How to Sell Bitcoin in 2023 | A Complete Guide

bitcoin

Tired of holding different assets and want to trim your portfolio? You've got some Bitcoin sitting around; you want to sell it to pay off some expected costs, and you’re wondering how to sell Bitcoin?

Or have you simply got some Bitcoin with a custodian and are getting worried about the collapse of both custodians and banks these days?

Well, we’ve got just the thing for you!This guide will look at exactly how to sell Bitcoin, covering the pros and cons of the different options as well as complications caused by custodial and non-custodial storage.

Keep reading to learn all about selling Bitcoin and how to go about it!

Before You Sell Bitcoin

Despite the fact that selling Bitcoin isn’t difficult in 2023, there are a few things you do need to figure out before pulling the trigger.

#1. What Currency Do You Want?

For one thing, you need to decide what you want to sell it for. In many cases, the answer to this question is fiat currency, but even fiat can take many forms, from cold, hard cash to a local currency transfer made to your bank account or credit card balance.

If you need to spend the money right away, you also need to keep cash settlement times in mind. Bank transfers can take a few days, unlike Bitcoin transactions, which are fully confirmed in an hour. For this reason, crypto debit cards can also help.

Then there’s also the possibility that you want to keep your funds in crypto and only want to sell Bitcoin to realize a profit (or a loss). In this case, you may be open to getting another crypto, such as ETH, in return or even a stablecoin like USDC.

#2. How Do You Currently Store BTC?

The second major thing to keep in mind is that your current storage method for BTC may dictate or even limit the best way to sell Bitcoin.

Despite its extremely risky nature, many Bitcoin investors store their Bitcoin on exchanges and other custodial platforms. Custodial is the key word—it means that your BTC is sitting in the custodian’s wallet, not yours.

Custodial storage is all about supposed convenience, but when it comes to withdrawing or selling your BTC, many custodians tend to become difficult. Some even disallow withdrawals as a matter of policy, raising questions as to whether they even have any BTC or have sold you CFDs instead.

Robinhood, a neo-broker, even has a reputation for going down whenever one of their assets spikes, thereby not allowing users to sell when the price is right. It may be important to note here that Robinhood users are not its customers—the firm’s actual customers are market makers like Citadel Securities and Virtu, who make up practically all of Robinhood’s income.

If you’ve been smart with your BTC and hold it in a non-custodial wallet under your own control, then you’re in luck. No option is off the table, and you have complete freedom in how to sell Bitcoin.

How to Sell Bitcoin

Now that we’ve established the limitations for selling Bitcoin, that is, what your storage method is and what currency you want to sell for, we can properly look at how to sell Bitcoin.

#1. P2P Trading Venues

Bitcoin was originally conceived as a peer-to-peer electronic currency, so why not go with the OG option? This generally means that you find someone who’ll trade you what you want for your BTC, and there are plenty of services that will perform “matchmaking” to this extent.

One of the main advantages of using a service like this is that it tends to offer escrow and dispute resolution services. This can be useful since, unlike a bank transfer, your Bitcoin transaction can’t be canceled after being initiated. This can be a bit tricky when you’re dealing with a stranger, so having an escrow in place provides ease of mind.

That said, there’s still a chance of fraud even if you use a P2P exchange. A wallet bug with the “replace-by-fee” feature has been exploited in the past to show Bitcoin buyers that their transaction is complete when it actually hasn’t even hit the blockchain.

So, P2P venues can be a good way to sell your Bitcoin, especially while retaining anonymity, but there can be risks in doing so. If you’re interested in selling your Bitcoin in this manner, here’s how:

- Create a listing. On a P2P trading venue, simply create a listing for the amount of BTC you want to sell. Alternatively, you can browse through listings created by buyers and see if there are any offers you’d like to take up.

- Initiate the trade. When you initiate the trade, you generally also have to lock your Bitcoin up in the platform’s escrow account.

- Confirm receipt of payment. Once the buyer makes the payment, you can confirm that you’ve received it and signal the release of BTC from escrow. How you take payment depends on you and the platform—it’s often handled by a payments provider like PayPal, but you may choose to meet the buyer in person and accept cash.

#2. Centralized Exchanges

Centralized exchanges tend to be an extremely convenient way to sell your Bitcoin, and they often provide lots of options in terms of currencies you can trade with. You can expect bigger exchanges such as Binance.com to offer you access to a range of fiat currencies, meaning that you can actually implement forex trading strategies alongside crypto quite easily.

Bitcoin also tends to be one of the trading pairs on most crypto exchange services. This means you can usually trade Bitcoin with practically any other cryptocurrency that’s listed on the platform. This includes stablecoins if you’re just after a temporary shelter from Bitcoin exposure.

