How to Stake Dogecoin: Best Places to Earn Interest on DOGE

crypto staking

Dogecoin is a particularly interesting cryptocurrency in an already exciting world of decentralized digital finance. It started as a meme before turning into one of the top 10 cryptocurrencies by market cap. So, it’s no surprise people started wondering how to stake Dogecoin and earn more with their assets.

So, how does one take advantage of a seemingly silly cryptocurrency with such playful origins? Where can you learn how to earn Dogecoin, what even is staking, and which platforms offer the best opportunities?

In this article, we’ll explain how new DOGE coins are introduced to the market, what platforms will give you the biggest staking rewards, what the pros and cons of staking are, and more. Let’s jump right in!

Can You Stake Dogecoin?

Dogecoin can’t be staked natively because it’s a proof-of-work (PoW) cryptocurrency (like Bitcoin). In fact, it was developed based on Bitcoin (DOGE is actually a Luckycoin blockchain fork that was based on Litecoin, which is a Bitcoin fork). As a result, it’s created the same way as BTC—with cryptocurrency mining.

With that in mind, the most direct way to obtain Dogecoin (apart from buying it) is to use powerful computer hardware to solve complex cryptography puzzles. Much like Bitcoin, you can mine DOGE using CPUs, GPUs, and specialized hardware miners called ASICs. This process is called proof of work because miners are rewarded for the work they put in.

However, that's not to say it’s impossible to earn passive income with your Dogecoin holdings. There are several different methods to stake Dogecoin and earn more of it indirectly. Some of these methods include soft staking, bridging staking, and cryptocurrency lending. All of them include using a CEX or DEX to earn more DOGE.

Finally, the Dogecoin trailmap on the foundation’s official website features a community proposal to switch this cryptocurrency from a proof-of-work to a proof-of-stake consensus mechanism. Should that proposal come to fruition, holders will likely be able to stake their DOGE coins natively.

Advantages of Staking Dogecoin

There are several advantages to staking Dogecoin, such as:

- Earning rewards. The biggest reason for crypto enthusiasts to stake their DOGE holdings is to earn passive income. If you already have a substantial amount of coins, you can stake them to increase your portfolio instead of letting them sit idly in your wallet.

- Providing liquidity. Some methods of staking Dogecoin involve providing liquidity to a decentralized exchange. By doing so, you make trading easier for other participants. In return, you get a portion of the trading fees. For instance, you can stake Dogecoin on PancakeSwap with another crypto as a liquidity pair.

- Bridging to other chains. The bridging method of staking Dogecoin involves wrapping your coins to be used on other chains. That increases the utility of your coins and allows you to take advantage of various chain-specific DeFi protocols, such as liquidity mining protocols, lending pools, and more.

Still, earning rewards and making passive income remains the main reason people learn how to stake Dogecoin. And while some places promise upwards of hundreds of percent of APY, it’s crucial to understand that as the gains increase, so does the risk. On top of that, there are several other disadvantages to staking Dogecoin, which we’ll explore in the following section.

Disadvantages of Staking Dogecoin

The disadvantages to staking Dogecoin include:

- No native staking. Since Dogecoin exists on a proof-of-work blockchain, it doesn’t have on-chain staking. As a result, it’s not always clear where staking rewards come from, and not all platforms disclose exactly how the participants earn more coins.

- Misrepresentation. The inability to perform on-chain staking coupled with a lack of transparency from many platforms that offer DOGE staking has led to confusion among the community. Some participants don’t know staking is possible, while others don’t trust the majority of platforms that feature Dogecoin staking.

- Security concerns. Depositing your coins for staking on a CEX or a DEX puts your assets at risk. Smart contracts on decentralized exchanges are prone to vulnerabilities, and centralized exchanges can be hacked as well.

There’s also plenty of misunderstanding surrounding Dogecoin staking. As a result, there are many malicious actors in the space who might try to steal your finds. That’s why it’s vital to do your own research before depositing your coins for staking.

How to Soft Stake Dogecoin

Soft staking refers to the process of passively increasing your Dogecoin holdings through a centralized exchange. It’s also one of the easiest ways to learn how to stake Dogecoin, and you can do it on various exchanges, including Binance and KuCoin.

