How to Stake MANA (Decentraland) & Should You Do It

crypto staking

Blockchain and the metaverse are two vastly different concepts that have existed independently of each other for years. However, it wasn’t until a project like Decentraland (MANA) that these two worlds collided into something completely new. By learning how to stake MANA, you can earn more with your assets and participate in this unique realm’s future.

Decentraland represents a virtual world where participants own plots of land in the form of NFTs. Users can freely roam the metaverse, enjoy exciting events, create or purchase various items, and more. All that requires Decentraland’s native token, MANA, which means the token has value and can be a potentially lucrative investment.

On the other hand, staking refers to the process of locking up your assets as collateral to support the operations of a network. In return, you gain more tokens as a reward. But can you stake MANA, where, and how profitable it is?

Keep reading to find out the answers to all these questions!

Can You Stake MANA?

You can’t stake MANA in a traditional sense. The token has a maximum supply of ~2.19 billion, and all of the coins have been minted and issued already. A part of the maximum supply has been locked up or burned, resulting in a circulating supply of around 1.8 billion. As a result, it’s impossible to stake your crypto and passively earn more of it.

Still, there are other ways to earn passive income with your MANA holdings, but you need to obtain the tokens first. One of the easiest ways to get MANA today is to buy it on a centralized exchange, like Binance or Crypto.com, or on a decentralized exchange, like Uniswap.

MANA is a fungible ERC-20 token used for both governance and value exchange in Decentraland. You can exchange it for the NFT parcels called LAND or for various goods and services within the metaverse.

3 Ways to Earn Extra MANA

While it’s impossible to natively stake MANA, there are other methods of getting more tokens with your holdings. They involve using handy features provided by centralized exchanges and lending platforms to increase your token count. Let’s examine some of the most popular ones.

