How to Stake Polkadot (DOT) in 2023

crypto staking

Polkadot is one of the most popular blockchain platforms among developers and investors, but did you know that you can earn passive income with it?

Proof of stake blockchains are all the rage, and staking DOT can be a great way to supplement your earnings while also participating in network consensus.

Keep reading to learn about staking cryptocurrency, how to stake Polkadot, and how much you can expect to earn by staking your DOT tokens!

What is Staking?

Proof of stake isn’t new, but it can certainly still be termed revolutionary. Blockchain technology was synonymous with proof-of-work consensus in its early years, but the criticisms toward crypto mining resulted in the development of the far less energy-intensive proof-of-stake consensus algorithm.

Consensus mechanisms allow blockchains to agree on what transactions make up the ledger despite the fact that they’re made up of independent nodes.Proof of work does this by letting miners deploy computing power toward the problem and tasking them with solving a cryptographic puzzle.

The miners race to find this solution, and the winner is given the block reward. This is lucrative and can make even the most expensive, elaborate mining setups profitable if they produce enough hash power.

Proof of stake, on the other hand, eliminates this hardware dependency. Instead, it requires prospective block producers, normally called validators, to buy a certain amount of network coins and bond them to the protocol via a smart contract. This is called a stake, and it gives the validator the right to deploy their hardware toward validating blocks for the blockchain.

There’s also a block reward here to incentivize validators. In proof of stake, though, validators invest in the network’s coins and then have a chance to win the block reward proportional to how big their stake is.

Stakers on proof of stake networks are, therefore, normally validators. This can be difficult, given the technical competence required to run a node, and expensive, with blockchains like Ethereum requiring at least 32 ETH for staking.

What is Polkadot?

Polkadot was co-founded in 2016 by one of the key members of Ethereum’s founding team, Dr. Gavin Wood. Wood is one of the most influential figures in cryptocurrency today, having also presented the proof of authority consensus mechanism and coined the term “Web 3.0.”

The Polkadot network's focus is scalability via interoperability. It’s sharded in design, with many chains connected in a single network, allowing transaction processing in parallel and free data exchange between all of the network’s chains.

At the center of Polkadot’s network is the “relay chain,” which connects to the other participating blockchains. This blockchain processes all of the network’s transactions concurrently.

The blockchains that connect to the relay chain are called “parachains.” These parachains are created by various teams that want to take advantage of the Polkadot relay chain’s security and scalability. There’s a lot of competition to become a parachain, though, and a process called a parachain auction dictates which chains are given a slot.

How to Stake Polkadot (DOT)

To stake DOT, you’ll first need to acquire a wallet and fund it. This isn’t required if you want to stake directly on the exchange where you buy crypto, but for decentralized staking, you’ll need a wallet like Polkadot.js.

#1. Native Staking

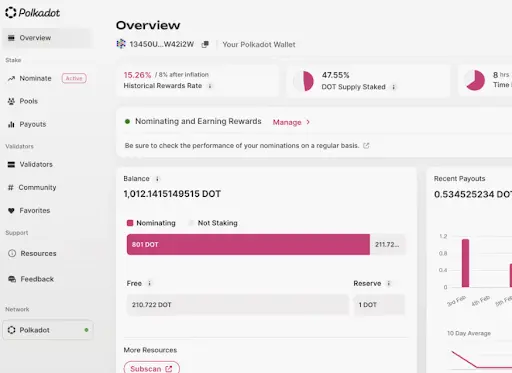

Native staking can be tricky with some blockchain projects, but it’s not very difficult with Polkadot. If you hold a minimum of 1 DOT, you can connect to the Polkadot staking dashboard and get cracking.

It’s a great option because you retain full control of your DOT, even when you assign it to nomination pools, and by choosing to nominate trustworthy validators, you’re helping protect the network and your investment. You can also participate in network governance this way, and it’s fully trustless and decentralized.

With 1 DOT, you can stake using a nomination pool, but at 300 DOT or more, you can nominate a validator directly or start your own nomination pool.

#2. Decentralized Staking Platforms

Decentralized staking platforms can offer several advantages, such as liquidity via a third-party token. Many native staking systems involve a certain unbonding interval, but when provided with a staking token, you can sell it whenever you’d like to and exit your staking position.

These platforms can offer benefits that are slightly different from native staking. They may also pose an additional risk and tend to centralize the network to some extent.

#3. Custodial Platforms and Exchanges

If all you want from staking is passive income and you’re willing to take risks to get it, then custodial platforms may be for you. Many exchanges want you to keep your funds with them for one reason or another.

Even if an exchange isn’t up to any funny business, recent crypto market events have shown that centralized platforms are risky, whether they’re staking platforms like Celsius, exchanges like FTX, or even fiat banks like Silicon Valley Bank.

Potential Earnings From Staking DOT

Polkadot has a dynamic return on staking, with a target of 10% inflation per year. It’s an uncapped currency, so while the supply is flexible, your income while staking ensures that your share of the total supply doesn’t diminish.