Cryptocurrency exchanges are a good option if you want the money from selling Bitcoin sent into your bank account or toward your credit card. Many also have their own crypto debit cards, so instead of selling Bitcoin, you can choose Bitcoin as one of your spendable currencies when you use that card.

On the downside, crypto exchanges are notoriously poor custodians. FTX rocked the crypto world when it came to light that they were funneling customer deposits to a hedge fund for risky trading activity. That said, given the FTX founder’s Wall Street past, it likely didn’t surprise anyone but the exchange’s customers.

On top of that, most top crypto exchanges require you to complete Know Your Customer protocols before undertaking any trading. This means that your BTC sale can be traced back to your identity, which raises privacy concerns but isn’t too worrying unless you acquired that BTC in an illicit manner.

Here are the basic steps if you want to sell Bitcoin via a centralized exchange:

- Create an account: Once you’ve finished the DYOR phase of searching for an exchange, simply create an account. As mentioned, this may involve KYC, which could take a few days until you’re verified. Many exchanges are happy to give you access to most services straight away, but cash or crypto withdrawals tend to be locked behind verification status.

- Use their trading interface. One of the key advantages of selling Bitcoin or any other asset via a centralized exchange is the fact that you can use tools such as limit sell orders. These can be useful if you want to sell at an exact price and are prepared to wait until a buyer meets it on the open market. Remember to pick the right trading pair from the list of available markets and choose the currency you want carefully. There are often options to sell Bitcoin using other interfaces, such as “Swap,” rather than classic trading, but the latter tends to be the cheapest and most efficient.

- Withdraw funds. Now that the trade is complete, you can navigate to your account balance and withdraw the funds to your bank account or credit card account.

#3. Bitcoin ATMs

If you want to sell Bitcoin for cash but don’t want to bother with human interaction, a Bitcoin ATM may be for you! Just remember that the number of Bitcoin ATMs out there can be limited, and you’ll have to use a Bitcoin ATM locator to find the nearest one.

On top of that, not every Bitcoin ATM can actually dispense cash. Many are made simply to accept cash to facilitate buying Bitcoin, so after you find an ATM, you’ll have to check if it allows selling BTC.

If this option sounds good to you, here’s what you need to do:

- Find a Bitcoin ATM. You can use an online map or Bitcoin ATM locator website, such as Bitcoin ATM Map or Coin ATM Radar, for this. Remember to check out the ATM’s fee structures and reviews, and make sure that the ATM offers the selling function.

- Verify Identity. Most Bitcoin ATMs require this, and it tends to be done via a phone number. Most phone numbers have to be registered to their owners, so it’s an indirect link to you, but a link nonetheless.

- Enter transaction details. This is where selling differs from buying. You should see the option to sell Bitcoin here, and you’re at the wrong Bitcoin ATM if you don’t. Once you hit Sell, you can sign off on the transaction using your wallet. Remember that the ATM doesn’t need your private key—if it asks for it, get out of there.

- Get a withdrawal receipt. Once you sign the transaction and it’s confirmed, the ATM operator will send you a withdrawal ticket via the phone number that you provided when verifying your identity.

- Use withdrawal receipt. You can now use this ticket to go back to the ATM, entering both your phone number and the ticket information to get your cash. Keep in mind that withdrawal tickets have a limited validity period, so remember to plan plenty of time for all this.

#4. Decentralized Exchanges

Decentralized exchanges are usually a great option for buying and selling crypto, but there are two major caveats. On the one hand, most DEX platforms only facilitate crypto-to-crypto transactions, so selling coins for fiat generally isn’t an option. The second is that the Bitcoin blockchain doesn’t currently feature any DEX platforms.

Bitcoin was designed to be a peer-to-peer payment network, and it remains an extremely safe and efficient way to send BTC from one wallet address to another. However, it isn’t smart contract capable (yet).

Smart contracts are what make building applications on top of a blockchain possible, but Bitcoin doesn’t have that infrastructure at the time of writing this guide. DEX platforms are well known in crypto, but they’re most prominent on smart contract-capable blockchains such as Ethereum, BNB Smart Chain, and others.

It’s possible that you may find DEX platforms on Bitcoin’s layer 2 Lightning Network or decentralized autonomous organizations such as Bisq, which provide decentralized Bitcoin trading options. These are in the minority, however, and haven’t been battle tested to the extent that top DEXs like Uniswap have been.

#5. Wrapped Bitcoin

If you’ve got your heart set on using a proven DEX, all is not lost. Wrapped Bitcoin, part of the Wrapped Tokens project run by BitGo, Kyber Network, and Ren, allows you to trade Bitcoin on the Ethereum blockchain, meaning you can use the best DEXs to sell Bitcoin.

How Wrapped Bitcoin works is that BTC on the Bitcoin blockchain is deposited with a custodian before ERC-20 WBTC tokens are minted, corresponding with the amount of BTC in custody. In this manner, WBTC tokens are held to be equivalent to BTC coins that are held securely.