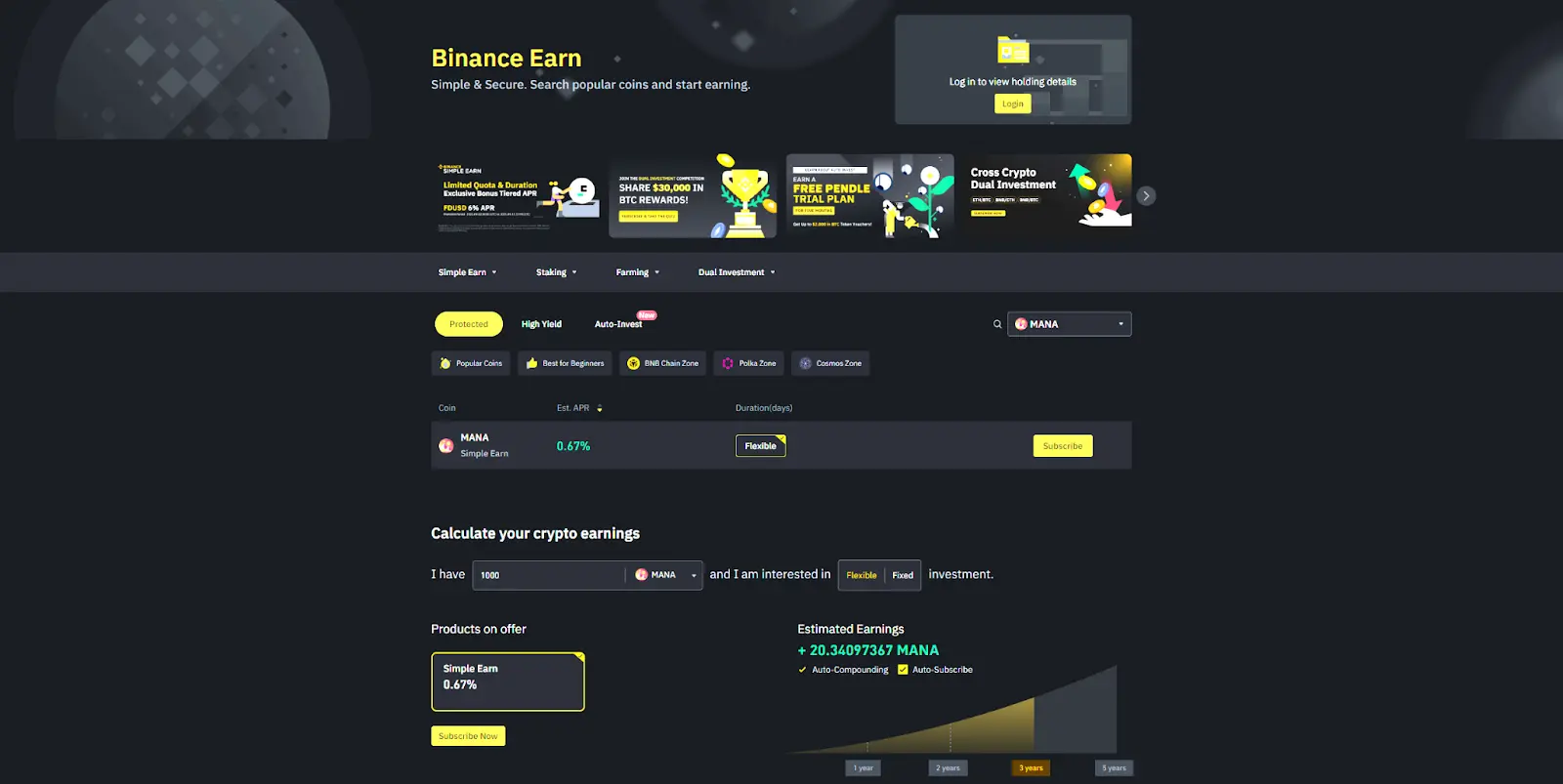

#1. Binance Earn

One of the best ways to earn extra MANA is on Binance, the biggest and most popular centralized crypto exchange in the world. This CEX offers different ways to earn passive income with various cryptocurrencies through staking, liquidity farming, double investing, and more.

Here’s a step-by-step process on how to start earning MANA on Binance:

- Create an account using your email or phone number.

- Perform Binance KYC verification using a government-issued ID.

- Buy MANA with fiat using a payment card, bank transfer, or third-party services.

- Go to the “Earn” section on the website and look up MANA token.

- Select how many tokens you want to submit for staking.

- Click on “Subscribe” and start earning more MANA.

Binance offers 0.67% APR with a flexible staking term. That might not be much, but it adds up over time, especially if you use their auto-compounding feature. Furthermore, the exchange offers a handy calculator that can help you estimate your earnings based on the amount of crypto submitted and the staking period.

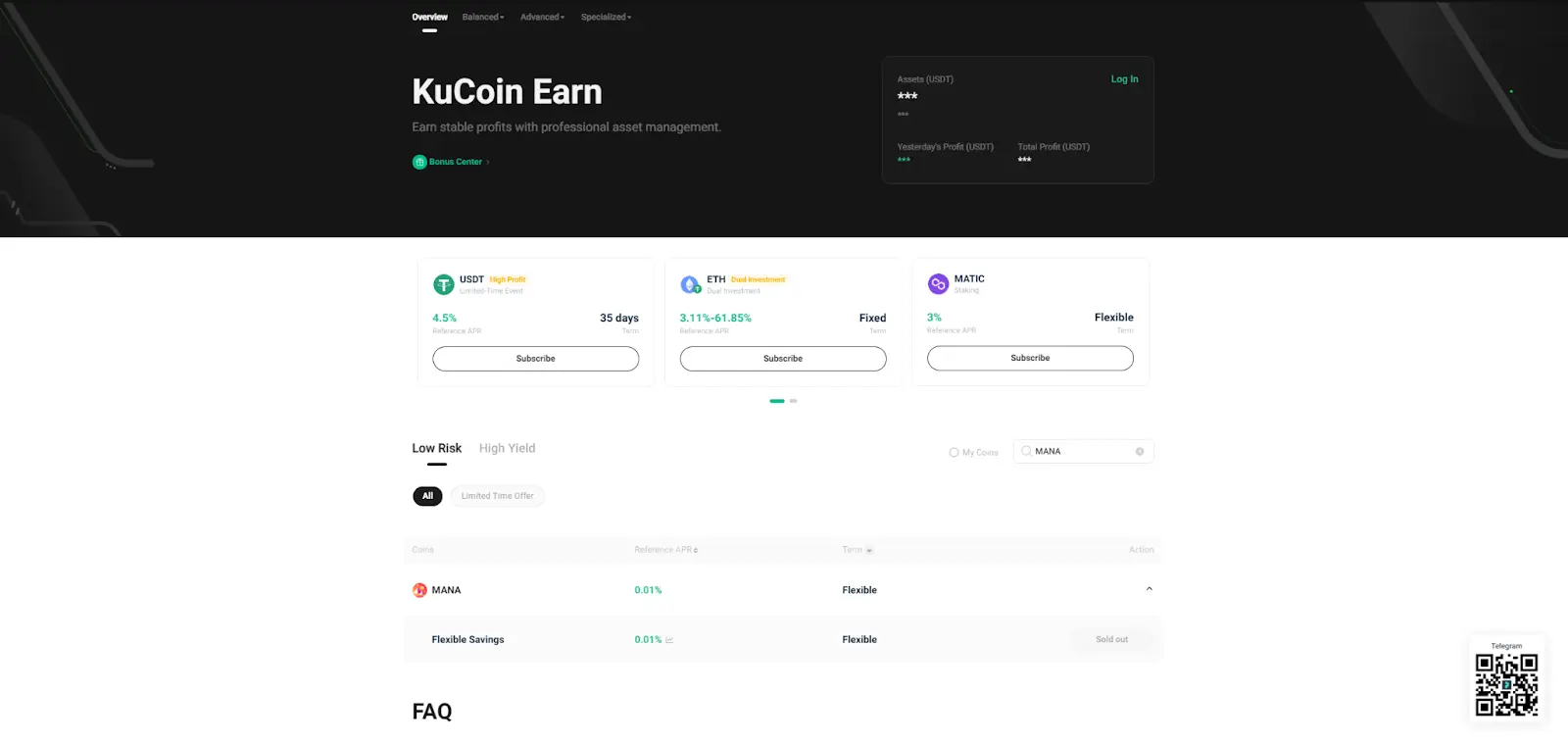

#2. KuCoin Earn

KuCoin is another popular centralized exchange where you can use MANA to earn passive income. KuCoin is famous for offering a wide array of features and earning options to its users, such as saving, staking, lending, and more. All that makes it a strong alternative to Binance.