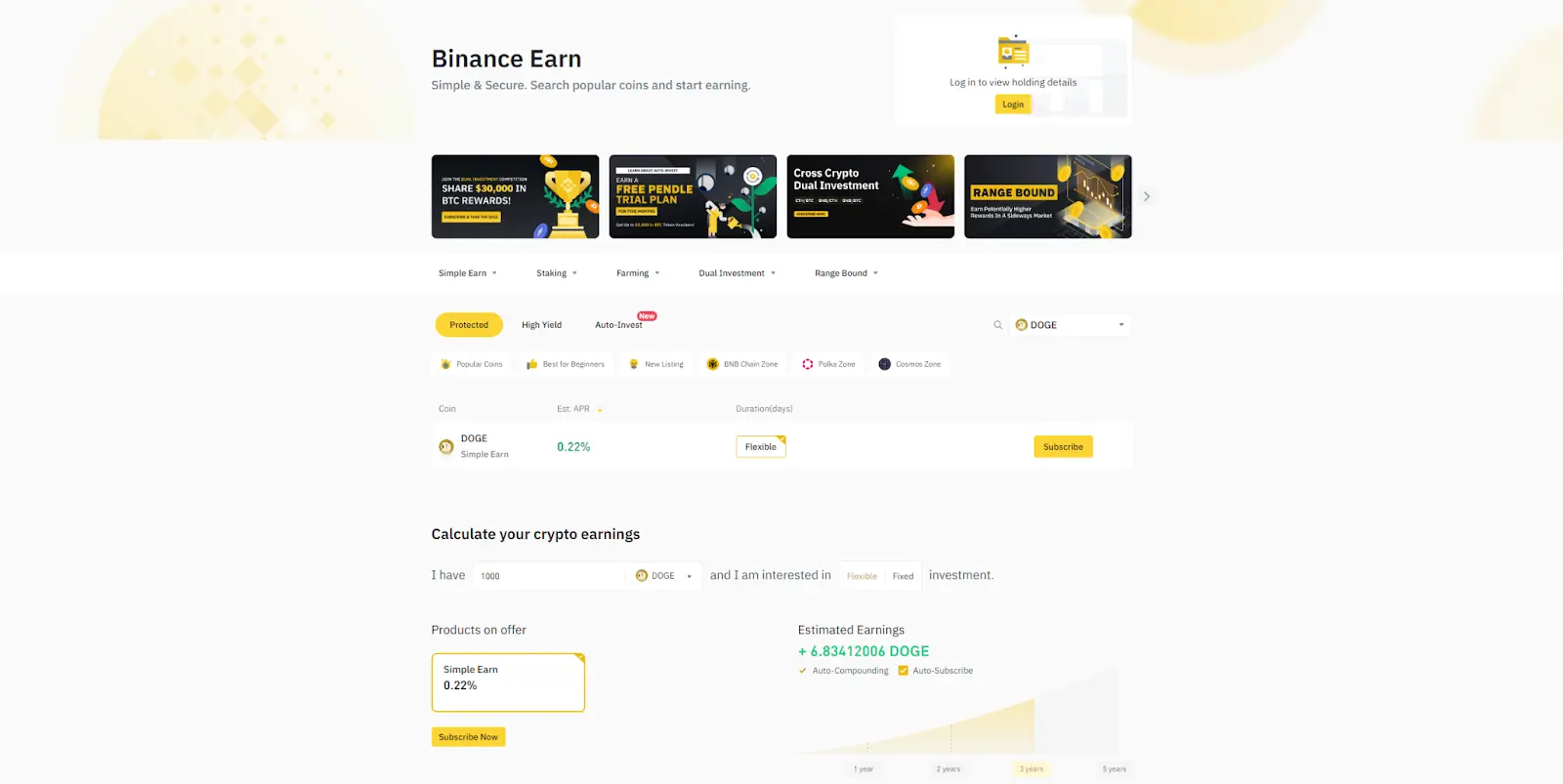

Let’s examine the process of putting your assets up for soft staking using the example of the Binance exchange:

- Start by creating an account with the exchange.

- Perform the Binance KYC (Know Your Customer) verification to unlock all the features.

- Purchase Dogecoin with fiat. You can do that with a credit or debit card, bank transaction, or third-party payment service.

- Optionally, you can trade other cryptocurrencies for DOGE or receive funds from another wallet using a private key.

- Navigate to the “Finance” section on the website and head to the “Earn” page.

- Choose among the number of options, such as “Protected,” “High Yield,” and “Liquidity Farm” earning.

- Deposit the amount of Dogecoin that you want to stake and tap “Subscribe” to start earning rewards.

When choosing the soft staking option that suits you best, you should consider several aspects, including the estimated APR, the lock-up period, and the amount of risk involved.

