How to Stake ICP: Beginner’s Guide to Earning ICP Rewards

crypto staking

One of the biggest benefits of cryptocurrencies is the ability to stake them and earn passive income simply by holding them. Combine that crypto feature with the potential of the Internet Computer (ICP), and you’ll begin to understand why people around the globe keep wondering how to stake ICP and get more tokens.

The Internet Computer seeks to revolutionize the World Wide Web and put the power back into the hands of individual users. The goal of its creators was to mitigate the influence that global corporations have on the online community through decentralization. So, by learning how to stake ICP, you’ll not only earn more tokens, but you'll also contribute to a greater cause.

But how exactly do you stake ICP, and what is the best platform to do it? Keep reading as we explain everything in-depth!

How to Stake ICP on NNS

The Internet Computer can be staked natively on its blockchain by participating in the Network Nervous System (NNS). This is the system that manages the Internet Computer network, and staking represents the way users govern it.

Let’s learn how you can stake ICP on NNS.

#1. Buy ICP

The best and simplest way to buy ICP is via a centralized exchange. Almost every major CEX in the world features the Internet Computer, so if you already have an account with some of the exchanges, you should check if they sell it. Otherwise, you should start by creating an account with exchanges such as Binance, Coinbase, Crypto.com, KuCoin, and many others.

Here’s a step-by-step guide to creating an account and buying ICP quickly and effortlessly:

- Look for exchanges that support ICP.

- Create an account using your email or phone number.

- Perform KYC verification.

- Buy ICPwith fiat using a credit or debit card, bank transfer, or third-party payment system.

Keep in mind that you’ll needat least 1 ICP to start staking. You should also be mindful of the fees involved when buying ICP with fiat. Due to fees, making one large purchase might be more cost-effective than making several smaller ones.

#2. Create an Internet Identity

An Internet Identity helps you authorize your device to participate in the ICP blockchain. You can think of it as an ICP networkaccount that allows you to own tokens, submit proposals, vote, and stake your assets.

To create an Internet Identity, you should head on over to Identity.ic0.app and tap on the “Create Internet Identity” button. Follow the instructions closely until you’ve authenticated your device. You can have more than one device authenticated with one Internet Identity, which is highly recommended in case you lose one of them or if one of them malfunctions.

#3. Sign in to the NNS DApp

Once you have your Internet Identity, use it to sign in to the NNS dApp to get an on-chain NNS wallet. This is the official wallet of the Network Nervous System, through which you can manage, transfer, and stake your ICP holdings, use them to vote on the network, and more.

#4. Transfer ICP to NNS

After signing in to the NNS, you’ll get an address that you can use to transfer your ICP. The address is a string of letters and numbers, and it will look something like this:

[box]

726cb421538da747c056c1b60s8w4050d6125afs46fx12a1428a15266c37s838

[/box]

To transfer ICP to your NNS wallet, you should log in to the CEX account where you bought your Internet Computer tokens. Carefully copy and paste this address into the destination address field when withdrawing funds from your account at the centralized exchange.

Keep in mind that a single misplaced letter can lead to a permanent loss of funds! If this is your first time transferring tokens, you can try with a small amount first. Wait until they’ve reached your ICP NNS wallet, and then send the rest.

#5. Stake ICP

Staking ICP involves locking up your tokens inside a “neuron.” You need at least 1 ICP to create a neuron, and the lock-up period ranges from 6 months to 8 years.

It’s recommended to start with the minimum amount, as you can always repeat the process to create more neurons and stake more ICP. Not only that, but you can merge your neurons, though this is an irreversible process.

Here’s a simple guide on how to stake ICP on NNS:

- Go to the NNS dApp.

- Sign in using your Internet Identity.

- Navigate to the “My Neuron Staking” tab.

- Type in how much of your ICP tokens you want to stake.

- Choose the staking period, which is called the “dissolve delay.”

- Confirm the lock-up period and start staking.

After you’ve created a neuron, you can find and track it on the ICP Dashboard, which looks like this:

How Does the Network Nervous System (NNS) Work?

The Network Nervous System works as a digital democracy. Every neuron gets to submit network proposals and vote on them as long as they've been locked up for at least six months. It is through that voting that network participants get ICP staking rewards.

The network creates a fixed number of ICP tokens per day, and every participant who votes gets their share. In essence, the more you vote, the greater the rewards. There are two methods of voting on the NNS platform, which are:

- Direct (manual) voting, where network participants use their neurons to individually analyze proposals and vote on them

- Delegated voting, where network participants can choose to follow the votes of other neurons with their own

Delegated voting creates a liquid democracy system, which is perfect for users who are looking for a hands-off approach to staking ICP. It allows you to automate the voting of your neurons and earn passive income without checking your NNS wallet every day.

