How To Stake BNB: A Complete Walkthrough for Beginners

crypto staking

Ever since its introduction in 2017, Binance Coin (BNB) has been a powerhouse in the world of cryptocurrencies. In fact, it’s the foundational element that facilitates the function of the Binance Smart Chain ecosystem. BNB has already seen explosive growth, and chances are it’ll continue to rise, which is why many are interested in learning how to stake BNB.

Staking BNB ensures the stability of the BNB Smart Chain network. Furthermore, it’s an option to make passive income, which makes it a particularly enticing feature for investors.

Whether you’re a seasoned crypto enthusiast or an eager newcomer, you’ll find plenty of useful information in this article on how to stake BNB and get the most out of your holdings. Let’s get started!

What Is BNB?

Binance Coin (BNB) is the native cryptocurrency of the Binance platform. It was introduced through an ICO 11 days before the Binance centralized exchange started working. The users could’ve purchased their share of 200 million released BNB at the price of 20,000 BNB for 1 BTC or 2,700 BNB for 1 ETH.

BNB was initially released on the ERC-20 network before being moved to the proprietary Binance Chain blockchain. One of its main purposes is to be used by traders to reducetransaction fees. BNB can save traders up to 25% in spot and margin trading fees and 10% in futures trading fees.

However, BNB’s use case extends far beyond trading on the Binance exchange. For instance, you can buy HTC smartphones and trading card packs with Binance Coins, book hotels and accommodations, pay for music copyrights, subscribe to various services, and more.

Finally, one of the key aspects of BNB is its burning mechanism. The purpose of quarterly burns combined with real-time burning during transactions is to reduce the total supply to 100 million tokens. That makes BNB a deflationary cryptocurrency. The goal of burning is to decrease BNB supply, increase its demand, and drive the price up.

What Is BNB Staking?

In the world of cryptocurrency, staking refers to the process of locking up your crypto assets to facilitate network operations. In essence, you’re using your funds as a promise that you won’t perform malicious actions. By staking your crypto, you can take part in various activities, including securing the network, voting on changes, and validating transactions.

BNB staking involves locking up your Binance Coin to support the operations of the Binance Smart Chain (BSC). In return, you’ll be rewarded with more BNB.

Binance Smart Chain operates using a Proof of Stake Authority (PoSA) consensus mechanism. In essence, validators—and, through them, delegators—confirm transactions and produce blocks. By staking their crypto, they have an economic incentive to act honestly since any malicious action can result in the loss of assets.

Therefore, validators contribute to the security of the BSC network. The more validators and delegators join the staking process, the more decentralized and stable the system gets. Additionally, by locking up their assets, network participants gain governance rights, which means they get a say in the development and changes in the network.

Ultimately, knowing how to stake BNB and familiarizing yourself with the operations of the blockchain can help you maximize potential gains. Since rewards are shared between validators and delegators based on various factors, it’s also important to find out what the different options are before committing your funds.

Proof of Stake Authority (PoSA)

Proof of stake authority (PoSA) represents a combination of proof-of-stake (PoS) and proof-of-authority (PoA) consensus mechanisms.

The PoA mechanism represents a variation of the PoS system. It was created to make up for the downside of the PoS consensus mechanism, which favors those with substantial holdings, possibly pricing out new participants.

However, the proof of authority system comes with authority concerns, where decision-making power can become too centralized. That’s where the proof-of-stake-authority (PoSA) mechanism comes into play to make up for the shortcomings of both previous systems.

On the BNB network, PoSA requires only 21 validators, but each has to have at least 10,000 BNB staked. On top of that, there’s a continuous election process where new validators are selected every 24 hours. As a result, PoSA offers lower fees and faster transactions compared to the other consensus mechanisms.

How To Stake BNB

There are two main methods of stalking your BNB to earn passive income:

- On a centralized exchange (CEX)

- On a decentralized exchange (DEX)

Both methods require a different degree of cryptocurrency knowledge and come with different pros and cons, so let’s explore both.

Staking BNB on a Centralized Exchange

Staking BNB on a centralized exchange is easier to do than staking on DEXs. As a result, this is an enticing option for entry-level cryptocurrency enthusiasts who want to make passive income with their BNB holdings.

