How to Stake USDC and Earn Interest with Your Holdings

crypto staking

Staking and stablecoins are some of the most appealing concepts to crypto enthusiasts. Staking allows users to earn passive income with their assets, while stablecoins (like USDC) mimic fiat currencies and are more beginner-friendly compared to Bitcoin and altcoins. As such, it’s only natural that people wonder how to stake USDC.

But, out of many other crypto tokens pegged to the US dollar, why is USDC one of the most sought-after options? And how does one go about staking it and maximizing their interest earnings?

In this guide, we’ll explore who the owners of USDC are, whether you can stake it, what the best ways are to earn passive income with your holdings, and much more. Without further ado, let’s jump right in!

Who Owns USDC?

USDC is owned and issued by a private-sector company called Circle. The stablecoin was initially launched on September 26, 2018, as a collaborative effort between Circle and Coinbase, acentralized exchange.

Circle is a financial institution founded in 2013 that prides itself on transparency and stability. In addition to USDC, they have also issued EURC, a euro-backed stablecoin. USDC is considered to be a fully-collateralized stablecoin. That means that Circle holds the equivalent amount of fiat USD in their reserves for every USDC issued.

Coinbase is one of the world’s biggest centralized exchanges, and it was established in 2012. It allows retail investors to buy, hold, sell, exchange, and otherwise manage their crypto assets.

The main reason behind the creation of USDC was to bring the stability of fiat to the volatile realm of cryptocurrencies. While USDC is an ERC-20 token built on the Ethereum network, unlike thousands of other crypto tokens on the blockchain, it is a stable asset. Its price should maintain a 1:1 peg to the US dollar regardless of market movement.

This stability allows USDC holders to participate in a thriving ecosystem of decentralized finance without concern for the volatility and price fluctuations of their assets. In essence, USDC aims to bring the best of the cryptosphere and the world of traditional finance together. It offers the trust and security of the blockchain along with the versatility of fiat.

Can You Stake USDC?

You cannot natively stake USDC, unlike many other ERC-20 tokens built on the Ethereum platform. The main reason for it is that USDC doesn’t feature a proof-of-stake consensus mechanism like Ethereum and many other cryptocurrencies.

Instead, new tokens are issued by Circle to buyers who deposit US dollars into the company account. This process is called minting, and it is the only way to introduce new tokens into the ecosystem.

Conversely, a holder can exchange their USDC crypto tokens for fiat US dollars at any given time through the process known as burning. In essence, they send USDC back to Circle and receive an equal amount in fiat currency while the company takes crypto tokens out of circulation.

Fortunately, there are still ways to earn passive income with your USDC holdings. There are several different methods of doing that, including:

- Liquidity provision. You can lock up your USDC tokens paired with another cryptocurrency in pools to facilitate those trading pairs. In return, you get part of the fees from the trading activity in these pools.

- Crypto lending. Platforms like Aave or Compound allow USDC holders to lend their assets and earn interest based on the supply and demand for the token.

- Interest earning. There are various platforms that facilitate user-friendly interest earning where holders can find lucrative annual rates. This is one of the simplest passive earning methods, and rates are often much higher than traditional banking saving rates.

How to Stake USDC

While USDC staking is not crypto staking in a traditional sense, it’s used as an umbrella term by the communityfor various methods of earning passive income. Regardless of the approach you take to earning with your USDC tokens, the process involves a couple of simple steps, so let’s see what they are.