BTC is held by custodians such as Mike Belshe-founded BitGo, while network partners called merchants such as Kyber and Ren mint the WBTC tokens equivalent to what’s held in reserve.

The main advantage of this system is that it allows the use of BTC, via the WBTC token, in Ethereum-based DeFi. This can mean earning a yield on Bitcoin, which isn’t otherwise possible outside of risky lending via custodial platforms, a number of which have failed recently.

WBTC wasn’t really designed to sell BTC, but you can use it that way, converting BTC into WBTC and then using WBTC on a DEX to convert it into any other ERC-20 token. Interested? Here’s how you do it:

- Contact a WBTC merchant. You can visit merchants like Ren and Kyber Network and send them your BTC with a wrapping request. Behind the scenes, they’ll send your BTC to BitGo and mint WBTC for you.

- Receive WBTC. Keep in mind that WBTC is an ERC-20 token, meaning that you’ll need an Ethereum-compatible wallet like MetaMask to receive and use the token.

- Use WBTC. Now you can do whatever you want with your WBTC tokens, whether that’s engaging in DeFi or visiting a DEX to trade your WBTC away for something else.

Note that using the Wrapped Bitcoin route can be expensive because of fees. There are several transactions involved between sending BTC to the network and minting WBTC, and as the user, you’ll be on the hook to pay for the lot. So, don’t bother with this route unless you’re dealing in enough BTC that the fees pale into insignificance.

#6. Neo Brokers

These guys are last on the list for a reason. From Robinhood going offline every time a coin spikes to the fact that most neo brokers don’t allow users to withdraw crypto from the platform, it’s an extremely risky idea to use them.

Assuming that the platform is operational and not having a mysterious outage when you want to sell any crypto you have in your account, though, it should just be a click of a button or a tap of the screen to be able to liquidate.

Should You Sell Your Bitcoin?

Now that you know exactly how to sell your Bitcoin, the question remains whether doing so is a wise move.

Bitcoin has been one of, if not the, best-performing assets throughout its history (January 2009-present). Having some Bitcoin today means you’re probably in an extremely strong position of profit unless you got in during the bull run of 2021 and early 2022.

That said, Bitcoin has still held up decently compared to many other assets across that time frame. Amazon’s stock has dropped from $175 to $103 from November 2021 to March 2023, with a low of $84 in December 2022.

Bitcoin's range of $57,000 to $28,000, with a low of $16,500, paints an almost identical picture. That’s telling since Amazon is widely considered a blue-chip stock and is recommended by most stock pickers as a solid long-term hold.

Many top stocks, including the likes of Tesla and Netflix, have done far worse over the same time period. And Bitcoin’s direct competitors? Well, banking giant Credit Suisse went from a price of $9.61 in November 2021 to an emergency rescue and takeover by a competitor in 2023!

Perhaps worryingly for believers in its libertarian ideals and status as an alternative investment asset, Bitcoin could actually be correlated to major equities. This, in turn, would suggest the finance industry itself and major investment players consider Bitcoin to have real value.

After all, many influential voices in the world of investing have eaten their words about Bitcoin in the past few years. Jamie Dimon, the controversial chief of banking giant JPMorgan, has long been a staunch critic of Bitcoin but now offers it to high-net-worth clients.

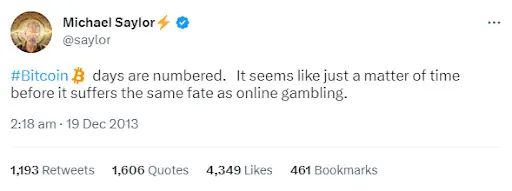

Michael Saylor is widely acknowledged as one of the biggest Bitcoin bulls today, and his company, Microstrategy, is the largest institutional Bitcoin holder, with over 140,000 BTC stashed away. Yet in 2013, this was his opinion:

What is Bitcoin?

Bitcoin isa “public decentralized ledger,” which means that you can view all of the transactions that take place on the network because it’s upheld by thousands and thousands of independent nodes. It’s a network of computers, really, and exists to facilitate the movement of assets between nodes.

You could operate a node yourself, as it happens. However, the presence of so many individual nodes increases Bitcoin’s censorship resistance and makes it extremely hard to compromise or attack.

By storing a copy of the blockchain, node operators can confront malicious actors who try to censor or change the blockchain. The more nodes with the same correct copy, the easier it is to defeat a malicious actor.

Which copy of the blockchain is “correct” comes down to Bitcoin’s proof of work consensus algorithm. Special nodes called miners devote their computational power to solving difficult cryptographic problems competitively. The winner is allowed to gather all of the network’s transactions in the last few minutes and write them into a ‘block.’