Generally, you can expect to earn between 7% and 15% for staking DOT, but this can vary depending on the total proportion of DOT staked and how you decide to stake. Running a validator node ensures that you’ll get the maximum reward, but it does require a lot of technical know-how.

How Safe is Staking DOT?

The risks of staking DOT depend very much on whether you choose to stake in a custodial or non-custodial (native) manner. Whenever you entrust your funds to a custodian, you could get locked out of the platform at a moment’s notice, and if the platform misbehaves, there’s a huge chance of losing your money.

Native staking, on the other hand, is far safer, but you still have to use your best judgment. Especially when nominating directly to a validator, make sure to do your due diligence on the validator—if they misbehave, both you and they may be partially slashed and lose some funds.

The same goes for nomination pools. Weigh them carefully, and read up on how the pool operates and chooses its validators. As always with crypto, do your own research to stay safe.

There’s also a dynamic minimum bond when nominating DOT, so you need to keep an eye on your staking dashboard constantly.If you fall below the minimum, you may not receive rewards unless you switch to a nomination pool.

How Does Staking DOT Work?

Polkadot uses a consensus mechanism called Nominated Proof of Stake (NPoS). This variation of proof of stake consensus introduces a couple of new roles among network nodes. It also makes staking DOT easy, even if you only hold a small amount and don’t wish to run a validator node.

The main role for network nodes that wish to stake DOT, however, is indeed that of validators. They are responsible for block production and validation, just like other proof of stake networks.

Then there are collators who maintain the entire history of the relay chain and its parachains, playing a major role in cross-chain messaging. Fishermen, meanwhile, have full parachain nodes and police the network for invalid transactions.

The final role may be the one that holds the most interest for average DOT holders. These are nominators who can simply stake their DOT from their wallets without having to run a network node 24/7.

Nominators’ importance to the network can’t be understated because their stakes are delegated to validators of the user’s choice. This allows the community to further empower reliable validators, tightening the network’s security even more.

Nominating your DOT is an example of native staking. There are third-party decentralized protocols, such as Lido DAO, that offer staking. Custodial exchanges also promise to stake your tokens and pay you a passive income.

There are four ways of natively staking your DOT, all in all. Namely, you can:

- Nominate DOT directly to a validator.

- Join a nomination pool.

- Run a nomination pool of your own.

- Run a validator node.

Benefits of Staking Polkadot

Let’s take a look at some of the reasons why staking might be a good idea:

- Passive income. What’s better than an additional income stream? Earning coins that you would invest in anyway! Especially if you believe that DOT is a good long-term hold, it’s nice to earn more DOT directly.

- Inflation. Polkadot has an “inflationary tokenomic model,” which means that staking is incentivized. Stakers earn a portion of the inflation, while non-stakers see their share of the total coin supply diminish.

- Network security. By staking, you’re taking an active role in securing the network, thereby protecting your own investment.

Cons of Staking Polkadot

Not all DOT holders choose to stake, namely because of:

- Liquidity. When you stake DOT, especially natively, there’s a lengthy unstaking period before you can access your coins again. This isn’t a big deal if you’re in it for the long haul, but it does mean you can’t liquidate your position quickly, for whatever reason.

- Technical knowledge. Staking any cryptocurrency can require a bit of research, from learning how to use wallets to deciding which staking platforms to connect to. This can be intimidating for first-timers.

Key Takeaways

Polkadot is an extremely popular blockchain network, and its founder, Dr. Gavin Wood, has some of the best credentials in the entire industry. The DOT coin is also extremely powerful, and by securing the Polkadot relay chain, it plays a huge role with regard to the system’s many parachains as well.

Luckily, DOT is easy to stake, and there are many ways to do it, even with as little as 1 DOT. If you have less than 300 DOT, you can join a nomination pool.This is a beginner-friendly way to get started with the Polkadot ecosystem, as well.

Holders of 300 or more DOT can set themselves up as nominators and directly nominate their tokens to validators. This role has a lot of responsibility, but by taking it on, you’re empowering yourself to act in the best interests of the network.

How to Stake Polkadot FAQ

What is the best way to stake Polkadot?

If you have less than 300 DOT, the best way to stake is by joining a nomination pool. Native staking via connecting your wallet to the Polkadot staking dashboard is the best way to go, but it’s also possible to stake on exchanges or decentralized staking platforms.

How profitable is staking Polkadot?

The yield you’ll earn for staking DOT is variable and will also depend on where and how you stake. Validators will earn the most, but yields are often still better than staking platforms if you nominate or join a pool.

How should I choose a validator?

Do plenty of due diligence on the validator and try to get an idea of whether the node operator has a good track record when it comes to performance and uptime.

Which wallet can I use for DOT staking?

The easiest Polkadot wallet to use is Polkadot.js, the official wallet for the Polkadot ecosystem. You can visit the official site to download and get acquainted with it.