Step 1 - Purchase USDC Tokens

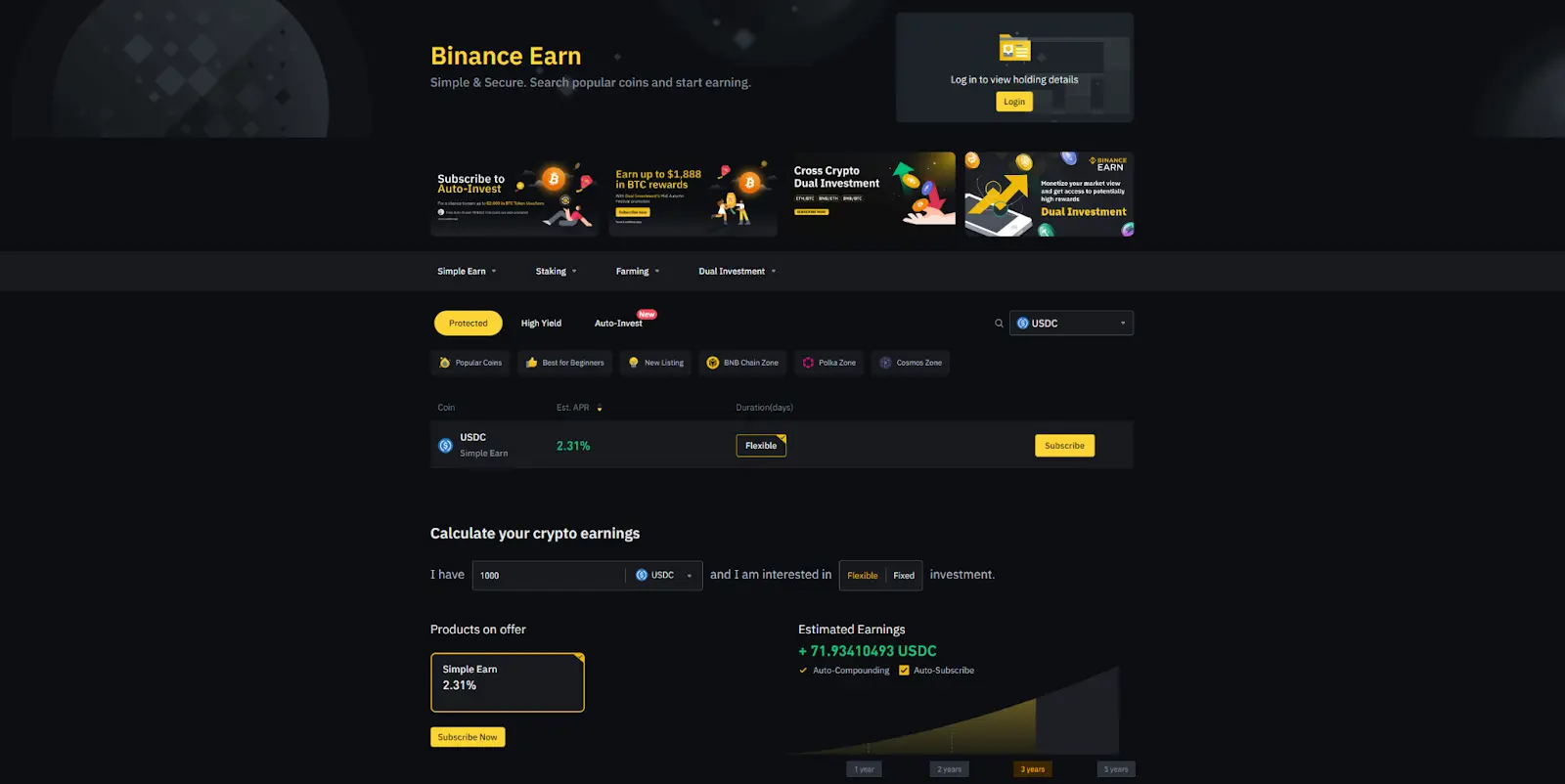

If you’re new to the cryptosphere, the simplest way to purchase USDC tokens is via a centralized exchange. Platforms like Binance, Coinbase, and KuCoin allow you to buy USDC directly with fiat.

You can make an account with the exchange in minutes using your email or phone number. However, to unlock the exchange’s features (including buying crypto with fiat), you’ll need to perform KYC verification.

After that, you’ll be able to use a credit or debit card, bank transfer, or third-party payment service to obtain USDC.

Step 2 - Pick a Staking Platform

Before submitting your assets for staking, you should do your own research to find the platform that suits your needs the best. Different places offer different features and USDC staking rates.

Centralized exchanges (CEXs), for instance, usually offer APY that’s on the low end. However, the process of staking your assets is straightforward, and the passive earning strategy can be as simple as set-and-forget.

On the other hand, learning how to stake USDC using decentralized exchanges (DEXs) and lending platforms can be more challenging, but the rewards are usually greater. Keep in mind that there is also more risk involved with using DEXes and dApps.

As a general rule of thumb, when answering the “Where can I stake USDC?” question, keep in mind that the greater the APY, the higher the risk.

Step 3 - Deposit USDC on the Platform

You need to deposit your USDC on the platform of your choice before being able to stake it.

If you’ve opted for a centralized exchange, the process is as simple as sending USDC to a designated wallet address that the exchange has provided you. Of course, if you’re staking USDC on the exchange where you’ve bought it, you can omit this step altogether.

However, staking USDC via a DEX or dApp involves having a wallet, like MetaMask. Similarly to sending your assets to a CEX address, you should send your USDC to your wallet address and then connect said wallet with a platform.

Step 4 - Follow Staking Guidelines

Once your wallet is funded and connected, you should follow the platform’s staking guidelines to start earning passive income using your USDC tokens. While each platform is different, CEXs generally allow users to start staking in a couple of simple steps, such as:

- Find the staking feature on the website or mobile app.

