventional or centralized exchange.

This, however, can lead to problems. To buy crypto on an exchange, you’ll need to pay somehow. You can usually do this via a credit card or a bank transfer, but it does mean the transfer of cash from your account to that of the exchange.

Once the transaction is confirmed by the payment network to the exchange’s satisfaction, you can buy your crypto. The problem here is that the cash is now being held by the exchange. It’s out of your control at this stage, and in some exchange horror stories, customers recount not being able to withdraw their crypto and then being denied refunds and even any sort of support.

An exchange that doesn’t have too much in the way of KYC, as you can imagine, may be operating in a relatively lax jurisdiction. They may be set up just so that they can get away with stealing funds from customers desperate to avoid KYC.

That said, exchanges in the best jurisdictions and subject to the utmost regulation can get away with the proverbial murder, too. Just look at good old FTX and how Sam Bankman-Fried pulled off his now-infamous banking fraud.

Do Other Asset Classes Need KYC Too?

Despite the particular attention regulators and policy-makers appear to bestow upon crypto, signing up with a service provider for other assets will also involve some form of KYC.

If you want to buy stocks and sign up with a broker, you’ll have to provide the same sort of information as you would to sign up with a top crypto exchange. In fact, the level of Know Your Customer information required by companies like stock brokers may exceed that of crypto firms by a good deal.

You may also find that you need to provide even more information as you request access to more complex investment products. Unless you use a holding company and open up a bag of advanced tricks, expect your banks, brokers, and others to be all up in your business.

In the crypto world, though, most centralized services, including staking platforms, crypto exchanges, and even NFT marketplaces, require some amount of KYC. Even Bitcoin ATMs have an element of this by requiring your phone number.

The Future of Know Your Customer in Crypto

Know Your Customer crypto exchanges tend to make up the top tiers of cryptocurrency platforms. These exchanges carry out extensive KYC procedures because of the jurisdictions they’re in and the financial compliance programs they require to do business.

This is generally a good thing for consumers because regulation equates to protection. By and large, regulated businesses in jurisdictions that take consumer protection seriously can’t think about scamming their clients and getting away with it.

Suppose you were to listen to policymakers and the world’s leading financial bodies. In that case, you’d quickly come to understand that, as time passes, Know Your Customer is simply a stepping stone on the march toward a complete lack of privacy.

While this eventuality may not come to pass, for the time being, at least, Know Your Customer fulfills an important role in corporate compliance and isn’t likely to disappear anytime soon.

Key Takeaways

Know Your Customer crypto exchanges require you to provide a selection of information about yourself to sign up to use their services. This could be as little as an email address but may extend all the way to government-provided ID documents and even a picture of you holding said ID.

KYC is carried out by crypto exchanges as part of the financial compliance programs they’re required to fulfill. This comes from the jurisdiction in which they operate, and that’s part of the reason why different exchanges have different KYC processes.

Exchanges that don’t require KYC, therefore, may be lacking in terms of financial compliance. Ultimately, you’re the one who decides what level of risk is acceptable to you.

You’ll find plenty of people online who have used KYC-less exchanges and are very happy with their experiences, but just as many customers are willing to go through KYC for that added element of safety.

Know Your Customer FAQ

What is know your customer in crypto?

Know Your Customer is a part of the financial compliance program that most cryptocurrency exchanges run. It is mandated by local authorities where the exchange operates or is based and is part of the global push against money laundering and terror financing.

Is know your customer used outside of crypto?

Yes. Most service providers in finance use know-your-customer processes of some sort, and KYC in traditional financial service companies may be far more extensive than what’s carried out by crypto firms.

What’s the usual know your customer process?

If you sign up for a top-tier exchange, you can expect to fill in many details as part of KYC, such as your name, address, email address, phone number, and some sort of government-issued ID. You may also have to provide a utility bill or bank statement to prove your address, or even a picture of yourself holding your ID to prove you’re you!