This method of putting your Dogecoin into soft staking stays similar no matter what CEX you decide to go with. There might be small differences, but the process is beginner-friendly, making centralized exchanges some of the best platforms to stake Dogecoin.

The main drawback of this method is that you’re giving the keys to your crypto to a third party. Furthermore, centralized exchanges generally offer lower APYs than their decentralized counterparts.

How to Stake Dogecoin: Bridging

Another method of staking your Dogecoin and earning passive income with it is bridging DOGE to other chains. That way, you can take advantage of the numerous benefits that the DeFi ecosystem has to offer.

One of a few popular ways to bridge your DOGE to other chains includes using platforms like BurgerSwap to bridge your coins to the Binance Smart Chain and swap them for BDOGE. Of course, you need a Dogecoin wallet that is compatible with the exchange, though both MetaMask and Trust Wallet (among many other options) work with BurgerSwap.

To fund your wallet, you can buy DOGE with fiat on Binance or transfer them from another wallet using your public key. Then, go to the BurgerSwap.org exchange, tap on the “Wallet Not Connected” button, and follow the instructions until you’ve connected it.

After that, you can select how many DOGE coins you want to swap for BDOGE. Once BDOGE is in your wallet, you’ll be able to use it in various DeFi protocols, including staking, yield farming, and others.

