Initial NFT Offering (INO) Explained

crypto basics

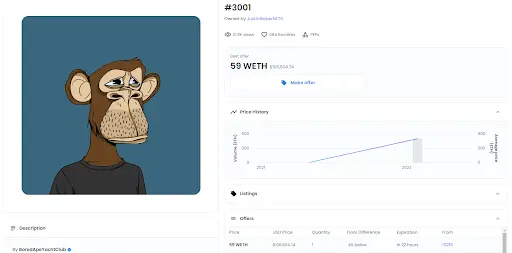

NFTs have taken the world by storm. Whether it’s ambitious tech companies promising the world thanks to their breakthrough applications or celebrities sporting monkey JPEGs as social media profile pictures, you’ve probably heard of them.

Did you know that NFTs are also being used by creators and startups to raise funds for their crucial early operations? Thanks to the innovative new “initial NFT offering” model, aspiring new teams are able to get off the ground fast.

If you want the complete scoop on what these initial NFT offerings are and how to take part in them, read on!

What is an NFT?

Before diving into initial NFT offerings properly, we need to step back and understand what an NFT is. Most cryptocurrencies that you’ve heard about are just that—currencies. One of the qualities of a currency is fungibility, whereby one unit equals one unit regardless.

NFTs, on the other hand, are non-fungible tokens by name and definition. This means that they are effectively unique, and each individual NFT can have its own value. One of the first applications of NFTs has been digital art, which is an apt way to value it as an asset—just as any famous artwork is unique, so too is an NFT.

That said, NFTs are far more provably unique than art, which can be faked, thanks to immutable blockchain technology. Simple digital images are also far from the limit of what NFTs can do, and the famous NFT art collections are simply mainstream pioneers or low-fi prototypes of the technology itself.

Many companies are already using NFTs (though they refer to them by different names) to enhance supply chain operations, and several games use NFTs to give players rare collectibles that also have attributes that can be used in-game. Web3 gaming, given its current explosive growth, looks to be one of the main vectors of mass NFT adoption.

What is Initial NFT Offering?

Initial NFT offerings leverage the previous popularity and “gold rush” mentality of ICOs to raise funds for the project teams. ICOs themselves were the decentralized community’s answer to the Initial Public Offering model traditional firms use to raise funds from the public, and the INO is one of many descendants.

In an INO, a blockchain-based project creates or mints a specific amount or set of verifiably unique digital assets and sells them to investors. Most INOs use cryptocurrencies such as Ether for this, although projects based on other chains often use the native cryptocurrencies of those blockchains.

Initial NFT offering participants are speculating on the price and performance of the NFT they buy, although NFTs that are packed with utility are their own reward. If the project or collection does well and garners a significant amount of hype, the gains can be very appreciable.

Investing in an INO also carries risks. If the NFT project fails, or worse yet, is a scam or a rug-pull, investors can lose some or all of their funds. Unfortunately, there isn’t any protection for investors since the industry remains under-regulated.

It’s also possible that NFTs, or at least early NFTs with little to no utility, are a fad. Crypto publication Decrypt pointed out in late 2022 that the Bored Ape Yacht Club collection has suffered significantly alongside the wider crypto market. Namely, singer Justin Bieber’s Ape crashed in value from the $1.3 million he paid for it to just $69,800.

That said, Bieber didn’t take part in any sort of initial NFT offering; he just decided to follow the hype. Furthermore, the BAYC team has baked at least some utility into their NFTs, rewarding holders with various perks—that’s something that many INOs will attempt to do as well, enhancing the value of their NFTs from the outset.

How Does an Initial NFT Offering Work?

To get the ball rolling, creators or project teams usually provide as much literature as they can to prospective investors, including technical documentation and project roadmaps. Marketing is just as important as technical development at this stage, and many projects try to set up an active Discord server to build a community.

Community engagement and gamification are the names of the game as the team attempts to develop an NFT distribution model. While they’ll mainly be hoping to sell NFTs or whitelist spots, they’ll also run giveaways via social media engagement challenges to widen the funnel. All of this engagement builds up to the NFT collection’s mint date.

The Importance of Initial NFT Offering

The INO model offers a decentralized way for creators of NFT collections to raise the funds that they require to continue their work. It’s a versatile model since digital art creators can use it in just the same way as project teams developing product offerings on a more ambitious scale.

Therefore, the initial NFT offering model can bypass many of the issues that creators face when it comes to raising funds, and it affords anyone the option to issue verifiably scarce, blockchain-based digital assets with the benefit of immediate liquidity.

There are many NFT marketplaces and launchpads out there that facilitate INOs. Some make it very easy to issue NFTs that reach a wider audience, while others tie benefits and allocation to platform tokens. It’s easy to find a launchpad that suits your needs both as an investor and a creator, with the latter group being able to configure every facet of their creation, such as rarity, attributes, and so on.

The best NFT marketplaces also take the ideals of Web3 seriously and do a good job of facilitating and protecting creators. ImmutableX, the second biggest blockchain for NFT volume behind Ethereum and host of the GameStop NFT marketplace, also doubled down on enforceable royalties to ensure that creators get their fair share.

6 Alternatives to Initial NFT Offering

As mentioned, the initial NFT offering is something of a descendant of the ICO fundraising model that has proven so successful on the blockchain. But what are the alternatives when it comes to fundraising for a crypto startup?

#1. Initial Public Offering (IPO)

Very much the traditional means for a firm to seek funding, but an IPO isn’t achievable in the short term. Many blockchain firms may target an IPO in the long term but still carry out one of the other options in the short term.