Centralized exchanges such as Binance and KuCoin have intuitive websites and applications that make staking easy. All you need to do is create an account with the centralized exchange of your choice and perform KYC verification. After that, you can either buy BNB with fiat or transfer it from another wallet.

From there, you’ll usually find dedicated sections on the exchanges’ websites that will help you stake your coins. The process can be as simple as selecting the amount you want to stake and confirming the activity.

Most centralized exchanges have BNB staking calculators where you can find out estimated earnings based on the amount of coins you stake and the staking period.

The downside to staking BNB on a centralized exchange is that you’re keeping your assets on a CEX. Exchange wallets are hot wallets and are, thus, susceptible to hacking and other malicious attacks.

Staking BNB on a Decentralized Exchange

Staking BNB on a decentralized exchange requires intermediate technical knowledge about cryptocurrencies. Decentralized exchanges don’t require an account created with an email or a phone number. Moreover, there’s generally no need for KYC verification, which is beneficial to those who want to avoid regulatory hassle.

However, users need to have a crypto wallet compatible with a DEX platform and know how to connect it. On the upside, staking this way allows users to retain complete control over their assets. Plus, DEXs often have lower fees than CEXs, which can result in greater gains in the long run.

Still, there are some risks when staking BNB on a decentralized exchange. For instance, smart contracts can be vulnerable to bugs, resulting in security concerns. Moreover, some DEXs can run into problems with low liquidity. Lastly, there’s the risk of impermanent loss.

Where To Stake BNB

Now that you have a general idea about how to stake BNB, let’s explore the different platforms you can use. First, we’re going to examine several centralized exchanges where you can stake your assets with little effort, and then the self-custody option that includes a software wallet.