One of the options is KuCoin Earn. Just like with Binance, you need to create an account with KuCoin and perform KYC verification. After that, you should head on over to the “Earn” section on the main page and the “KuCoin Earn” feature.

You’ll find plenty of different earning opportunities that offer as much as a triple-digit APR. You can use the search bar to find MANA and see what kind of saving options are there for this cryptocurrency.

Much like Binance, KuCoin also offers a low APR (as low as 0.01%) with flexible MANA staking. The upside is that the terms change all the time, so you can wait for better terms before putting your funds to work.

#3. Gemini Earn

Gemini is an all-in-one crypto platform that features an exchange, an NFT marketplace, staking services, and more. They also have a credit card for their users, who can earn crypto back on every purchase.

The platform features a vast array of cryptocurrencies and stablecoins on which you can earn interest. Moreover, they continuously update the rates to remain transparent and provide their users with the best gains possible.

When it comes to staking MANA, Gemini offers a 0.75% base APY, and the rewards are paid in kind. However, there’s been an extended period of time where Gemini has paused withdrawals for its customers, so you should do your research and be careful when investing.

Should You Invest in MANA?

You should invest in MANA if you have a high risk tolerance and are looking for potentially large gains. As of the writing of this article, the current price for one MANA is $0.28, which is 95.23% down compared to its all-time high price of $5.90.

If MANA were simply to return to its ATH price in the next bull run, the holders would see more than a 21X return on their current investment. However, there are many different factors that affect the price of this ERC-20 token.

First off, there’s the overall market movement that affects the entire cryptosphere. When the market is in a long-term downtrend, chances are MANA won’t see big—if any—gains. Moreover, the crypto might never return to its all-time high price, and it can just keep going down from here.

Another important factor to consider is the popularity of the metaverse. Decentraland is one of the most popular blockchain metaverses. So, if you notice virtual reality worlds becoming prominent, chances are Decentraland will follow. With more network participants, demand for MANA will increase, which will likely drive the price up!

Ultimately, investing in MANA is definitely a riskier endeavor than buying a more established cryptocurrency like Bitcoin. However, there’s greater potential for higher returns!

The Future of MANA

The future of MANA depends on how successful Decentraland gets, and it’s already one of the most popular metaverses in the world. That’s promising, considering Meta (formerly known as Facebook) invested more than $10 billion in their metaverse project.

Decentraland quickly rose in popularity soon after its launch in 2020. That was partly due to a global COVID lockdown crisis, but the ecosystem keeps thriving and expanding today. Developers have plans to implement royalty systems that would allow creators on the platform to profit from their efforts.

On top of that, there are already plenty of events happening in this metaverse. Some of these events are gaming-oriented and include cycling, golfing, hiking games, Minecraft, and more. There are also many art and culture events, music festivals, live performances, and so on.

Developers keep adding features to Decentraland. They work hard on integrating blockchain and NFT technologies into the metaverse, which will likely attract more users and increase demand for MANA.

Key Takeaways

That sums up everything you need to know when it comes to staking MANA. The realm of Decentraland is an intriguing one and represents an intersection of blockchain technology and virtual reality.

Participants in this new world use MANA, and the health of this virtual ecosystem as a whole is essential to this crypto’s success. Regardless, if you’re already holding tokens in your portfolio, why not put them to work and earn more?

Just don’t forget to do research and be careful when investing—only then will you be able to take advantage of MANA’s full potential.

How to Stake MANA (Decentraland) FAQ

Can you stake MANA?

You can't natively stake MANA since all of the tokens have been minted and distributed already. However, there are other ways to earn passive income by lending your assets. That’s best done through the convenient features available on centralized exchanges such as Binance and KuCoin.

Where is the best place to stake MANA?

The best places to stake MANA are on centralized exchanges that support this cryptocurrency and offer earning features through lending. First off, you need an account on a centralized exchange like Binance. Then, perform KYC verification to unlock the necessary features. Finally, put your assets to work and start earning.

Can MANA get to $1,000?

It’s highly unlikely for MANA to get to $1,000 in the foreseeable future. With its total supply of 2.2 billion, a price of $1,000 per MANA would put this cryptocurrency at $2.2 trillion in market capitalization. That would make this token alone worth twice the total current cryptocurrency market cap.