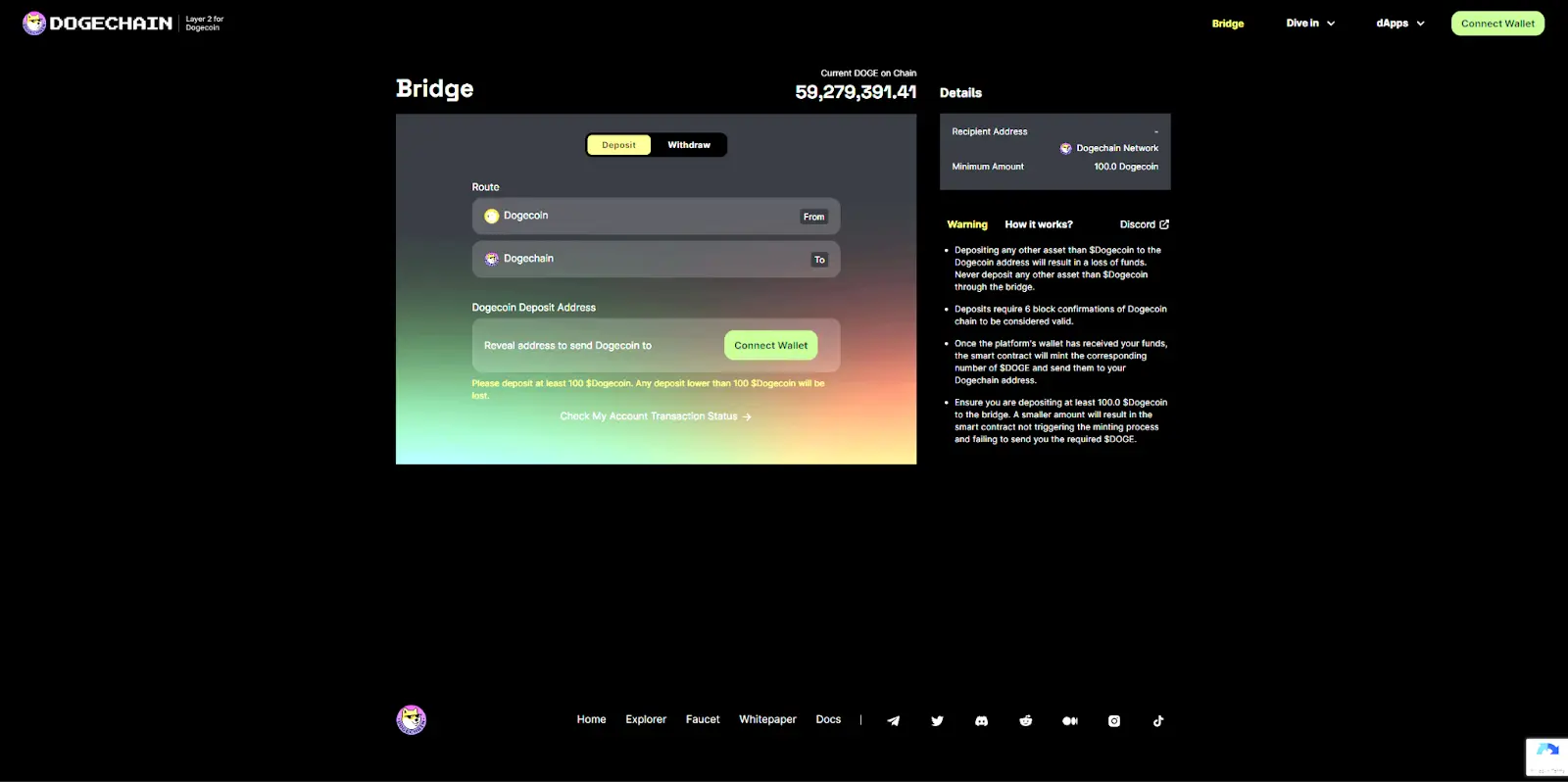

Another popular method involves swapping your DOGE for Dogechain on the Dogechain Bridge, which is Layer 2 for Dogecoin. The process is similar to BDOGE bridging and includes connecting a funded wallet before swapping coins. Dogechain Bridge supports MetaMask, Coinbase Wallet, Wallet Connect, and Clover.

The Dogechain ecosystem is vast and offers plenty of opportunities to DOGE holders. For instance, there’s an NFT collection, decentralized domains, crypto games, and much more. On top of all that, there are various staking options that can help you get the most out of your crypto.

How to Stake Dogecoin: Lending

Dogecoin lending is the final and most complex staking option for making passive income with your assets. Because of this, it’s highly recommended to do as much research as possible before attempting to lend or borrow against your DOGE. While there’s a high potential for lucrative rewards, the process is quite risky and can quickly lead to liquidation.

Nexo is an EU-licensed and regulated company and one of the most popular platforms for lending and borrowing DOGE. Nexo Exchange allows you to buy DOGE directly before staking it and earning interest. The platform offers up to 3% APY on DOGE, and the rewards are paid out daily.

Moreover, Nexo allows you to borrow by using your Dogecoin as collateral. You’ll get instant cash with a flexible repayment schedule and plenty of other perks.

CoinRabbit.io is another platform where you can get a loan using DOGE as collateral. It allows you to choose your loan-to-value (LTV) ratio, which ranges from 50% to 90%.

When receiving funds, you can choose from a number of different stablecoins, as well as BTC, ETH, and DGB. You can also borrow DOGE by using one of the 184+ other cryptocurrencies as collateral.

YouHodler is a solid third option for DOGE holders who want to earn interest. The platform offers up to 3.04% APY in addition to many other perks, such as quick deposits and withdrawals, crime insurance, 2FA and 3FA security features, etc.

Tax Implications for Dogecoin Staking Rewards

There are tax implications regarding Dogecoin staking, but they can vary depending on the state and jurisdiction. While staking taxation isn’t fully defined, the IRS started looking at cryptocurrency as property in 2014.

As a result, selling the rewards obtained while staking Dogecoins and getting fiat in return is considered a taxable event.

However, the policy isn’t always clear, as sometimes the coins issued during mining immediately become gross income and are thus taxable. That makes the situation regarding staking Dogecoin even more confusing.

Because of all this, it’s essential to do research and consult a tax professional to be on the safe side.

Key Takeaways

As you can see, the answer to the “can I stake Dogecoin?” question is more complex than it seems at first. While it’s impossible to stake DOGE in a traditional sense, there are many other ways to earn passive income and increase your holdings.

But as you venture into this lucrative world of DeFi, staking, lending, and bridging, remember to prioritize research and security. The cryptocurrency landscape is dynamic and filled with opportunity, but it can also be quite punishing for the uninformed.

Still, with the right approach and the knowledge gained from this guide, you’ll be one step closer to becoming a DOGE aficionado. To the moon!

How to Stake Dogecoin FAQ

Does Dogecoin allow staking?

Dogecoin does not allow native staking, as it’s a proof-of-work cryptocurrency where new coins are obtained through mining. However, there are roundabout ways of staking DOGE, such as soft staking, bridging staking, and crypto lending.

What is the best way to earn Dogecoin?

The best way to earn Dogecoin depends on your risk tolerance and technical knowledge. Centralized exchanges offer an easy and generally secure way of staking Dogecoin, with the drawback of a low APY. Decentralized exchange staking is riskier and more challenging to get into, but it can provide greater gains.

What are Dogecoin staking rewards?

Dogecoin staking rewards include DOGE and many other cryptocurrency coins or tokens. You obtain these for staking your Dogecoin on a centralized exchange, providing liquidity on a decentralized exchange, bridging DOGE to other chains to participate in DeFi protocols, and more.