A Detailed Guide to Bitcoin Price History [2009-2023]

bitcoin

Bitcoin price history is a captivating topic that has gathered significant attention over the years. Bitcoin, a digital currency created by an unknown person or group of people using the pseudonym Satoshi Nakamoto, was launched in 2009.

Since then, it has experienced significant price fluctuations, with its value rising from almost nothing to over $64,000.

In this article, we explore the detailed history of Bitcoin’s price from its inception in 2009 to the present day. We’ll also highlight the key events, factors, and trends that have impacted the price of Bitcoin over the years, and more!

Whether you’re a crypto enthusiast or simply curious about Bitcoin’s price history, this blog post will provide you with an in-depth understanding of the world’s most popular digital currency.

Let’s begin!

Bitcoin Price History 2009 - 2012

During the 2009-2012 period, the Bitcoin price was highly volatile, with significant fluctuations in its value. In 2009, the price of Bitcoin was almost negligible, with one Bitcoin worth less than a penny. However, by 2010, the price had risen to $0,08, and by mid-2011, it had reached $31, demonstrating the highly volatile nature of the crypto market.

One of the key factors that contributed to the development of Bitcoin’s price during this period was the growing interest in the new type of currency, especially from tech enthusiasts and early adopters. As more people began to understand Bitcoin’s potential and its underlying technology, demand for the cryptocurrency increased, leading to a surge in its price.

Another contributing factor to Bitcoin’s price growth during this period was the increasing acceptance of Bitcoin as a legitimate form of payment. Several merchants, including WikiLeaks and WordPress, began accepting Bitcoin as a means of payment, increasing its popularity and value.

However, despite its popularity, bitcoin wasn’t widely accepted as a mainstream currency. It was still mainly used by tech enthusiasts and early adopters, and there were limited opportunities to buy or sell goods and services with Bitcoin.

Overall, the period between 2009-2012 was a time of significant growth and development for Bitcoin, with its price rising from almost nothing to over $30. While the price was highly volatile, the growing interest in Bitcoin and its increasing acceptance as a legitimate form of payment helped to drive its value higher.

Bitcoin Price History 2013 - 2017

The period of 2013-2017 was a time of significant growth and development for Bitcoin, with its price skyrocketing from around $13 to nearly $20,000. However, the journey was far from smooth, with several significant price fluctuations and market crashes taking place during this period.

One of the key contributing factors to the development of Bitcoin’s price during this period was the increasing adoption of cryptocurrency by individuals and businesses worldwide. As more people began to recognize the benefits of using Bitcoin, including its speed, security, and low transaction fees,demand for the cryptocurrency increased, leading to a surge in its price.

Another significant factor was the increasing number of use cases for Bitcoin. People were using it increasingly as a store of value, with many individuals and institutional investors buying and holding Bitcoin as a long-term investment.

Despite all of this, Bitcoin was still not widely accepted as a mainstream currency. However, major companies like Microsoft and Expedia began accepting Bitcoin as a payment, increasing its popularity and legitimacy.

One of the most notable events during this period in Bitcoin price history was the market crash in 2013 when the Bitcoin price dropped by more than 50% in just a few days. Nevertheless, the cryptocurrency quickly recovered, with its price reaching new highs in the following years.

Between 2013 and 2017, Bitcoin’s adoption by individuals and businesses worldwide contributed to driving its value to $20,000, even though the price fluctuated greatly several times during this period.

Bitcoin Price History 2018 - 2021

The period from 2018 to 2021 was marked by significant volatility for Bitcoin, with the cryptocurrency experiencing several major price fluctuations and market crises. In December 2017, Bitcoin hit its first price record of nearly $20,000. But its price quickly began to drop in the following months—by December 2018, Bitcoin’s worth was only $3,000.

The increasing regulation of cryptocurrency by governments and financial institutions was one of the key factors that contributed to the decline in Bitcoin’s price during this period. As more countries imposed strict regulations on the use and trading of crypto, the demand for Bitcoin and other cryptocurrencies decreased, leading to a drop in their value.

Another contributing factor to Bitcoin’s price decline was the increasing competition from other new cryptocurrencies. As they gained popularity, Bitcoin’s market share decreased further.

However, Bitcoin was still being used for various purposes during this volatile period. Individuals used Bitcoin to buy and sell goods and services online, and companies likePaypal and Overstock began accepting Bitcoin as a legitimate payment.

Still, Bitcoin was not widely accepted as a mainstream currency despite its popularity and usage. While businesses were accepting Bitcoin as a regular form of payment, there were limited opportunities to buy and sell goods and services using Bitcoin.

Despite these fluctuations, the overall trend was significantly volatile, with the price of Bitcoin going from $20,000 in December 2017 to around $3,000 a year later, only to recover to around $60,000 in April 2021. At this point, the world started to acknowledge that Bitcoin was becoming an increasingly important and valuable asset.

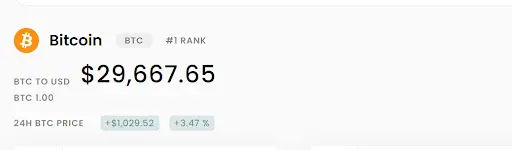

Bitcoin Price - Present

The period from 2021 until now has been marked by significant developments and fluctuations in the Bitcoin price. After reaching a new price record of around $64,000 in April 2021, the price of Bitcoin began to decline, with the cryptocurrency experiencing several major crashes and recoveries in the months that followed.