- Select the number of tokens.

- (Optional) Choose a lock-up period.

- Submit your assets and start staking.

DEX staking often involves a couple of extra steps, such as connecting wallets, submitting trading pairs, obtaining LP (Liquidity Provider) tokens, joining staking pools, etc. As a result, it’s essential to carefully examine every platform’s guidelines and follow them closely.

Is Staking USDC Worth It?

Whether staking USDC is worth it varies between individuals and depends on the circumstances. The annual percentage yield fluctuates between platforms and ranges from 1–2% to 12% or more.

As a result, USDC staking offers modest profit potential compared to the rest of the volatile crypto market, where some altcoins can experience upwards of 100x increases. On the other hand, the stability of USDC and the APY that’s on the lower end are better tailored toward risk-averse investors.

If you want exposure to the crypto market but don’t like the volatility of altcoins or even Bitcoin, you can take advantage of the slow and steady gains that come with USDC staking. You’ll get predictable returns that are generally higher than anything traditional bank savings accounts have to offer.

Keep in mind that some places might offer extremely high triple-digit APYs. In these cases, it’s crucial to approach these platforms carefully, as there are high chances of malicious activity and potential scams.

Is Staking USDC Safe?

Staking USDC is generally considered to be one of the safest methods of earning passive income in the realm of cryptocurrency. It’s even considered safer than USDT staking due to Tether’s depegging and transparency concerns.

Centralized platforms like Binance and Coinbase feature robust security features to protect their users’ assets. On the other end, smart contracts provide protection against malicious actors by automatically punishing any attempts at manipulation.

However, USDC staking is not without risks. Centralized exchanges are often targeted by hackers, who sometimes succeed in their attempts. Moreover, even the biggest centralized exchanges, like FTX, can collapse due to scams and fraud.

On the other end, DeFi protocols that operate without intermediaries and centralized authority feature risks like smart contract vulnerabilities, bugs, and exploits.

Lastly, there are always additional risks to consider, such as platform solvency, impermanent losses, tax considerations, regulatory concerns, interest rate fluctuations, and more.

Benefits of Staking USDC

The benefits of staking USDC often far outweigh the risks associated with it. Here are some of the key advantages of earning passive income by using your stablecoins:

- The process is tailored toward conservative crypto investors. If you’re a risk-averse investor and crypto enthusiast and you don’t want exposure to more volatile crypto assets like Bitcoin and altcoins, you can stake USDC to earn steady income while maintaining a 1:1 peg to the US dollar.

- You can earn higher yields than with traditional bank savings accounts. While there are extra steps to swapping your US dollars for USDC, it can be worth it in the long run due to significantly higher APY.

- USDC staking is one of the best ways to diversify your income. By allocating only a fraction of your portfolio to USDC staking, you can minimize the risk associated with potential loss while taking advantage of the volatile crypto market.

Key Takeaways

In a complex and volatile world of cryptocurrencies, staking is one of the more stable and simpler ways of earning passive income. Knowing how to stake USDC allows users to take advantage of one of the most secure ways of making money with their stablecoins.

However, while the potential for high returns can be enticing, it’s essential to approach this earning method with caution. Understanding everything from how to send USDC to how to connect your wallet to a decentralized exchange can help you get the most out of your crypto.

As we’ve journeyed through this comprehensive article, we’ve hopefully equipped you with enough knowledge to navigate the lucrative stablecoin landscape. Best of luck with smart investing!

How to Stake USDC FAQ

How much can I earn from staking USDC?

You can earn anywhere between 1% and 12% APY or more when staking USDC. The precise amount varies between different platforms. In general, higher APYs usually carry more risk or require additional technical know-how to take advantage of.

What is the minimum amount for staking USD Coin?

he minimum amount for staking USD Coin varies between platforms. Some places allow users to start staking with as little as $0.1 worth of USDC. Other platforms might require a minimum deposit of $1 or $50 equivalent in USDC. Finally, some places have no minimum amount required to start staking.

What happens when you stake USDC?

What happens when you stake USDC depends on the platform that you use. In general, users submit their assets to platforms to lend them or provide liquidity. In return, they are compensated with awards in USDC that come from trading fees, loan interests, and more.

Can you earn interest on USDC?

You can earn interest on USDC by lending your tokens or using them to provide liquidity. The exact interest rates depend on the specific method and platform used but generally range between 1% and 12% APY.

What are the risks of staking USDC?

When staking USDC, there are platform risks, both with centralized exchanges and DeFi protocols. Moreover, smart contracts that facilitate staking and lending can be vulnerable and prone to hacks or exploits. There is also the risk of impermanent loss, as well as regulatory concerns and tax implications.