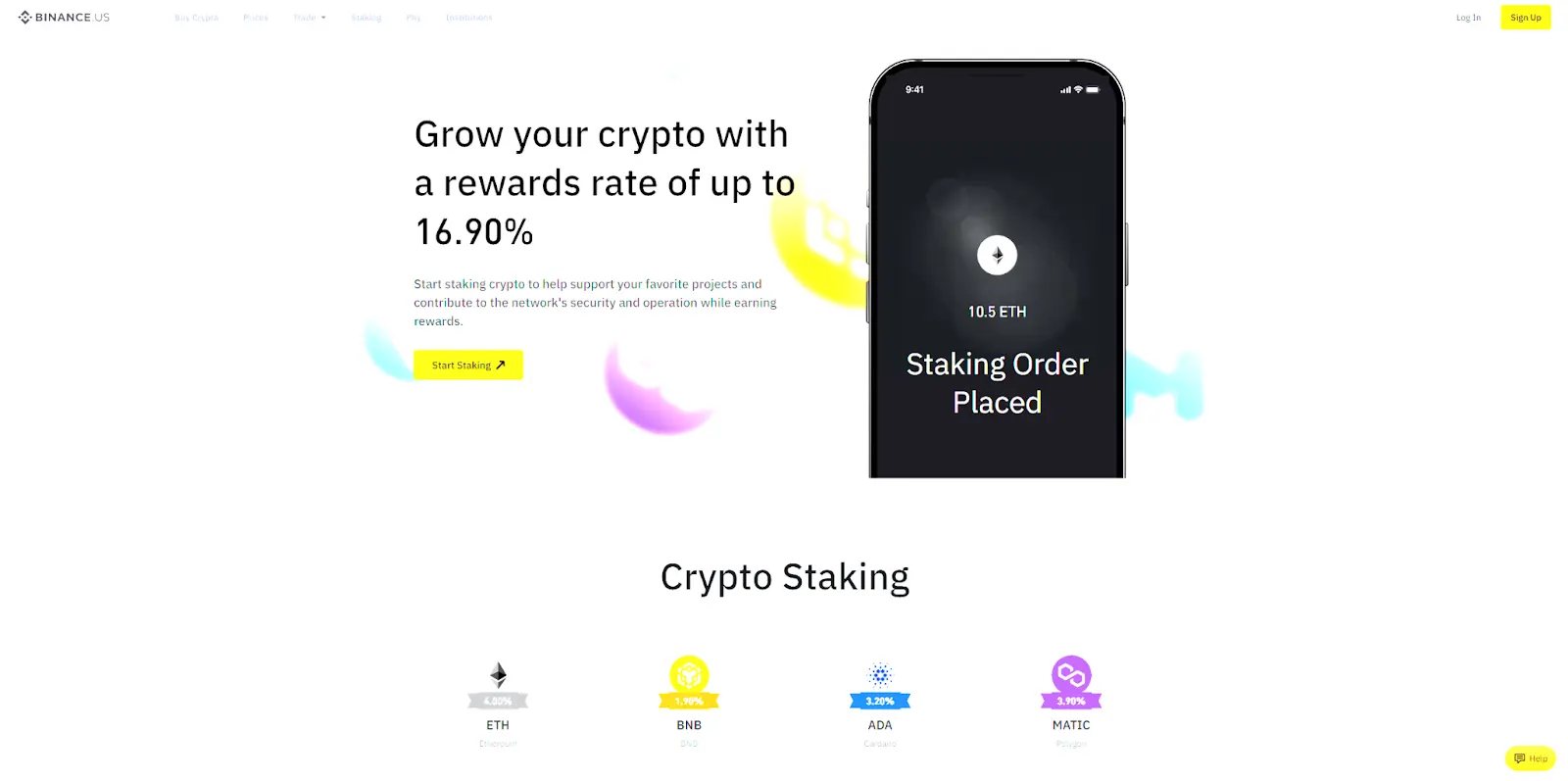

#1. Binance.US

One of the best ways to stake BNB is on Binance.US, considering Binance Coin is this platform’s native cryptocurrency. The main benefits of staking BNB on Binance.US are that the process is easy to set up and that the platform offers robust security features, making staking as safe as possible.

You don’t need wallets or specialized hardware and software to stake BNB on Binance. All you need is an account with the exchange, which you can create using your email or phone number. After that, you need to complete the Binance KYC verification process, and you’ll be able to purchase BNB with fiat and stake it.

Staking BNB on Binance.US is as simple as going to the “Staking” page and clicking on “Stake BNB.” A user-friendly website design will help you effortlessly select how much of your assets you want to lock up, whether you want fixed or flexible staking, and for what period of time.

On a final note, Binance offers many other ways to earn passive income with BNB. For instance, you can compare BNB Vault vs. BNB staking rewards to figure out which solution suits you best. The BNB Vault is just as easy to set up and combines various rewards into one.