One of the key factors that contributed to Bitcoin’s decline was the increasing regulatory scrutiny of cryptocurrencies by governments and financial institutions worldwide. Concerns over the potential use of cryptocurrencies for illegal activities, such as money laundering and terrorism financing, led to increased calls for stricter regulations on the use and trading of cryptocurrencies.

Another factor in Bitcoin’s price was again the increasing competition from other cryptocurrencies, like Ethereum (EHT) or Tether (USDT). New cryptocurrencies appear every day, contributing further to Bitcoin’s market share decrease and drop in value.

The period from 2018 until today is called the “crypto winter.”. It describes the prolonged decline period and consolidation in the crypto market. During this time, many cryptocurrencies, including Bitcoin, experienced significant drops in value, with some even becoming redundant.

Despite the challenges Bitcoin has been facing during this period, the cryptocurrency has continued to be used by individuals and businesses as a form of payment.

In recent months, there have been signs of a recovery in the cryptocurrency market, with Bitcoin’s price having had several major recoveries and reaching anall-time high of over $67,000 in November 2021.

We can connect this recovery to several factors, including the increasing adoption of cryptocurrencies by institutional investors and the growing interest in crypto as a hedge against inflation.

What Affects the Price of Bitcoin?

Bitcoin’s price is affected by many factors, including supply and demand, mining, regulation, and media coverage.

Below are some of the key factors that can impact the price of Bitcoin:

- Supply and demand. Like any other asset, the price of Bitcoin is influenced by the laws of supply and demand. If there’s high demand for Bitcoin but limited supply, the price is likely to increase. On the other hand, if there’s low demand but high supply, the price will decrease.

- Mining. Mining new Bitcoins can also impact the price of the cryptocurrency. As the mining difficulty increases, the cost of producing new Bitcoins also rises, which can put upward pressure on the price. Conversely, if the cost of mining decreases, the price of Bitcoin may decrease as well.

- Regulation. The regulatory environment surrounding Bitcoin can also sway its price. If governments around the world impose strict regulations on the use and trading of cryptocurrencies, the demand for Bitcoin may decrease, leading to a drop in its price. Conversely, if governments adopt more favorable policies toward crypto, the demand for Bitcoin may increase, leading to a rise in its price.

- Media coverage. The media can also have a significant impact on the price of Bitcoin. Positive news stories about Bitcoin, such as its increasing adoption by major companies or its potential to fight inflation, can drive up demand and increase its price. On the other hand, negative news, such as reports of Bitcoin being used for illegal activities or concerns about the environmental impact of Bitcoin mining, can decrease its demand and lead to a price drop.

While these are just a few factors that can impact the price of Bitcoin, they highlight the complex and multifaceted nature of the crypto market. As Bitcoin continues to evolve and gain wider acceptance, new factors will likely emerge that could impact its price in the future.

Bitcoin Price Future

The future of Bitcoin is uncertain, with experts offering a wide range of speculations and predictions about what the next few years could hold for the cryptocurrency.

While some experts predict that the price of Bitcoin will continue to rise in the coming years, with some even suggesting it could eventually reach $1 million per coin.

Meanwhile, others are more skeptical, warning that the highly volatile nature of the cryptocurrency market makes it difficult to predict Bitcoin’s future price movements.

Despite the uncertainty surrounding its future price, several factors could impact the future of Bitcoin.

One of the key factors is the increasing adoption of cryptocurrencies by individuals and businesses worldwide.As more people recognize the benefits of using cryptocurrencies, including their speed, security, and low transaction fees, the demand for Bitcoin and other cryptocurrencies is likely to increase, potentially driving up their prices.

Another factor that could impact the future of Bitcoin is the increasing regulatory scrutiny of cryptocurrencies by governments and financial institutions worldwide. If governments impose strict regulations on the use and trading of cryptocurrencies, the demand for bitcoin could decrease, potentially leading to a drop in its price.

Overall, Bitcoin remains uncertain, with its price likely to be impacted by a wide range of factors, including supply and demand, mining, regulation, and media coverage. As the cryptocurrency market continues to evolve, new factors will likely emerge that could impact the future price of Bitcoin in ways that are difficult to predict.

What is clear is that cryptocurrency has already had a significant impact on the world of finance and technology. Whether it continues to rise in value or experiences a significant decline, Bitcoin is likely to remain an important and valuable asset for years to come.

Key Takeaways

Bitcoin has had a captivating price history, facing fluctuations, crashes, and regulatory scrutiny, but it remains resilient and widely used. Its future remains uncertain, impacted by various factors, including supply and demand, mining, regulation, and media coverage.

As the cryptocurrency market evolves, new factors will likely emerge that can impact its future price. However, despite the challenges, Bitcoin remains an important and valuable asset for finance and technology. Understanding its history and key events is crucial to appreciate the world’s most popular digital currency.

Bitcoin Price History FAQ

How much was Bitcoin in 2009?

In 2009, the price of Bitcoin was almost negligible, with one Bitcoin worth less than a penny.

What was Bitcoin’s lowest price?

Bitcoin’s lowest price was less than a penny back in 2009.

What is Bitcoin’s highest price?

Bitcoin reached a record price of around $67,000 in November 2021.