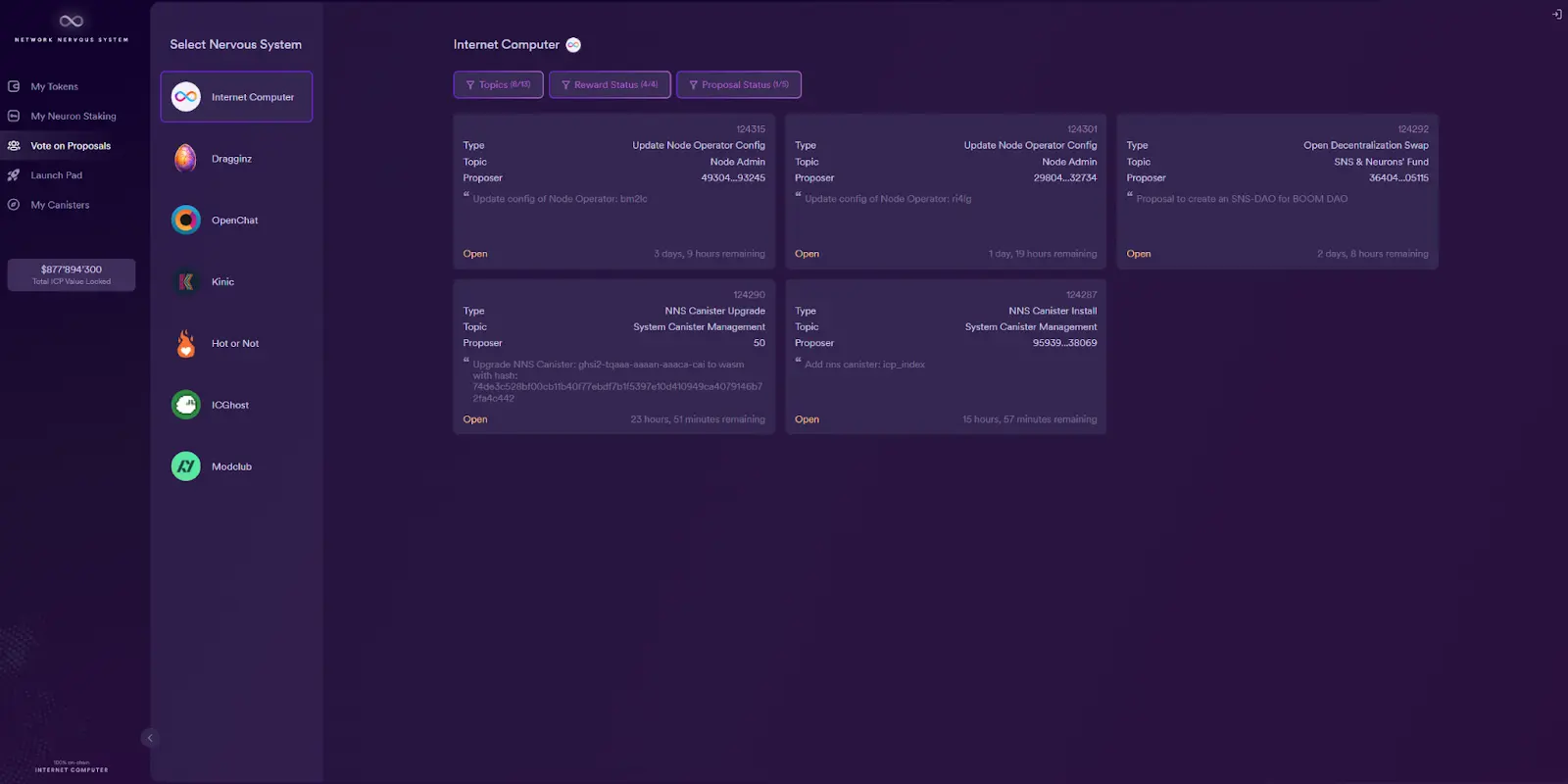

Here’s how to vote manually on NNS:

- Go to the “Vote on Proposals” tab in the NNS dApp.

- Open a topic to find more information about a proposal

- Select the neurons associated with your Internet Identity.

- Vote by tapping on “Adopt” or “Reject.”

This is what the voting page looks like:

You can also use the dApp’s filter feature to sort through different proposals based on their topics, reward status, and proposal status.

And here’s how to set up your neurons to follow others for voting:

- Select your neuron in the NNS dApp.

- Tap “Edit Followees.”

- Choose if you want your neurons to follow others on specific or all topics.

- Select the ID of the neuron you want to follow for chosen topics.

- (Optional) Supervise your Neurons and change who they follow at any given moment.

ICP Maturity

ICP maturity represents ICP staking rewards. As you use your neuron to vote on proposals, its maturity increases, which means you’re getting more staking rewards. However, you can’t just withdraw your rewards once you’re satisfied with them. Instead, you need to create a “reward neuron,” which transforms the original neuron’s “maturity.”

Another thing to keep in mind is that there’s a minimum maturity level your neuron needs to reach before it can create a new one. This minimum threshold is 1 ICP, which means you can’t withdraw your staking rewards until you’ve earned at least one token.

Moreover, when you create a reward neuron, the maturity level of the original one goes back to zero. As a result, the less often you withdraw staking rewards, the more profitable you’ll be in the long run.