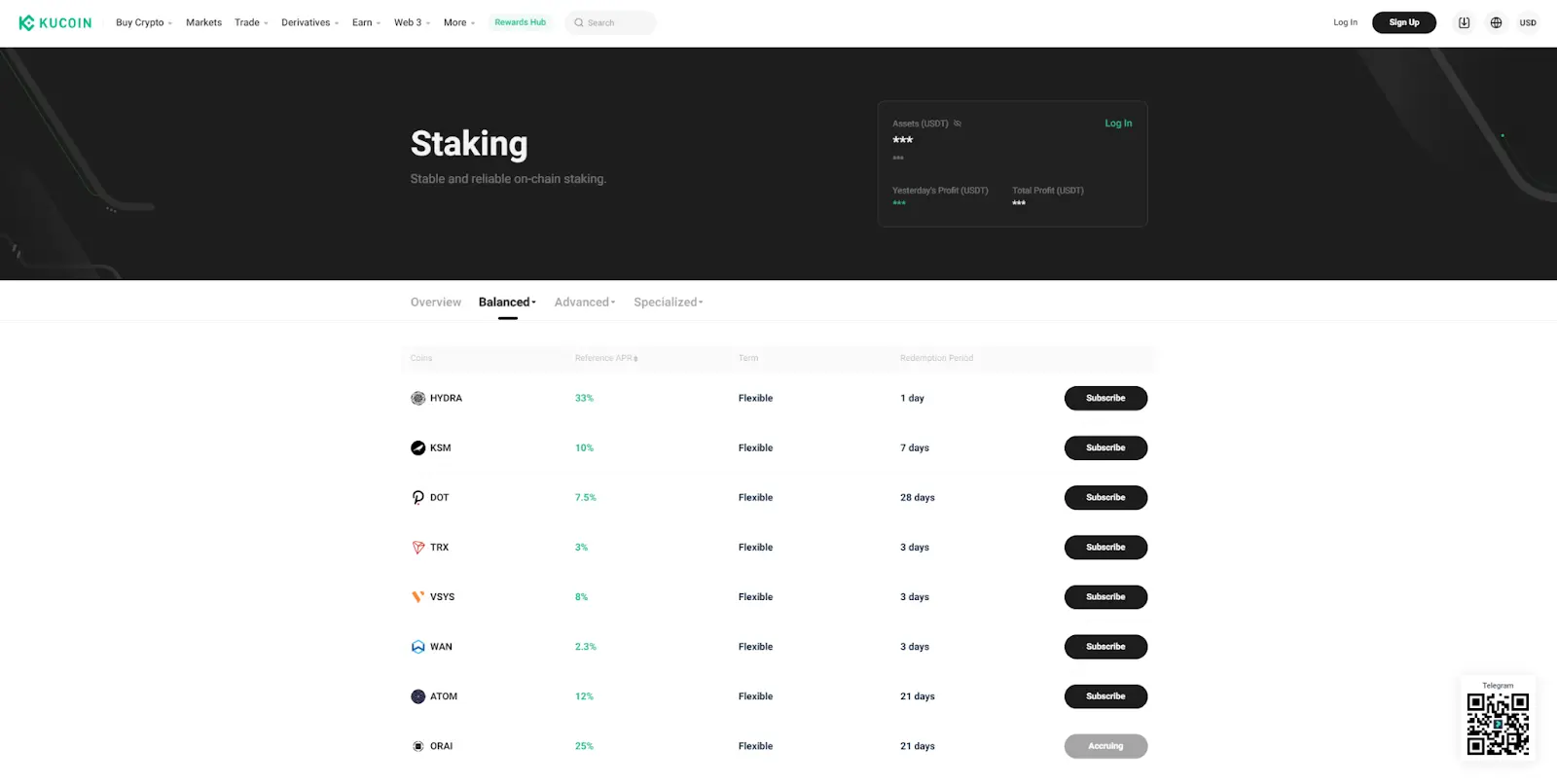

#2. KuCoin

KuCoin is another great platform where you can stake your BNB holdings. This is another centralized exchange that offers staking services tailored toward inexperienced crypto investors.

Much like Binance, KuCoin has an “Earn” section on its website where you can go to check out the platform’s staking options. KuCoin offers a 2% BNB staking APY with a flexible term. However, it’s worth noting that there’s a 7-day redemption period during which your assets will remain locked.

After creating an account and obtaining BNB, you can simply subscribe to the staking service and start earning passive income.

Moreover, you can take advantage of other KuCoin features to make passive income on your BNB. For instance, there’s the advanced KuCoin Dual Investment feature, specialized crypto lending, and more.

