What is Crypto Shilling & How to Recognize it

crypto basics

Crypto shilling can be challenging to recognize since it’s a manipulative technique that promotes digital currencies through various false sources. While it can be challenging to recognize it, it’s crucial to know about it so you can protect yourself from fraudulent activities.

By understanding the risks involved in investing in digital currencies and learning how to recognize shilling, you’ll be better equipped to make sound investment decisions.

In this article, we’ll explore the history of crypto shilling, its types, examples of real-life cases, and essential tips to recognize and protect yourself from it.

Let’s get into it!

What is Crypto Shilling?

Crypto shilling is a technique for promoting digital currencies or tokens through false or misleading information. This technique is usually used by individuals or groups, also known as “shillers,” who have a vested interest in a particular cryptocurrency.

Shillers try to manipulate the market by promoting a particular cryptocurrency to increase its value or create hype around it.

This can be done through social media, forums, and messaging apps. Shillers may also create fake news or reviews to promote the cryptocurrency they’re currently dealing with.

It’s not rare that companies or individuals will pay certain groups to do shilling so they can create additional hype, attract investors, and then disappear with their money.

How to recognize Crypto Shilling?

Some signs of crypto shilling include:

- Overhyped claims about a cryptocurrency’s potential

- Sudden and unexplained price jumps

- Anonymous or fake social media accounts promoting a specific cryptocurrency

- A lack of transparency about the cryptocurrency’s technology, team, or development roadmap.

Remember, the crypto shilling is a manipulative technique that can harm investors. That’s why it’s essential to do your research and be cautious when investing in digital currencies.

Crypto Shilling History

Shilling is not a new concept and has existed in various forms throughout history.

The term “shill”originally referred to a person who pretended to be a member of the theater audience or auction house, secretly working for the seller to increase the bidding price. In the digital age, shilling has taken on a new form with the same purpose, especially in the crypto market.

Crypto shilling started as soon as digital currencies became popular and people realized there was an opportunity to profit from them. Shillers have used various tactics over the years, including creating fake social media accounts, writing fake news, and everything in between, to promote a particular crypto.

Unfortunately, many people are still victims of these manipulative techniques.

Types of Crypto Shilling

Here are some of the most common types of crypto shilling, along with a brief explanation of how they operate:

Influencers

Influencers are individuals with a large following on social media or other platforms. They may be celebrities like, for example, Matt Damon, or simply people with a large following. Influencers are often paid to promote a particular cryptocurrency to their followers.

Influencer shilling is effective because their followers trust their opinions and recommendations. However, it can also be dangerous because influencers don’t always have the necessary knowledge or expertise to provide accurate information about the crypto they’re promoting.

Businessmen

Businessmen may shill a particular cryptocurrency to promote their business interests. They may be involved in the development or promotion of the cryptocurrency and stand to gain financially from its success.

This form of shilling can be effective because they often have a vested interest in the success of cryptocurrency. This can also be dangerous because they may prioritize their interests over the interests of investors.

Team Members (Founders)

Team members, including founders, may shill a particular crypto to increase its value or create hype around it. They may also be paid by the company to promote a specific cryptocurrency.

Team member shilling is effective because they have inside knowledge about the cryptocurrency and can provide accurate information about its potential.

However, like businessmen, they may also have a vested interest, which may not align with the interests of investors.

Does All Crypto Promotion Equal Crypto Shilling?

Not all crypto promotion is crypto shilling. Crypto promotion is the act of promoting a cryptocurrency or digital token through various means, such as social media, forums, or other platforms.

Promotion can be done by individuals, groups, or companies that believe in the potential of a particular cryptocurrency and want to increase its exposure to a wider audience.

Regardless, crypto shilling happens more often than you’d think to increase its value or simply create a commotion on the market.