Therefore, an IPO is not necessarily a competing model, but it doesn’t help a young firm trying to get off the ground. Rather, it can take an established business to the next level of operation—or expose them to the predations of Wall Street.

#2. Initial Coin Offering (ICO)

The predecessor to most other decentralized funding models, ICOs were big during the 2017/18 crypto bull run and earned several projects hundreds of millions of dollars in funding. They’re coming under increased scrutiny by regulators now, and their days may be numbered, but ICOs are noted for their historical success.

#3. Initial Exchange Offering (IEO)

An evolution of the ICO, the IEO leverages the relationship between a crypto exchange and an up-and-coming project akin to that of venture capital. The exchange platform is then used, exposing the exchange’s customers to the opportunity to buy the token relatively early. Many of the top crypto exchanges offer this model to this day.

#4. Initial DEX Offering (IDO)

The decentralized cousin of the IEO, IDO, is functionally the same thing, except it’s carried out on a DEX (decentralized exchange). This can mean that there’s no VC-like role played by anyone and, therefore, could well be considered a fairer model, at least as far as token buyers are concerned.

#5. Initial Stake Pool Offering (ISPO)

Conceived thanks to Cardano’s use of “stake pools” for validation, the ISPO is an innovative model that doesn't actually require participants to spend money on any tokens. Instead, they stake their native coins (Cardano’s ADA) to stake pools run by the party or project team seeking funding. The validator rewards earned by the pool fund the project, and they can pay stakers back in their own tokens.

#6. Token Generation Event (TGE)

Since ICOs are under the watchful eye of regulators, a rebrand is in order as far as some parties are concerned. The boundary between TGE and ICO is blurry, but generally, a TGE offers a token that has a little more utility than ICOs historically have had.

Benefits of Initial NFT Offering

Here are some of the benefits of the INO model:

- Funding. The main reason for a project team or creator to carry out an INO is to raise money. These funds can pay the bills and provide the capital needed to get the project off the ground.

- Appreciation/ROI. On the other hand, for investors or collectors, the hope is that the NFTs in question will appreciate significantly following the INO. Many investors have made huge profits by getting involved with INOs.

- Ease of launch. An INO is generally easy to carry out and participate in, and there are plenty of decentralized platforms, launchpads, and NFT marketplaces to choose from.

- Control over variables. The team or creator behind the NFT collection generally has full freedom to create and tailor the NFTs as they wish. This can include adding elements of random generation, various properties and attributes, and setting things like royalties. Transaction fees are also not often a big problem.

Risks Associated With Initial NFT Offering

Despite the benefits, Initial NFT Offerings can be risky if an investor goes in without doing the requisite research. Some of the main risks in play include:

- Soundness of investment. While the creator of an NFT collection may imbue it with plenty of utility, this may not add much value. NFTs are still in their infancy, and early-stage projects may not retain their perceived value in the long run.

- Scams and rugpulls. Given how easy it is to set up and run an INO, there are plenty of scams to be found. DYOR before jumping in!

- Regulation. Given that INOs disrupt the traditional funding model of the IPO and are largely outside of Wall Street’s clutches, regulators may turn their gaze toward INOs sooner rather than later.

- Shills, hype, and influencers. Celebrities are often involved in encouraging investors to buy NFTs, just as with ICOs—a practice often referred to as shilling. It is already under fire from regulators, proving that their involvement isn’t always bad, but plenty of shilling still goes on under the radar.

How to Participate in Initial NFT Offering

Once you hear about an upcoming initial NFT offering, connect with the project and community via social media. Not only does this keep you abreast of all project information and updates, but there are often chances to win additional NFTs or whitelist spots.

Then, get connected to the project via Twitter and Discord and do your due diligence by reading the whitepaper and checking the team credentials. Some teams and creators remain anonymous, but many are happy to “doxx” themselves to prove their legitimacy.

After that, all that remains is to keep an eye on the team's or creator’s announcements to know when you can pick up a whitelist spot and be part of the NFT’s mint.

Future of Initial NFT Offering

NFTs are still a new technology, but their true potential has yet to be unlocked. Even as the corporate media criticizes NFTs in much the same way that every revolutionary attracts initial flak, top tech companies are building their NFT tech stacks.

It’s very likely that corporate media will change the sentiment around NFTs as Wall Street darlings enter the fray, but regardless of the noise, projects will continue to build. Some of those projects will look to use initial NFT offerings as their route toward stepping up development because it’s a logical and easy step.

Key Takeaways

Initial NFT offering is a descendant of the revolutionary initial coin offering model that took the financial world by storm and raised billions across a number of the 2017 and 2018 era’s top blockchain projects.

The INO model is easy to deploy and can be used by anyone, whether it’s an ambitious project team looking to launch a sprawling metaverse or simply a content creator seeking to fund their path toward an eventual masterpiece.

The trick to participating in INOs is to get wind of them in the first place. Once you find them, join their communities and do your due diligence on the team and project whitepaper. A little bit of caution and a lot of research will help you make the most of the INOs you do discover.

Initial NFT Offering FAQ

Is initial NFT offering legal?

Initial NFT offerings are generally legal, although the views of regulators can and may change. ICOs are illegal in some countries and are subject to increased scrutiny in others. If they come under pressure, then so too might the INO model.

What is the difference between INO vs. ICO?

An ICO is a way to raise funds without necessarily needing to give up controlling shares of a company, but it does mean fungible coins or tokens have to be sold. An INO allows a team to sell non-fungible tokens to raise funds instead.

What is INO used for?

INO is used by blockchain project teams and creators to raise funds in a decentralized, public manner without minting fungible coins or giving up control of their intellectual property through a public listing.