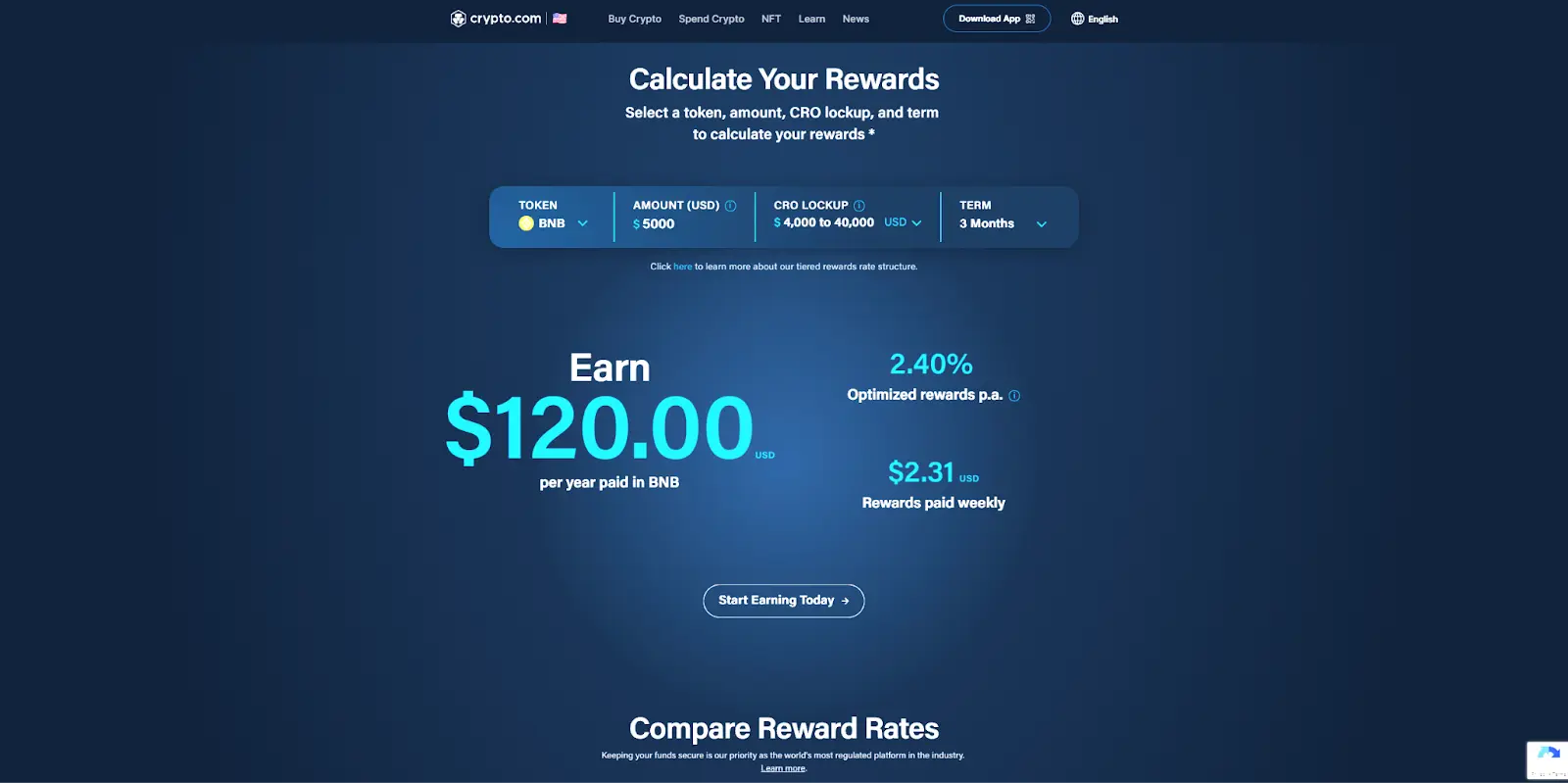

#3. Crypto.com

Crypto.com allows its users to earn up to 5% APY on their BNB holdings. They feature a customizable system where crypto holders can adjust how they want to stake their assets.

First off, you get to choose which token you want to stake and its amount. To make things easier for newcomers, Crypto.com’s calculator immediately converts all currencies to USD, so you get precise predictions in fiat.

After that, Crypto.com presents you with two additional options you can use to increase your gains:

- Lock up your CRO holdings (CRO stands for Crypto.com’s native currency called Cronos) to increase your rewards. Naturally, the more CRO you lock up, the bigger the rewards.

- Choose a deposit term and select between flexible, 1-month, and 3-month staking periods. Naturally, 3-month staking terms yield the greatest returns.

You’ll get the biggest APY (5%) on your BNB staking by locking up more than 40,000 CRO and using 3-month terms. However, it’s important to note that only 3% of those staking rewards will be in BNB, while the other 2% will be in CRO.