ICP Voting Power

ICP voting power directly impacts ICP staking rates and determines how much weight your neuron has in the voting process. The voting power is calculated using three elements, which are:

- The number of ICP tokens in a neuron

- The dissolve delay, since the longer you lock up your assets, the greater their voting power

- The neuron’s age, or the amount of time you’ve been staking it without dissolving

You can calculate the voting power of your neurons using the following information:

- 1 ICP token equals the power of 1 vote.

- A 6-month lock-up period multiplies the neuron’s voting power by 1.06, while 8 years grant a 2.0 multiplier.

- 4+ years without dissolving gives a 1.25 multiplier bonus to the voting power. Up to that point, the voting power increases linearly.

Keeping all multipliers in mind, you can obtain a maximum of 2.5 multipliersper ICP staked. Of course, that would require locking up your crypto for 8 years and holding it like that for at least 4 years.

How to Stake ICP on an Exchange

You can stake ICP on a centralized exchange simply by having the tokens in your wallet and subscribing to the exchange’s staking features. So, if you’re wondering, “Where can I stake ICP without creating an Internet Identity and learning about neurons?” CEX is the best option for you.

The process is much more straightforward than staking on NNS. Here’s a step-by-step guide based on the example of the biggest centralized exchange in the world, Binance:

- Create an account at the centralized exchange of your choice.

- Perform a Binance KYC verification process to unlock buying and staking features.

- Purchase ICP with fiat using the payment option that suits you best.

- Go to Binance Earn using the Finance tab on the main page.

- Type “ICP” in the search bar.

- Choose flexible staking or a fixed staking period.

- Input the number of ICP tokens that you want to stake.

- Subscribe and start earning rewards.

Most exchanges offer staking calculators where you can estimate your rewards, which can help you make a decision that suits you best. It’s important to notice that rewards can vary between exchanges and change over time. Moreover, some duration options can be “sold out,” so you’ll have to wait until they are available again or look for another option.

Regardless, CEX staking remains the simplest and easiestanswer to the “How to stake ICP tokens” question for entry-level crypto enthusiasts.

How Much Can You Earn by Staking ICP?

How much you can earn by staking ICP depends on several factors, such as your neuron’s maturity, voting power, the platform you’re using, and more.

At the height of the 2021 bull run, some users saw as much as 29% APY on their ICP holdings by taking advantage of high lock-up periods and neuron maturity.

If you want to go with the CEX staking route, you should check each individual exchange for its rates. For instance, Binance offers 0.15% APY on your ICP for flexible staking at the moment. The percentage goes up the longer you lock up your assets—if you opt for 120-day fixed staking, you’ll get as much as 9.9% APY.

Pros of Staking ICP

There are many benefits to staking ICP, including:

- Making passive income and earning potentially lucrative rewards by simply holding your assets in an NNS wallet or in a centralized exchange

- Governing the ICP network and impacting its future by voting on proposals

- Contributing to the security of the network by signing up for a long-term commitment through asset lock-up

- Protecting yourself from inflation by accruing cryptocurrency assets that are mostly independent from the traditional markets

- Avoiding slashing risks that exist with general staking since ICP holders will, at worst, just not get staking rewards

Cons of Staking ICP

Staking is not without its risks, which is why you need to be aware of some of the drawbacks of staking ICP, such as:

- Liquidity concerns exist while staking any cryptocurrency, including ICP. There’s always the risk of locked-up assets having a big surge in price when their holders aren’t able to capitalize on market movements. These risks are more prominent the longer you lock up your ICP.

- Value depreciation is another concern when locking up cryptocurrency for an extended period of time. If the price of ICP starts dropping significantly with no signs of change, you won’t be able to sell your tokens to recover some of the losses.

- The learning curve can be a barrier to entry for less experienced crypto enthusiasts. The process of staking ICP on NNS requires a certain level of technical competence, which can put off some users.

How to Unstake ICP

To unstake ICP on NNS, you need to start dissolving your neurons. In essence, when the dissolve delay (which is the lock-up period) reaches zero, you can withdraw your tokens from the platform. That’s why it’s essential to plan ahead and know exactly how long you want to stake your ICP.

In the meantime, you can withdraw rewards by “spawning” a reward neuron from a staked neuron that has reached sufficient maturity. In essence, you’re resetting the maturity (and lowering the staking power) of your main neuron to withdraw the rewards it obtained through voting on network proposals.

If you’re staking ICP on a centralized exchange, the process of unstaking is much simpler. You can just unsubscribe from the feature if you’ve chosen a flexible staking period. Otherwise, wait for the lock-up term to finish and withdraw your assets.

Key Takeaways

And that concludes today’s lesson on the potential of Internet Computer staking! The question is no longer “can you stake ICP,” but how lucrative it is and what benefits users gain from doing so.

One of the main aspects that draw retail investors to the thought of learning how to stake ICP is the unique opportunity to join the cause of decentralization and earn money in the process. While there’s a bit of technical know-how required to start staking ICP, the rewards are more than worth it.

But, just like with any financial investment, it’s crucial to do research and approach the whole endeavor cautiously. Be mindful of potential risks, and you’ll be one step closer to another great source of passive income!