How to Stake XRP Ripple: Crypto Staking Guide [2023]

crypto staking

It’s undeniable that cryptocurrency has changed the financial landscape since the moment Bitcoin was first released in 2009. Just a few years later, Ripple Labs created the famous XRP to make up for some of Bitcoin’s shortcomings, which is when people started wondering how to stake XRP.

One of the main perks of cryptocurrencies is their flexibility, as there’s more than one way to earn money with crypto. As a result, many enthusiasts look into ways of earning passive income, which is where XRP staking comes into play.

So, is it possible to stake your XRP and passively increase your holdings? What are the easiest and most profitable ways to do so, and what is the best place to stake XRP?

Keep reading as we answer all these questions and more.

What is Staking?

Staking is a fundamental concept in the world of cryptocurrencies that has a two-fold purpose, as it:

- Represents a digital alternative to traditional bank deposits

- Exists to secure a blockchain network

When staking, you lock up a certain amount of cryptocurrency in your wallet to facilitate operations such as transaction verification and block validation. Simply put, you’re staking your assets as a promise that you won’t try to manipulate or hack the blockchain.

Staking comes as a result of the proof-of-stake (PoS) consensus mechanism used by some cryptocurrencies. This mechanism was devised as an energy-efficient alternative to an older proof-of-work algorithm utilized by Bitcoin.

In general, blockchain network participants stake their coins to earn interest, much like having a traditional bank savings account. By using their assets to help keep the network secure and operational, users are awarded compensation in the form of staking rewards.

However, it’s important to know that staking is not without risks and downsides. For instance, some cryptocurrencies require participants to lock up their assets for a set amount of time, during which they can’t withdraw them. Should that cryptocurrency drop in value, the owners won’t be able to sell anything and mitigate losses until the lock-up period expires.

What is Ripple (XRP)?

Ripple is a fintech company that developed a cryptocurrency token called XRP in 2012. The purpose of XRP is to facilitate fast and energy-efficient transactions between global participants.

XRP’s creators noticed several shortcomings in Bitcoin in 2011. Notably, the Bitcoin blockchain’s proof-of-work system means miners need to use vast amounts of energy to create new blocks and validate transactions. Furthermore, the BTC network supports only seven transactions per second.

On the other hand, XRP exists on a blockchain called XRPL, which can process up to 1,500 transactions per second. Not only that, but transactions require up to 100,000 times less energy than those on Bitcoin’s network.

However, XRPL’s speed and efficiency come at the “cost” of asset centralization. All 100 billion XRP tokens were pre-mined, with 55 billion of the 80 billion tokens allocated to Ripple being locked up and steadily released at a rate of around 1 billion per month. Current projections state that all XRP will be released in the summer of 2026.

Is Staking XRP Possible?

It’s not possible to stake XRPin the traditional sense. XRP doesn’t operate on a proof-of-stake consensus mechanism; instead, it features an exclusive mechanism called the XRP Ledger Consensus Protocol.

In general, most participants on the XRPL network need to agree on a transaction to verify it. That approach results in network decentralization and enhanced transaction security. The blockchain can continue working properly with up to 20% of faulty validators.

Finally, there’s no monetary incentive to become an XRP validator. In reality, most of the network participants do so for the common good.

There’s no mining reward, like with Bitcoin, or staking compensation, like with Ethereum. Even if you have a hardware wallet and are wondering how to stake XRP on Ledger or Trezor, you’ll have to look into alternative ways to earn passive income.

Instead, Ripple steadily releases the aforementioned 1 billion XRP per month to ensure market predictability. Ripple decides the recipients of these releases, which include partners, institutional investors, projects, and more.

Proof-of-Stake vs Proof-of-Work

Before we go into different indirect ways of staking your XRP, let’s first establish how the two most prominent consensus mechanisms work.

Both proof-of-work and proof-of-stake consensus mechanisms are designed to facilitate network decentralization and security while incentivizing participants with rewards.

The proof-of-work system is the older of the two. It’s used by Bitcoin and was used by Ethereum before its 2022 update called The Merge, among other cryptocurrencies. The main characteristic of this consensus mechanism is that it requires a lot of computational powerand electric energy.