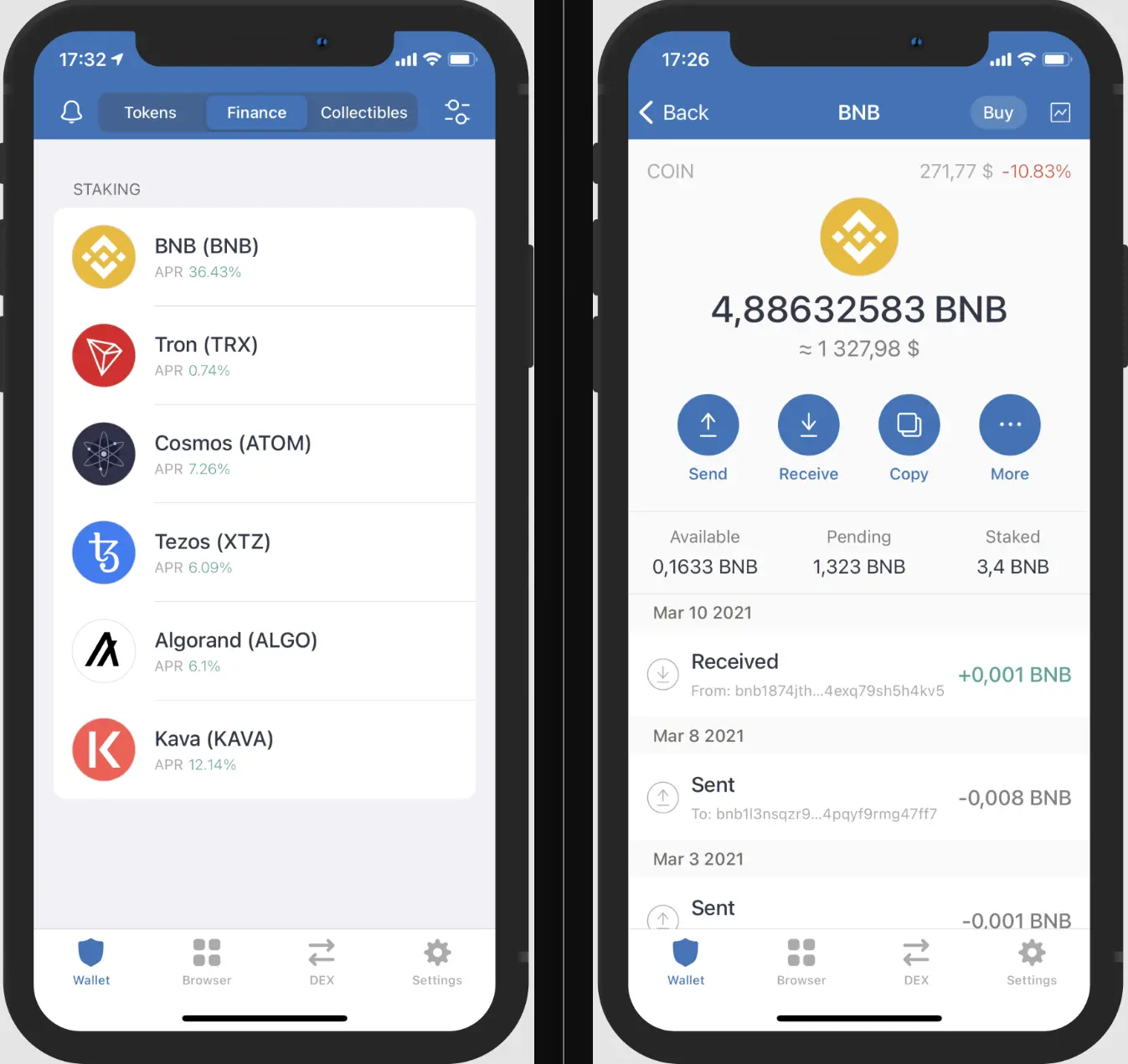

#4. Trust Wallet

Trust Wallet is one of the safest software wallets that supports many cryptocurrencies and offers a bunch of features to its users. It’s also one of the best options for beginner crypto enthusiasts who want to learn how to stake BNB while maintaining full control over their assets.

Before you start staking, you first need to download Trust Wallet to your device. You can find it on the App Store, Google Play Store, and as a Chrome web extension. The app will guide you through a simple process of creating a new wallet, after which you’ll be able to transfer BNB to it or buy it through Trust Wallet directly.

After that, you’ll be able to access the Finance tab, where you can put your BNB to work. Finally, one of the key reasons you might want to learn how to stake on Trust Wallet is because they offer the potential to earn as much as 30%+ APY.

How Much Can You Earn Staking BNB?

BNB staking can be a highly lucrative endeavor. However, it’s important to know that bigger gains generally come with higher risks or more challenging requirements.

For instance, on Crypto.com, flexible staking with 0–4000 CRO locked up will yield a mere 0.10% BNB staking APY. On the other hand, if you lock up 40,000 CRO or more and use 3-month staking terms, you can get up to 5% APY.