The other miners can check their work and reach a consensus on its validity, providing nodes with a consensus on the truth. The produced and validated block is then added to the blockchain.

All of this is done publicly, and you can view the transactions on the Bitcoin blockchain as they happen using a blockchain explorer. This transparency is one of Bitcoin’s hallmarks and the reason it remains a viable alternative to the contrasting opacity of traditional finance.

BTC is the native coin and digital asset of the Bitcoin blockchain. It’s the currency used to reward miners via block rewards, and one of the reasons it has so much value is its tight supply.

Unlike the unlimited nature of fiat, there will only ever be 21 million BTC. In fact, there’ll probably be a lot less because many wallets have been lost and owners have passed away without ever sharing their private keys with inheritors. It’s also possible that the estimated 1.1 million BTC mined by pseudonymous creator Satoshi Nakamoto will never re-enter circulation.

How to Buy Bitcoin

Reading this article, there’s every chance you’ve decided that you’d rather buy more Bitcoin than sell what you have. Or maybe you’ve got some BTC with a neo-broker and would like to do things right this time. Here’s a brief look at some ways to buy Bitcoin!

#1. P2P Trading

Just like you can sell BTC in-person or using a P2P trading venue, they’re just as good an option for buying it. You might have heard of LocalBitcoins, which is an extremely popular venue for this. The service is closing down in 2024, but it and platforms like it remain one of the top anonymous ways to buy Bitcoin.

#2. Centralized Exchanges

Throw a rock online, and you’ll hit a centralized crypto exchange. There are plenty out there, and Bitcoin tends to be number one on just about every platform. While they can be a bit risky from time to time, especially for long-term holding, it’s generally easy to sign up with an exchange, buy some BTC, and withdraw it quickly to your own wallet.

#3. Bitcoin ATMs

Buying Bitcoin tends to be the raison d’etre for most Bitcoin ATMs. As mentioned, selling BTC is a function that not every Bitcoin ATM has, but you can buy Bitcoin from all of them.

#4. Wallet On-Ramps

Some crypto wallets have extensive partnerships to improve their functions and services, and this sometimes extends to an on-ramp. What this means is that rather than looking for a dedicated exchange or way to buy Bitcoin, you can do it without leaving your wallet interface.

The Future of Bitcoin

Bitcoin is considered by many to be a pristine asset, and though it has its detractors, it remains a favorite investment for household investors and institutions alike. In fact, increased institutional interest has often been suggested to be behind the surges in Bitcoin’s price over the last few years.

Yet, the fundamentals of Bitcoin also continue to shine. Part of this can be seen through raw market data as Bitcoin rallies amidst the collapses of banks, falling like dominoes to the consequences of risky bets and unsustainable leverage.

While as little as a margin call may be enough to sever a financial giant, Bitcoin cannot be stopped. The network has every chance of prospering as its promise of unlimited transparency appeals to younger generations unwilling to submit to the overreach of the elites.

Even if you don’t believe the often unreasonable hype of “Bitcoin to $1 million,” selling all of the BTC you own seems like a very grave risk indeed.

Key Takeaways

It’s not hard to sell Bitcoin, given its position as the king of cryptocurrencies. Before rushing in, though, you need to examine your options based on where you’re holding your BTC right now.

For instance, BTC on a neo broker can usually only be sold on that broker’s platform. On the other hand, if you keep your Bitcoin in your own private wallet, your options are completely unlimited.

Most people choose to sell Bitcoin either via P2P trading or a centralized exchange. The latter is an extremely convenient option and offers tools that may or may not be familiar but could certainly be useful, such as the ability to place limit sell orders.

P2P trading tends to be a go-to option because it affords more anonymity. That said, fraud is a risk you must be aware of, and it may well be that you need to physically meet the buyer in order to accept cash for your BTC.

Selling Bitcoin FAQ

Can you sell Bitcoin from your wallet?

Wallet off-ramps aren’t as common as wallet on-ramps, unfortunately. While there may be a few, and the numbers may grow as time passes, you may have to use P2P channels or an exchange to sell your Bitcoin.

Can you sell Bitcoin on Binance?

Absolutely. Binance and its peers, such as Coinbase and Kraken, are built around trading cryptocurrencies, and Bitcoin tends to be one of the most traded cryptos. In fact, you can usually sell Bitcoin for, or use Bitcoin to buy, practically every other cryptocurrency listed on these exchanges.

How to sell Bitcoin in Nigeria?

Nigeria is one of the most innovative countries when it comes to finance, and there are plenty of mainstream exchanges and local firms that offer Bitcoin trading.

How to buy Bitcoin?

You’ll need a wallet and some currency with which to buy BTC. Then just find the venue that suits you best, be it a P2P trading platform or a centralized exchange. Remember to check your wallet as well, as it may have an integrated on-ramp that’ll save you a lot of trouble at the cost of a small fee.