Examples of Crypto Shilling

Here are a few real-life examples of crypto shilling:

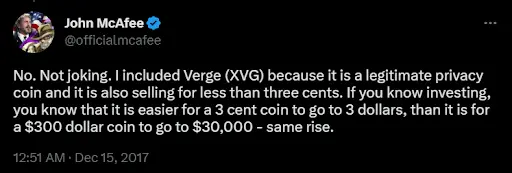

#1. John McAfee and Verge (XVG)

John McAfee, the founder of McAfee antivirus software, is a well-known figure in the cryptocurrency world. In 2018, McAfee tweeted multiple times about a cryptocurrency called Verge (XVG), claiming it was going to be the next big thing on the market. He even went as far as to predict that the price of XVG would reach $15 by the end of the year.

However, it later came to light that McAfee was being paid by the Verge team to promote the cryptocurrency. They paid him over $100,000 to promote the cryptocurrency on social media, which is a clear example of crypto shilling.

#2. BitConnect (BCC)

BitConnect was a crypto platform that promised high returns to its investors. The platform had a referral program that rewarded users for bringing in new investors. This led to a lot of shilling on social media, with users promoting BitConnect as a way to make a quick buck.

The platform was later exposed as a Ponzi scheme, and the price of BitConnect’s token (BCC) plummeted. Many investors lost their money, and the platform shut down in 2018.

#3. ICO Reviews

Initial Coin Offerings (ICOs) are a popular way for companies to raise funds through digital currencies. However, many ICO reviews are biased, and the companies pay for those reviews themselves. The reviews often exaggerate the potential of the cryptocurrency and downplay any risks associated with it.

This is why investors need to be careful when reading ICO reviews and should always do their research before investing in any digital currency.

How to Protect Yourself From Crypto Shilling

Here are some essential tips to help protect yourself from falling victim to crypto shilling:

- Do your research. Don’t rely solely on information shillers provide or social media. Make sure to research the cryptocurrency’s technology, team, and development roadmap. Look for a review from reputable sources, and check the cryptocurrency’s history and market trends.

- Be cautious of overhyped claims. Avoid believing promises of immediate profits or assurances that a cryptocurrency will succeed. Instead, look for realistic projections and growth patterns.

- Watch for sudden and unexplained price jumps. If a cryptocurrency’s price suddenly jumps for no apparent reason, it may be a sign of shilling. Be careful when investing in a cryptocurrency that has experienced a sudden and unexplained price increase.

- Check for Transparency. Make sure the cryptocurrency you’re considering investing in has a transparent development team and roadmap. Look for information about the team’s experience, the cryptocurrency’s technology, and its plan for the future.

- Use Trusted Sources. Look for reviews and information from reputable sources, such as established media outlets, financial analysts, and industry experts.

- Seek Advice from the aforementioned Sources. If you’re unsure about a cryptocurrency or suspect that it might be a scam, ask for advice from trusted sources. Talk to a financial advisor, reach out to reputable crypto communities, or consult with industry experts.

Key Takeaways

As you can see, shillers use various tactics to exaggerate the potential of the cryptocurrency they’re trying to promote. To avoid being a victim of crypto-shilling manipulative techniques, always do your research, be cautious of overhyped claims, and always check for transparency.

While the crypto market is highly volatile, it’s unlikely for a cryptocurrency to skyrocket overnight. So be careful and seek advice from trusted sources if you need to, even if your best friend is recommending you invest in a specific crypto.

Crypto Shilling FAQ

Is crypto shilling legal?

Crypto shilling, or promoting digital currencies or tokens through false or misleading information, is generally considered unethical but not necessarily illegal.

However, it can harm investors and is often associated with fraudulent activities. Investors should be cautious and conduct research before investing in any digital currency.

Is shilling crypto bad?

Yes, the crypto shilling is generally bad and harms investors. It’s a manipulative technique whose goal is to promote digital currencies through misleading or false information.

How to recognize crypto shilling?

You can recognize crypto shilling by looking out for overhyped claims, sudden and unexplained price jumps, anonymous or fake social media accounts, and a lack of transparency about the cryptocurrency’s technology, team, or development plan.