In short, miners use specialized equipment to solve complex mathematical problems to add blocks to the blockchain. By providing proof of their work, they get rewarded in cryptocurrency in return.

The proof-of-stake consensus mechanism involves participants locking up or “staking” their assets as collateral. The participants are then rewarded with transaction fees for their efforts.

The benefits of proof-of-work systems include:

- Enhanced security

- Decentralization

- Mining rewards

On the other hand, the proof-of-stake systems offer:

- Energy efficiency

- Transaction speed

- Scalability

Alternative Ways to Earn Interest on Ripple XRP

While it’s impossible to natively stake XRP and earn rewards on its blockchain, there are alternative ways to make passive income with your assets. Some of the most prominent ways to earn interest on XRP include:

- Centralized lending. This option is available on centralized platforms and exchanges such as Binance and Coinbase. For instance, Nexo offers 8% interest on your XRP deposits.

- Peer-to-peer lending. P2P lending happens on decentralized platforms. DeFi lending backed by smart contracts allows you to use these platforms to directly lend your assets to borrowers and earn interest in return.

- Liquidity providing. You can provide your XRP to a decentralized exchange to contribute to its liquidity. Liquidity providers (LP) must also deposit an equal amount of a second cryptocurrency that forms a trade pair with XRP.

- Liquid staking. When you use XRP and a paired cryptocurrency to add liquidity to a decentralized exchange, you’ll get a new token as a “receipt.” This token can then be traded or deposited for staking on lending platforms (e.g., Aave and Compound), giving you even more options to yield farm using XRP.

How to Stake Ripple on an Exchange

One of the simplest ways to earn passive income on your XRP is through a centralized exchange. Here’s a simple step-by-step guide on how to stake XRP on Binance:

- Create an account on Binance using your email address or phone number.

- Go through the KYC verification process to confirm your identity and unlock the exchange’s services.

- Fund your account with XRP by buying it with fiat or transferring assets from another address.