You’ll find similar rates on Binance, where APY percentages increase the longer you lock your coins up.

If you decide to take part in the DeFi ecosystem, you’ll likely find better reward opportunities. Just remember that DeFi requires a lot more knowledge, and there are higher chances of being scammed or hacked if you don’t know what you’re doing.

Is It Safe To Stake BNB?

Staking BNB is one of the safest ways to earn passive income in the world of cryptocurrencies. However, that’s not to say there’s zero risk.

The biggest risk when staking BNB comes from the volatility of the cryptocurrency market. If you lock up your assets for an extended period of time, you’re exposed to sudden market movements. If the price starts dropping and you think that it’s not going to recover, you won’t be able to sell your assets to cover some of the losses.

Similarly, you won’t be able to take advantage of any potential surges in price until your assets are released. Until then, the price might return to normal, resulting in a potential loss.

It’s important to know that there's usually an unbonding period of seven days when unstaking BNB. You should take that period into account before staking and when deciding to unstake your assets.

Another safety concern when staking BNB is “slashing.” Essentially, if validators misbehave and try to manipulate the network, they’re slashed, losing the BNB they staked. While that shouldn’t affect the delegators’ staked BNB, it can still result in a loss of rewards.

Pros and Cons of Staking BNB

Before we wrap things up, let’s explore the pros and cons of staking BNB.

Pros Of Staking BNB

There are many good reasons to stake your BNB instead of merely keeping the coins idle in your wallet. Some of these reasons include:

- Earning passive income by contributing to network operations. Considering BNB might continue growing in the future, there’s potential for even greater gains in the long run.

- Participating in decision-makingprocesses and influencing how the network is going to develop. That way, validators and delegators can ensure the network keeps working in the users’ best interest.

- Boosting the network’s security and decentralization.That way, you’re reducing the chance that malicious actors can gain control of a large part of the network.

Cons Of Staking BNB

Most of the cons of staking BNB come in the form of the risk of losing your assets. Some of these cons include:

- Liquidity risk. If you lock BNB for a long period of time, you won’t be able to sell it in case you need funds quickly.

- Slashing risk. Delegating your assets to a misbehaving validator can result in “slashing” or a loss of staking rewards.

- Smart contract concerns. Staking BNB on DeFi platforms can lead to a loss of funds due to a smart contract bug, hack, or exploit.

Key Takeaways

The cryptocurrency market is filled with possibilities, and staking is one of the best ways to earn passive income on your holdings. As we’ve seen in this article, learning how to stake BNB won’t just give you potentially lucrative rewards—it’ll make you a valuable member of the community.

BNB staking is a win-win activity where participants expand their portfolios and make more money while contributing to the security and decentralization of the financial system. Remember to do your research, and you’ll be able to harness the full potential of BNB staking!

How To Stake BNB FAQ

Is staking BNB profitable?

Staking BNB can be profitable, as network participants are rewarded for securing the BSC network and facilitating transactions. However, the profitability of staking depends on multiple factors, including the platform’s rates, lock-up periods, BNB market value, and other aspects.

How much BNB do I need for staking?

How much BNB you need for staking will depend on the platform that you’re going to use. For instance, some centralized exchanges allow you to stake your BNB even if you have a fraction of a coin. On the flip side, validators are required to stake a minimum of 10,000 BNB.

How to unstake BNB?

To unstake your BNB, you should follow the instructions provided by the platform that you’re using. The process is often as simple as navigating to the staking pool and selecting “withdraw” or “unstake” to release your assets.

Is staking BNB safe?

Staking BNB is considered one of the safest ways to earn passive income with your cryptocurrency. However, there are some risks that stem from market volatility, smart contract bugs and exploits, and slashing events.

What is the best way to stake BNB?

The best way to stake BNB depends on the users’ needs. Centralized exchanges are easier to start with, with the downside of giving your keys to a third party. Decentralized platforms offer more control but are more difficult to use.

How long does BNB need to be staked for?

BNB staking can be fixed or flexible. Flexible staking allows you to retrieve your assets at any moment at the cost of a lower APY compared to fixed staking. Fixed staking times vary between platforms and can be anywhere from a couple of days to 120 days or more.