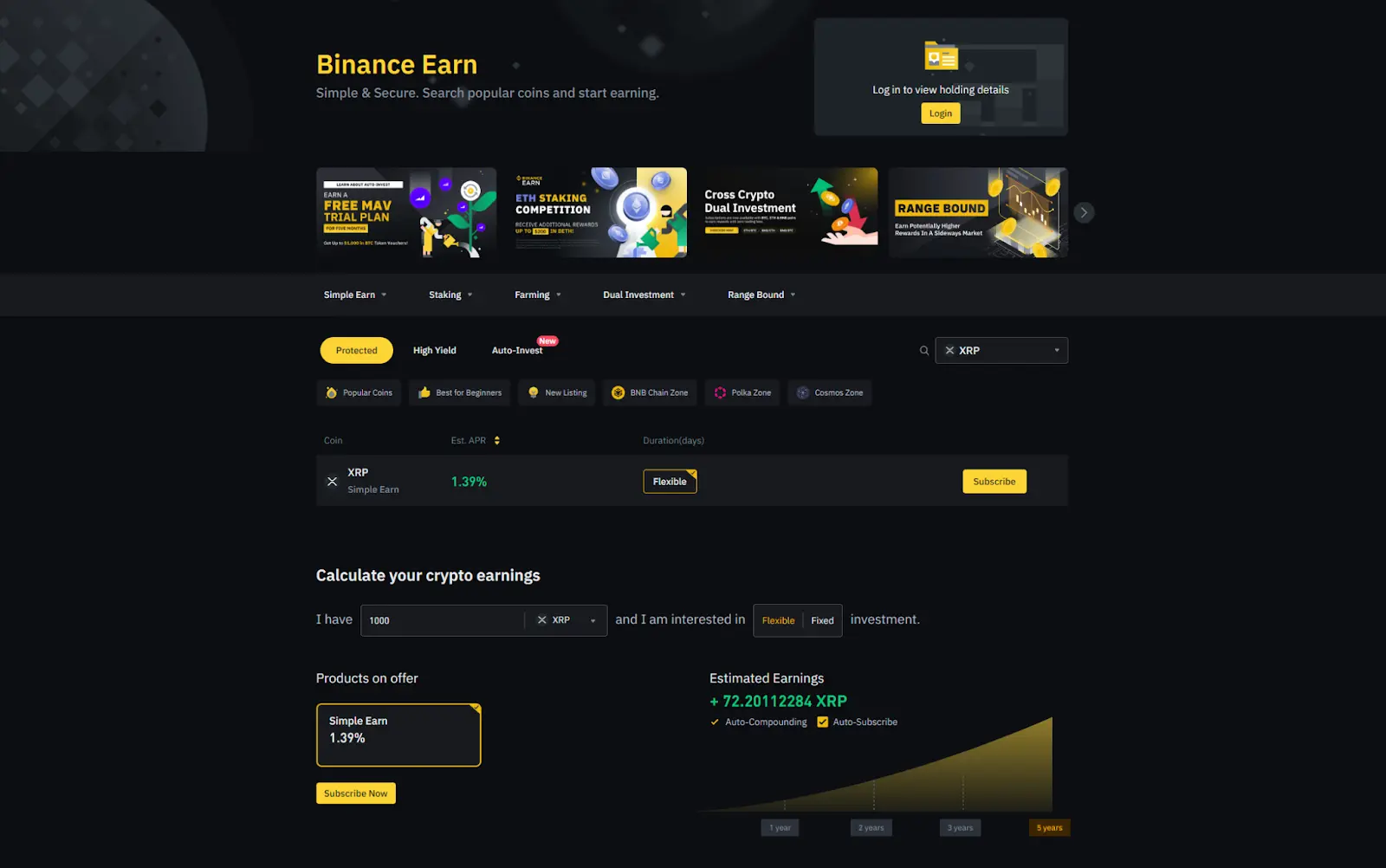

- Go to Binance’s Simple Earn service on the website, which you can access through the Finance tab on the main page.

- Use the calculator to estimate your earnings based on the amount and duration of the investment.

- Choose between a flexible and fixed investment.

- Input the amount of XRP that you want to invest and confirm to start staking.

- Continue tracking your investment and making adjustments if necessary.

This is what Binance’s Simple Earn page looks like:

Here are a few things to keep in mind:

- Flexible investing allows you to retrieve your assets at any moment, but the rewards are smaller than with fixed investing.

- The rewards earned this way don’t come from traditional staking but from Binance’s own funds.

- There’s always risk when giving the keysto your crypto to a third party, like a centralized exchange.

Staking XRP Tax Implications

There’s a lot of legal and tax ambiguity surrounding cryptocurrencies in general, including many ongoing debates and competing bills regarding crypto regulation. Not only that, but each state has different laws that crypto enthusiasts need to be aware of. Regardless, the IRS's current policy is to look at crypto assets as commodities and tax them accordingly.

Furthermore, the IRS is increasing its efforts when it comes to cryptocurrencies, with the goal of preventing potential tax evasion. Due to this, it’s imperative to do research and determine the exact tax implications of staking your XRP. As a general rule, once yousell XRP that you earned by staking for fiat, you should report it as taxable income.

Key Takeaways

In summary, while you can’t natively stake XRP on its blockchain, there are plenty of other ways to earn passive income with these assets. Like with everything else in the world of cryptocurrencies, it’s just vital to do research to figure out what the best options are for you.

Considering Ripple is one of the biggest names in the cryptosphere that has a lot of potential, it can be highly lucrative to learn how to stake XRP. After all, even Albert Einstein called compound interest the eighth wonder of the world!

How to Stake XRP FAQ

Can you earn passive income on XRP?

There are plenty of ways to earn passive income with XRP. Some of the most prominent ways include lending XRP on CEXs and DEXs or yield framing by providing liquidity.

Can you stake XRP on Binance?

You can stake XRP on Binance by using the exchange’s Simple Earn feature. You can choose between a fixed and flexible investment method. Binance even offers a calculator that can help you estimate your earnings.

Where can I lend my XRP?

You can lend your XRP to earn passive income on various centralized and decentralized platforms. For instance, CoinLoan is a peer-to-peer crypto lending platform where you can use your XRP. Another great place to lend and borrow XRP is Binance.

How can I buy Ripple (XRP)?

One of the easiest ways to buy Ripple (XRP) with fiat is by using centralized exchanges like Binance, Coinbase, or Kraken. After creating an account and passing the KYC verification process, you can buy XRP using one of the many payment options, including a bank transfer or a credit card.